Balance of payments, first half of 2019

Holdings of foreign portfolio assets increased

Statistical news from Statistics Sweden 2020-01-22 9.30

Swedish holdings in foreign portfolio assets increased in the first half of 2019. Total holdings amounted to SEK 5 903.7 billion at the end of June 2019, which was an increase of 14.8 percent compared with the end of 2018. This is the largest percentage increase over a six-month period since six-month measurements were launched in June 2015.

Portfolio assets consist of foreign shares, investment fund shares, and long-term and short-term debt securities.

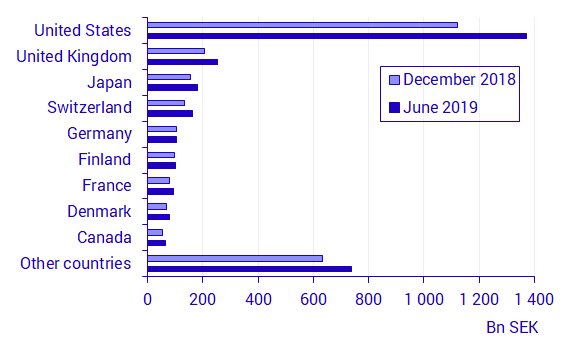

Swedish holdings in shares amounted to SEK 3 151.9 billion at the end of June 2019, which was an increase of 18.9 percent compared with the end of 2018. At the end of June 2019, shares accounted for 53.4 percent of Swedish investors’ total portfolio assets abroad. Shares in the United States were most common at the end of June 2019. Swedish holdings in US shares amounted to SEK 1 373.2 billion, which was 43.6 percent of total Swedish holdings in foreign shares.

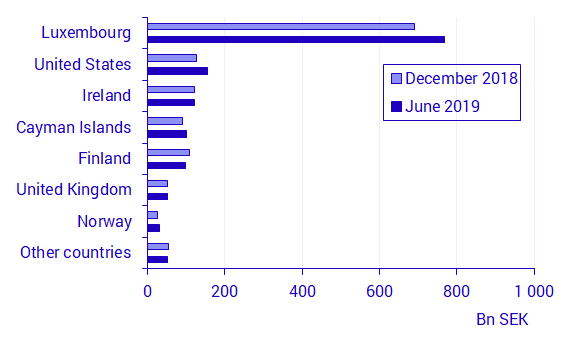

Holdings in funds amounted to SEK 1 377.2 billion at the end of June 2019, which was an increase of 8.6 percent compared with the end of December 2018. Luxembourg remains the single largest recipient country for Swedish holdings in foreign investment fund shares, accounting for SEK 768.5 billion.

Other financial institutions remain the largest holder sector

The largest holder sector was the other financial institutions sector, which accounted for 68.1 percent of total holdings at the end of June 2019. The other financial institutions sector includes securities companies, fund management companies and insurance companies. This sector holds mainly shares and investment fund shares, but also has the largest holdings of debt securities. The second largest sector was the social insurance sector, which accounted for 15.8 percent of total holdings.

Holdings in government securities increasingly common

Swedish total holdings in long-term debt securities abroad amounted to SEK 1 311.1 billion at the end of June 2019, which was an increase of 12.2 percent compared with the end of 2018. The United States was the most common country in which to have long-term debt securities, where holdings were valued at SEK 331.3 billion. Total holdings in short-term debt securities amounted to SEK 63.5 billion, which was an increase of 12 percent compared with the end of 2018. At the end of June 2019, holdings in Sweden in government securities issued abroad amounted to SEK 677.6 billion, which represented 49.3 percent of total holdings in debt securities. This can be compared with the end of June 2015, when the corresponding holdings in government securities accounted for 40.4 percent.

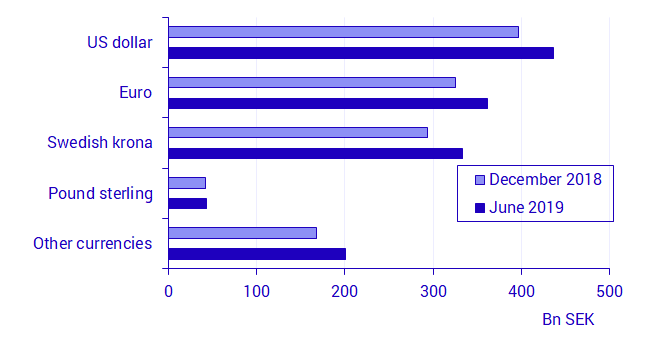

Debt securities issued in US dollars most common

Holdings in debt securities were dominated by the currencies US dollars, euros, and Swedish kronor, in which securities issued in US dollars accounted for the largest share. Swedish investors’ holdings in debt securities issued in US dollars amounted to SEK 432.1 billion at the end of June 2019. Swedish holdings issued in British pounds represented 3.2 percent of holdings in debt securities at the end of June 2019. This percentage has gradually decreased since the end of June 2015, when Swedish holdings issued in British pounds corresponded to 8.0 percent.

Swedish holdings in foreign debt securities per currency

Definitions and explanations

This study is part of the IMF’s biannual international survey and measures Swedish holdings of foreign portfolio assets with regard to both foreign shares, investment fund shares and debt securities. Sweden has taken part in this survey since 2001. Assets in the first six months of the year are measured at the end of June, and in the second half of the year, assets are measured at the end of December.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.