Savings Barometer, 3rd quarter 2019

Lower savings in bank accounts

Statistical news from Statistics Sweden 2019-11-21 9.30

Households’ financial savings amounted to SEK 4 billion in the third quarter, which is lower than in the corresponding quarter in 2018. This lower level of financial savings is due, in part, to lower savings in bank accounts and a negative impact of tax accrual. Households’ loan growth rate slowed further and was 0.1 percentage points lower than the previous quarter.

New savings in financial assets amounted to SEK 51 billion, while debts increased by just over SEK 46 billion in the third quarter of 2019, which resulted in SEK 4 billion in financial savings. Households’ financial wealth rose by 2.2 percent to SEK 10 450 billion. According to the Affärsvärlden General Index, the stock market rose by 1.9 percent during the quarter.

Lower savings in bank accounts and slowing loan growth rate

The primary contributor to the lower financial savings was lower savings in bank accounts and a negative impact of tax accruals. Tax accrual refers to taxes and social contributions that are booked at the time they arise rather than when they are actually paid.

Households’ savings in bank accounts has been a strong contributing factor to a higher level of financial savings in recent years. In the third quarter this year, savings in bank accounts amounted to SEK 9 billion, which is the lowest level for a third quarter in five years. The impact of tax accrual amounted to minus SEK 14 billion, which can be compared with SEK 4 billion in the corresponding period a year ago.

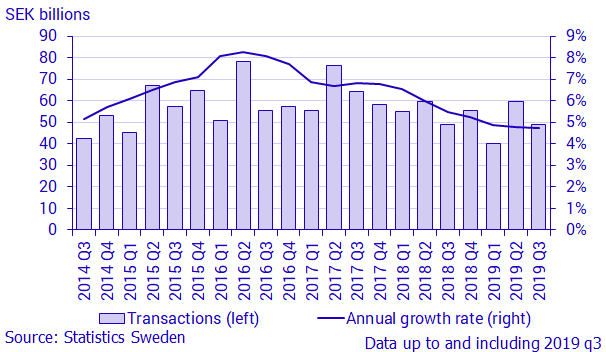

Net borrowing, that is, new loans minus amortisations, amounted to SEK 49 billion in the third quarter 2019, which is in line with net borrowing in the corresponding quarter a year ago. The annual growth rate on loans slowed further and amounted to 4.7 percent, which was 0.1 percentage point lower than in the previous quarter. Households’ loans, which consist primarily of loans in bank and housing institutes and CSN student loans, amounted to SEK 4 378 billion at the end of the third quarter.

Net purchases of new tenant-owned apartments decreasing

Net purchases of new tenant-owned apartments amounted to SEK 9 billion in the third quarter 2019, which was SEK 6 billion less than in the corresponding period a year ago.

Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included, since they constitute real assets. Households made net purchases of holiday homes abroad for SEK 0.5 billion. Households’ assets in tenant-owned apartments in Sweden and holiday homes abroad were valued at SEK 2 931 billion, in which the value of tenant-owned apartments accounted for 93 percent.

Households made net purchases of funds and shares

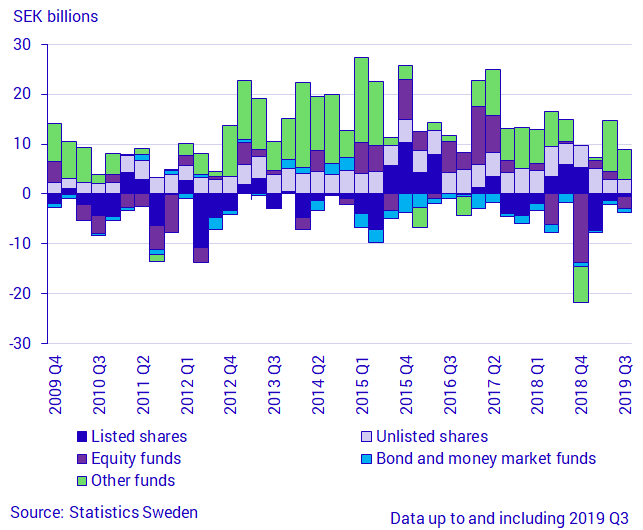

Households made net purchases of mutual fund units and shares amounting to SEK 2.8 billion and SEK 2.5 billion, respectively. In the past ten years, households have made average net purchases of shares and mutual fund units for SEK 3.2 billion and SEK 4.9 billion, respectively. In the same period, among these asset classes, other funds and unlisted shares have been preferred ahead of other subcategories of asset classes.

Households have invested in unlisted shares for SEK 3.9 billion per quarter on average. In the same period, listed shares were net sold for SEK 0.4 billion per quarter on average, but this has varied more between quarters. Within the funds asset class, bond market funds were net sold for on average SEK 0.8 billion per quarter during the ten-year period, equity funds were net sold for SEK 0.5 billion, while other funds were net purchased for on average SEK 5.4 billion per quarter. Other funds consist of mixed funds, hedge funds and other funds.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer in the third quarter of 2019, the entire time series will be updated from the first quarter 1996 onwards with the revisions introduced in the Financial Accounts’ publication on 24 September.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Next publishing will be

2020-02-20 at 09:30.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.