Financial accounts fourth quarter 2018

Households’ assets decreased sharply

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-03-21 9.30

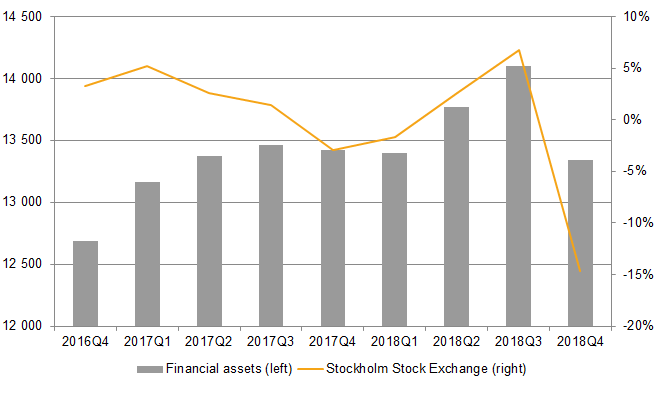

The Stockholm Stock Exchange fell in the fourth quarter of 2018, thereby contributing to a decrease of SEK 760 billion in households’ financial assets. The market value of households’ tenant-owned apartments also dropped and the annual growth rate of households’ loan stock fell to the lowest level since the third quarter of 2014.

In the fourth quarter of 2018, the Stockholm Stock Exchange recorded the largest decline in a single quarter in more than seven years. The stock market development has a large impact on households’ financial assets, since these are to a large extent shares or related to shares.

Overall, households’ financial assets decreased by SEK 760 billion, which corresponds to 5.7 percent, and amounted to SEK 13 337 billion at the end of the quarter.

Source: Statistics Sweden

Low household savings

The households’ financial savings was low in the fourth quarter and amounted to minus SEK 13 billion. Total financial savings in 2018 was SEK 183 billion, which is higher than in the past three years. The level of deposits in bank accounts remained high, both in the fourth quarter and for the whole year. Households made net sales of equity funds and bond market funds during the year, while at the same time, they net purchased shares and other funds.

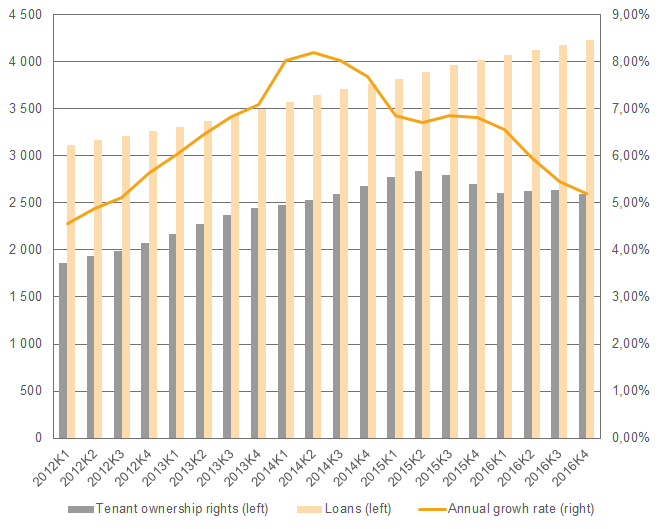

Assets in tenant-owned apartments fell and households’ loans continued to increase

The value of households’ holdings in tenant-owned apartments decreased by SEK 55 billion in the fourth quarter of 2018. Purchases of newly produced tenant-owned apartments and apartments with changing rights of tenancy to tenant-occupied apartments also decreased in the quarter and levels were the lowest since the third quarter of 2016. Assets in tenant-owned apartments amounted to SEK 2 385 billion at the end of the quarter. Households’ loans, which to a large extent consist of housing loans, continued to increase, although the rate of increase stalled at 5.2 percent. At the end of the quarter, total household loans amounted to SEK 4 229 billion.

Source: Statistics Sweden

Non-financial corporations’ financing

At the end of the fourth quarter, non-financial corporations’ issued debt securities and loans in monetary financial institutions amounted to SEK 3 506 billion. Non-financial institutions’ net transactions in debt securities were negative during the quarter for the first time since 2015, although for the whole year 2018, this form of financing has nonetheless grown more important. As a share of financing via issued debt securities and loans in monetary financial institutions, borrowing in securities has risen from 25 percent to 35 percent in the past six years.

Revisions

In connection with this publication, revisions were made for 2015–2018. The largest revisions concern the rest of the world sector and revisions in public administration. Revisions concerning central government refer to liabilities in debt securities, insurances, pensions and standardised guarantees, as well as other accounts receivable/payable.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ financial savings, net lending/net borrowing, are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing are measured as the difference between income and costs in the non-financial accounts, which, like the financial accounts, form part of the national accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

Publication

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial accounts. Financial assets and liabilities are collected from the Financial accounts and are thereby consistent with the values published in the Financial accounts.

For further information:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next press release in this series is scheduled for publication on 2019-06-19 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.