Savings Barometer, 2nd quarter 2022

High level of savings in bank accounts

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2022-08-25 8.00

Households’ financial net wealth declined 10 percent in the second quarter of 2022, when both the stock market and the value of tenant-owned apartments fell. At the same time, savings in bank accounts reached an all-time high. During the quarter, interest rates increased and the growth rate for loans to households fell 0.6 percentage points to 6.3 percent after an upswing in 2020 and 2021.

Households’ new savings in financial assets amounted to SEK 236 billion in the second quarter of 2022. At the same time, debts rose

SEK 75 billion, generating financial savings of SEK 161 billion – the second-highest savings level ever measured. Only the second quarter of last year has shown a higher savings level. There is a seasonal variation in households’ savings, which usually peak in the second quarter. This is largely because most stock dividends are paid out then.

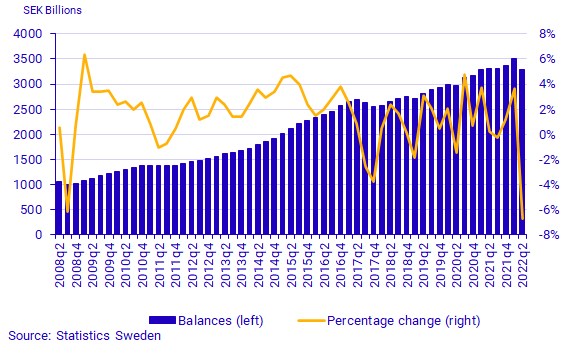

Savings in bank accounts at an all-time high

For the second quarter of 2022, households’ net deposits into bank accounts were at an all-time high, reaching SEK 97 billion. Households’ net deposits into bank accounts have not been at such high levels since the first quarter of 2020, when the covid-19 pandemic broke out and households deposited a net amount of SEK 86 billion.

In the latest five-year period, households have deposited a net amount of SEK 828 billion into bank accounts despite low deposit rates.

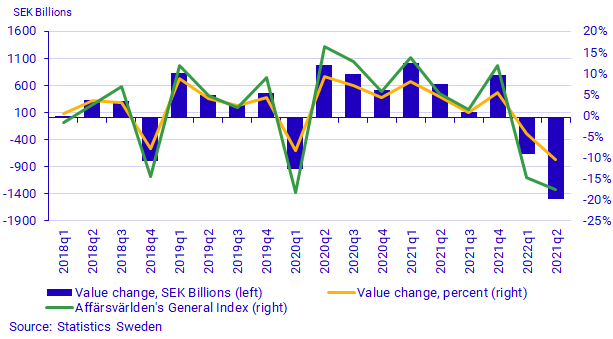

Households bought shares and sold funds

According to Affärsvärlden's General Index, the stock market fell 17.6 percent in the second quarter of 2022. Over the same period, households purchased shares to a net amount of SEK 18 billion, with Swedish listed shares representing the biggest net purchase of SEK 14 billion. At the same time, households sold funds to a net amount of

SEK 10 billion, with the biggest sales in foreign-registered funds. It is the second consecutive quarter in which households have sold off fund units.

The market value of households' tenant-owned apartments declined

Households’ assets in tenant-owned apartments amounted to SEK 3 281 billion at the end of the second quarter – a decrease of SEK 226 billion compared with the previous quarter. The market value of households’ assets in tenant-owned apartments has risen over a long period of time, with the exception of very few quarters. In the second quarter of 2022, when interest rates rose, the market value fell 6.7 percent. Although the market value remains at high levels, a similar downturn has only occurred once before. That was in the third quarter of 2008, when the market value fell 6.2 percent in the wake of the financial crisis.

Households’ net purchases of new tenant-owned apartments amounted to SEK 10 billion, which was in line with the previous quarter, but SEK 8 billion lower than in the same quarter of the previous year. New tenant-owned apartments consist of apartments with converted occupancy rights (from tenancy to tenant-ownership), and newly produced tenant-owned apartments.

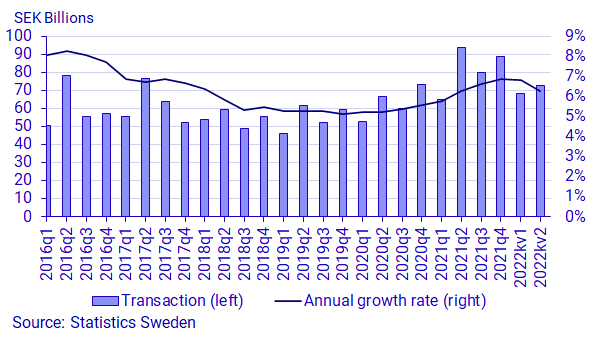

Growth rate for loans decreased

In the second quarter of 2022, the annual growth rate for loans was 6.3 percent, which was 0.6 percent lower than in the previous quarter. One reason for the decline was the interest-rate hikes that were made during the quarter. Loans consist of new loans minus amortisation payments made.

Decline in financial net wealth

Despite a sustained high level of financial net savings, net wealth declined in the second quarter, when both the Stockholm stock exchange and market value of tenant-owned apartments fell.

At the end of the second quarter of 2022, financial net wealth was SEK 13 030 billion – a decline of SEK 1 504 billion, or 10 percent, from the previous quarter. This is the largest decrease since the time series started in 1996. Despite the downturn in the quarter, households’ financial net wealth has risen SEK 2 660 billion since the covid-19 pandemic broke out in the first quarter of 2020.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take account of inflation.

Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included however, since they constitute real assets. Information on households’ total assets in dwellings is available in the publication National Wealth.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the second quarter of 2022, the time series is updated as of the first quarter of 2019 with the revisions introduced into the Financial Accounts’ publication on 16 June.

More detailed descriptions of major revisions are provided in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2022-11-17 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.