Savings Barometer, 2nd quarter 2020

Large bank deposits and high levels of household savings continue in the second quarter

Statistical news from Statistics Sweden 2020-08-27 9.30

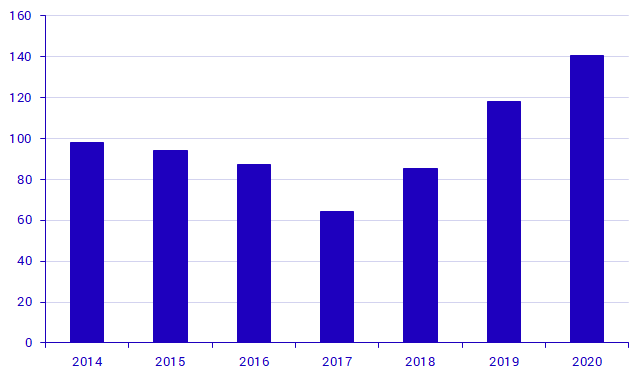

Households’ financial savings amounted to SEK 140 billion in the second quarter of 2020. The main contributor to the high level of savings was net deposits in bank accounts and net purchases of shares and investment fund shares. At the end of the second quarter 2020, households’ financial wealth had almost recovered from the significant downturn in value in the first quarter 2020.

In the second quarter of 2020, new savings in financial assets amounted to SEK 216 billion, while liabilities increased by SEK 76 billion, which resulted in SEK 140 billion in positive financial savings. Financial savings noted the highest level since the beginning of the time series in 1996, SEK 17 billion more than the previous quarter.

Source: Statistics Sweden. Data up to and including 2020q2.

The main contributor to the high level of savings was the large net deposits in bank accounts, amounting to SEK 73 billion. Households’ net deposits in bank accounts are normally large in the second quarter of the year, when most share dividends are distributed. This year, many enterprises opted to completely refrain from or delay distribution of dividends. Nonetheless, the high level of net deposits in the second quarter is probably due to dropping household consumption instead, as an effect of the coronavirus pandemic. Net deposits in bank accounts in the second quarter of 2020 were SEK 13 billion less than net deposits in the first quarter of the year. The first quarter of 2020 noted the highest net deposits in bank accounts noted throughout the time series.

Households purchased equity funds and listed shares

When the stock markets fell in the previous quarter, households net sold SEK 46 billion in funds. As the stock markets turned upwards in the second quarter, households made net purchases of shares and investment fund shares of SEK 22 billion and SEK 10 billion respectively. Households net purchased equity funds for SEK 17 billion, and net sold bond and money market funds and other funds for SEK 6 billion. At the same time, households net purchased listed and unlisted shares for SEK 16 billion and SEK 6 billion respectively.

Marginally higher cash savings

In the second quarter, households noted savings of SEK 3 billion in currency, SEK 0.5 billion more than in the corresponding quarter last year. In the past ten years, holdings in currency fell by one-third and amounted to SEK 50 billion at the end of the second quarter.

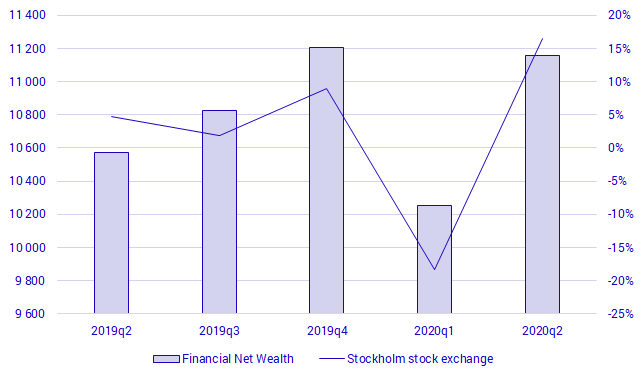

Households’ financial net wealth recovered

Households financial net wealth increased by just under SEK 900 billion in the second quarter 2020, in part due to the high level of financial savings, but mainly due to the sharp upturn in the stock market. Large parts of households’ financial assets are directly held in shares or share-related assets, such as equity funds or insurance savings, which are affected, to a large extent, by the stock market development. According to Affärsvärldens general index, the stock market rose by 16.5 percent in the second quarter, following a drop of 18.4 percent in the first quarter. This means that households’ net wealth, which noted a sharp drop in the first quarter, had recovered to a large extent by the end of the second quarter. Financial net wealth amounted to SEK 11 154 billion at the end of the second quarter.

Source: Statistics Sweden. Data up to and including 2020q2.

Households’ tenant-owned apartments decreased somewhat in value

Households’ net purchases of new tenant-owned apartments amounted to SEK 13 billion, which is SEK 7 billion less than in the same quarter a year ago and the lowest level in a second quarter in the last four years. New tenant-owned apartments consist of apartments with changing rights of tenancy to tenant-owned apartments and newly produced tenant-owned apartments. Households’ assets in tenant-owned apartments amounted to SEK 2 907 billion at the end of the second quarter, which was a decrease in value of 1.4 percent during the quarter. Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included, since they constitute real assets. Information about households’ total assets in housing is available in the National Wealth. Read more about National Wealth under More information.

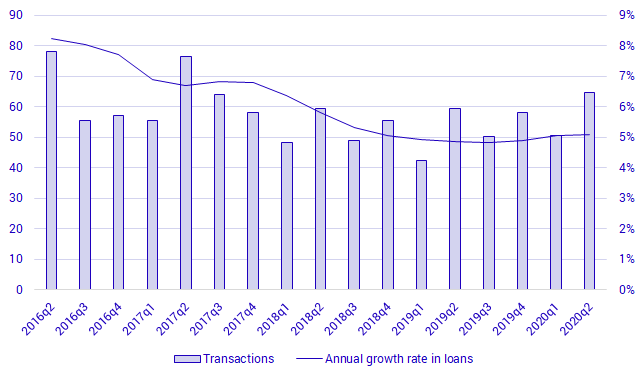

Households’ growth rate was unchanged

Households’ net borrowing, that is, new loans minus amortisations, amounted to SEK 65 billion in the second quarter of 2020, which is SEK 5 billion more than in the corresponding period a year ago. Net borrowing has not been at the same level since the third quarter 2017. This higher level of net borrowing can be explained, in part, by banks’ temporary relaxation on amortisation requirements. This may have led to decreased amortisations on loans, which in turn led to a decreased subdued effect on households’ net borrowing. The annual growth rate on loans was 5.1 percent in the second quarter, which is in line with the previous quarter and is marginally higher than in 2019.

Source: Statistics Sweden. Data up to and including 2020q2.

Definitions and explanations

Financial savings is calculated as the difference between transactions in financial assets and transactions in liabilities.

The Savings Barometer comprises a preliminary calculation of the household sector. A more complete calculation of the household sector is presented in conjunction with the publication of the Financial Accounts.

The statistics in the Savings Barometer concerning households’ funds is distinct from the statistics on the product Investment funds, assets and liabilities. The Savings Barometer includes ownership in investment fund shares registered in nominee accounts. Furthermore, households’ retained dividend payments are recorded as purchases of new investment fund shares.

The Savings Barometer does not publish any revisions other than the revisions introduced in the latest publication of the Financial Accounts. In connection with this publication of the Savings Barometer, the time series will be updated from the first quarter of 2018 onward with the revisions introduced in the Financial Accounts’ publication on 17 June.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

More information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from Financial accounts and are thereby consistent with the values published in Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (svenska) (pdf)

Statistical database;

Next publishing will be

2020-11-19 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.