Financial accounts, 1st quarter 2018:

Households are saving more in bank accounts

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2018-06-20 9.30

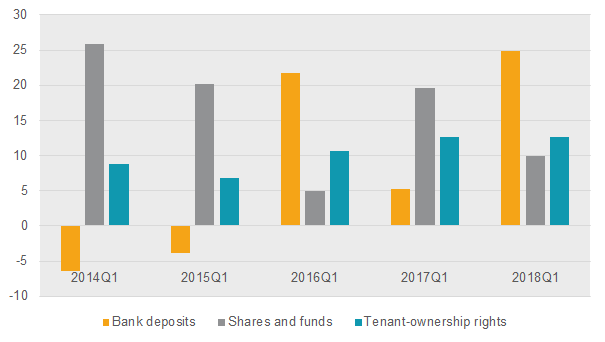

Households’ net deposits in bank accounts were SEK 25 billion in the first quarter of 2018. This is the highest net deposits in a first quarter since 2007. Investments in shares and funds also increased in the quarter, as did net purchases of tenant-ownership rights.

Households’ savings in bank accounts amounted to SEK 25 billion in the first quarter of 2018 and have not been at a higher level in a first quarter since 2007, when the wealth tax was abolished. When the wealth tax was still in place, it was seasonally normal for significant amounts to be deposited in the beginning of the new year. Households’ total assets in bank accounts was SEK 1 760 billion at the end of the period.

Households’ net savings in shares and funds amounted to SEK 10 billion in the first quarter. This is about half of the amount compared with the corresponding quarter of 2017. Households’ total savings in shares and funds were SEK 3 318 billion at the end of the first quarter of 2018.

Households’ assets in tenant-ownership rights decreased as market prices declined in the quarter. Net purchases were SEK 13 billion, and the total value of tenant-ownership rights was SEK 2 686 billion at the end of the quarter.

Households’ liabilities increased by SEK 57 billion in the first quarter of 2018, but the annual growth rate has declined since the second quarter of 2017. Loans were SEK 4 069 billion at the end of the first quarter of 2018.

Non-financial corporations’ borrowings

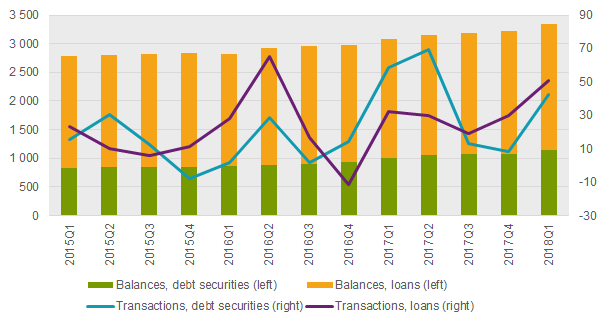

In the first quarter of 2018, non-financial corporations continued to obtain financing through borrowing in debt securities, but also through loans in monetary financial institutions.

Borrowing through debt securities increased in the quarter by SEK 79 billion, of which SEK 42 billion was increased borrowing through issues less matured securities and SEK 37 billion was an increase in debt due to the weakening of the Swedish krona. Liabilities in debt securities were SEK 1 146 billion at the end of the quarter. Borrowing through loans in monetary finance institutions also increased during the quarter and remained the largest source of financing for non-financial corporations.

Revisions

In connection with this publication, revisions were made for the period 2017Q1–2017Q4.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities as well as changes in net lending/net borrowing and wealth for different economic sectors. The net lending/net borrowing in the financial accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. In the non-financial accounts, net lending/net borrowing is measured as the difference between income and expenditure. However, as the financial and non-financial accounts are, for some sectors, based on different sources, there are differences between the two estimates of net lending/net borrowing.

Publication

In line with the previous publication of Financial accounts, the statistics will no longer be reported in a Statistical Report. Data previously published in Statistical Reports is now available under the heading Tables and diagrams.

In connection with the publishing of Financial accounts, the National Wealth, which contains annual data on real and financial assets, is also published. For 2016, there were minor revisions of inventory, and 2017 was published for the first time. Consequently, financial assets and liabilities now have the same values in both accounts.

For further information:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next press release in this series is scheduled for publication on 2018-09-20 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.