Financial Accounts second quarter 2022

Government savings turned from negative to positive

Statistical news from Statistics Sweden 2022-09-22 8.00

In the second quarter of 2022, the government exhibited positive savings, mainly due to increased tax revenues and dividends from state-owned companies. In the wake of the pandemic with war in Sweden’s vicinity and rising consumer and producer prices, households’ risk appetite waned while savings in bank accounts hit record levels.

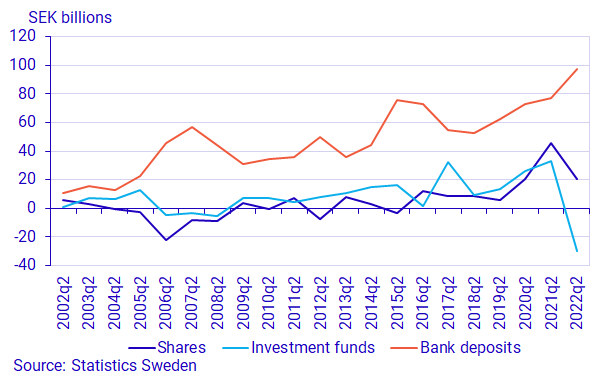

Households’ bank deposits were record-high

Households’ financial savings amounted to SEK 152 billion at the end of the second quarter of the year – a decline of 18 percent from the same quarter last year. There is a seasonal variation in households’ savings, with a historical peak in the second quarter, mainly due to stock dividends. Despite deposit rates remaining low, net deposits into bank accounts reached a record high of SEK 97 billion. The stock market also fell sharply in the second quarter and households continued to sell funds and buy shares.

Households’ annual growth rate in loans, new loans minus amortisation, came to a halt already in the prior quarter and fell to 6.3 percent in the second quarter of 2022.

Non-financial corporations continued to borrow

In connection with the outbreak of the covid-19 pandemic, non-financial corporations had difficulty in issuing securities on the fixed-income market. Instead, loans from banks and monetary financial institutions increased. Since last year, these loans have increased by SEK 381 billion. This can be compared with issued interest-bearing securities which, excluding maturity, increased by SEK 131 billion.

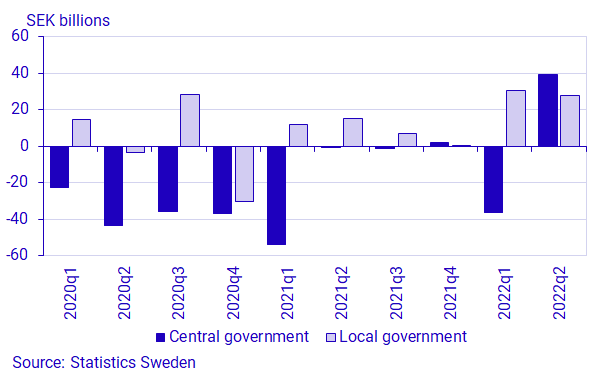

From negative to positive savings for the government

At the end of the second quarter of 2022, the government exhibited positive savings of SEK 39 billion, which can be compared with the previous quarter when savings were a negative SEK 36 billion. The main reasons for the government turning negative savings positive in the second quarter were dividends from state-owned companies, higher tax revenues and to some extent a reduction in covid-19-related support measures. As in the previous quarter, municipalities and regions had positive savings in the second quarter. Financial savings amounted to SEK 28 billion, which was SEK 3 billion lower than in the previous quarter. Taxes and government subsidies were a contributory factor to the maintained positive savings of municipalities and regions.

The market value of the government debt was SEK 2 247 billion at the end of the second quarter of 2022, which was in line with the first quarter.

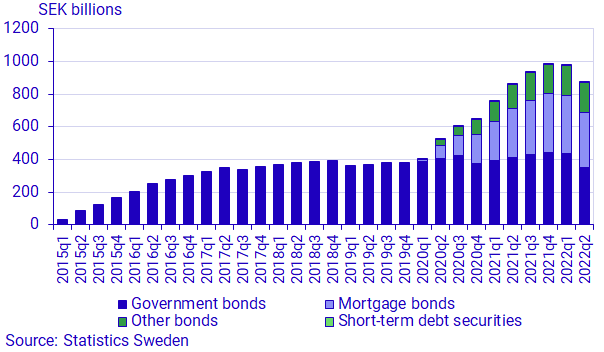

The Riksbank scaled back its rescue purchases

Since the outbreak of the pandemic in the first quarter of 2020, the Riksbank has more than doubled its holdings in Swedish interest-bearing securities with a view to conducting more expansionary monetary policy. At the end of the first quarter of 2022, the holdings amounted to SEK 979 billion. In the second quarter of 2022, these assets, which were mainly in government and mortgage bonds, had declined by 11 percent.

Elevated trading in derivatives

In the wake of rising inflation, many central banks, including the Riksbank, raised their policy rates in the second quarter of 2022. During this period, the Swedish krona weakened against both the dollar and the euro by 10 and 3 percent, respectively. Following the uncertainty in the global economy there has been elevated trading on the derivatives market. Among financial corporations, which make up the sector that trades most in derivatives, many are exposed to both interest-rate and currency risks. These entities can use derivatives for risk management but also for speculation. In the second quarter of 2022, the value of Swedish ownership in foreign derivatives was SEK 1 529 billion, while foreign ownership in Swedish derivatives was SEK 1 569 billion. This was an increase of 64 and 69 percent, respectively, compared to the end of the previous quarter, which was also a quarter of high trading in derivatives.

Revisions

When calculating the second quarter of 2022, annual statistics and quarterly statistics have been revised for the period 2011–2022Q1. The holdings of several sectors in interest-bearing securities and holdings in foreign shares and funds have been revised as of the first quarter of 2019 with data from the securities holdings database (VINN). This may cause a break in the time series between the fourth quarter of 2018 and the first quarter of 2019. Data for issued interest-bearing securities has also been revised from 2019 with data from the Swedish Securities Database (SVDB). In addition, the foreign sector has been revised as of the first quarter of 2019 with new information from the balance of payments. A number of revisions have also been made with regard to public administration. For the public sector, extraordinary dividends and assets abroad have been revised from 2016 onwards. Valuation of assets in bonds has been revised from 2017 onwards. In the municipal sector, revisions have been made to 2020 and onwards, with new sources received for the 2021 annual calculation. In addition to these revisions, municipalities’ finance lease liabilities in particular have been revised from 2017 onwards.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in financial savings and wealth for various economic sectors.

The financial accounts’ financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. In the non-financial sector accounts which, like the financial accounts, form part of the National Accounts, financial savings are calculated as the difference between income and costs. However, the financial accounts and non-financial sector accounts are based on different sources, which causes disparities between the products.

In the Financial Accounts, the government debt is calculated differently from the government debt metric that is most frequently reported and which is calculated according to the convergence criteria – the ‘Maastricht debt’. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented in nominal value and the liabilities for government administration are consolidated. The government debt in the Financial Accounts is unconsolidated and includes all financial instruments at market value.

In addition to the government agencies, the government administration sector also includes certain state foundations and state-owned companies. Government administration does not include entities within the retirement pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations and certain municipal foundations and certain municipally or regionally owned companies.

Further information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publishing on

2022-12-15 at. 08.00.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.