Savings Barometer, 3rd quarter 2018:

Households borrowed less in the third quarter

Statistical news from Statistics Sweden 2018-11-22 9.30

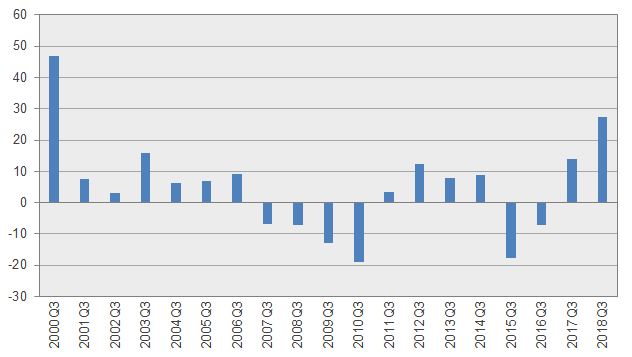

Households’ financial savings amounted to SEK 27 billion in the third quarter of 2018, which is higher than in the corresponding quarter of 2017. This higher level of financial savings is due, in part, to a slower increase in loans.

Households’ financial savings, new savings minus increase in debt, amounted to SEK 27 billion in the third quarter of 2018, which is the highest savings in the third quarter in 18 years. Not since the IT bubble burst in 2000 have households’ savings been higher in the third quarter.

Source: Statistics Sweden

The high level of savings in the third quarter of 2018 is mainly explained by a slowed increase in debt. Households’ new loans minus amortisation increased by SEK 49 billion during the quarter, which is SEK 16 billion less than in the corresponding quarter last year, making it the lowest increase in loans in a single quarter since the first quarter of 2015.

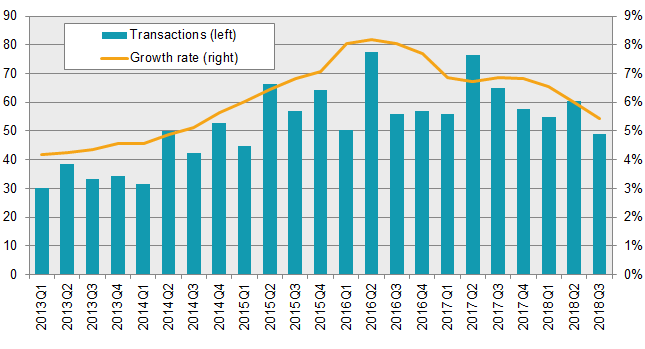

Annual growth rate of households’ loans declined

Households’ loans consist primarily of loans in banks and housing credit institutions, as well as CSN student loans and other loans. Since the introduction of the first amortisation requirements in June 2016, the annual growth rate of households’ loans has decreased from 8.2 percent, to 5.5 percent in the third quarter of 2018. The annual growth rate of loans has not been this low since the third quarter of 2014. At the close of the third quarter of 2018, household loans amounted to SEK 4 177 billion.

Source: Statistics Sweden

Value of tenant-owned apartments fell

At the same time as the growth rate of loans declined during the quarter, the value of households’ tenant-owned apartments also decreased. The market value of households’ tenant-owned apartments fell by 3 percent during the third quarter. The market value of tenant-owned apartments fell by 7 percent compared with the third quarter of 2017. Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. Tangible assets such as one- or two-dwelling buildings with ownership rights are not included in the Savings Barometer.

Net purchases of newly produced tenant-owned apartments and apartments with changing rights of tenancy to tenant-owned apartments amounted to SEK 7 billion in the third quarter of 2018, which is SEK 3 billion less than in the corresponding quarter of 2017. The outstanding value of households’ assets in tenant-owned apartments amounted to SEK 2 417 billion at the end of the period.

Value of households’ share portfolio increased

The value of households’ Swedish listed shares increased by 10 percent in the third quarter of 2018, which is the highest increase in a single quarter since the third quarter of 2016. Households’ holdings in Swedish listed shares amounted to SEK 820 billion at the close of the third quarter.

Despite the low deposit rate, households continued to save in bank accounts in the third quarter of 2018, although to a lower degree than before. Households made SEK 29 billion in net deposits in bank accounts, SEK 10 billion less than in the third quarter of 2017. Households made net sales of SEK 7 billion during the quarter in structured products, mainly in index-linked bonds. Net purchases were made in equity funds and other funds, which includes hedge funds, while net sales continued in interest funds, which has been a trend for the past three years.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities.

In the Savings Barometer, only the most recent quarter is updated with new data. The time series of the Savings Barometer, on the other hand, is updated with regard to revisions and method changes introduced in the most recent publication of the Financial Accounts. There is more time in the Financial Accounts for calculations and reconciliation. Detailed descriptions of major revisions are presented in the statistical news on the Financial Accounts:

Next publishing will be

2019-02-21 at 09:30.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.