Savings Barometer, 4th quarter 2019

Negative household savings in the fourth quarter

Statistical news from Statistics Sweden 2020-02-20 9.30

Households’ financial savings in the fourth quarter of 2019 amounted to SEK -14 billion, the lowest level in more than four years. Households’ levels of net deposits in bank accounts were low, and at the same time, households made net purchases of new tenant-owned apartments and funds during the quarter.

In the fourth quarter of 2019, new savings in financial assets amounted to SEK 50 billion, while liabilities increased by SEK 64 billion, which resulted in SEK 14 billion in negative financial savings. This was the lowest level of financial savings since the third quarter of 2015. Financial savings has historically commonly been lower in the fourth quarter than in the other three quarters. The main contributor to the low level of financial savings this quarter was low net deposits in bank accounts, a negative impact of tax accrual and higher levels of net borrowing.

Households purchased funds and savings on bank accounts were low

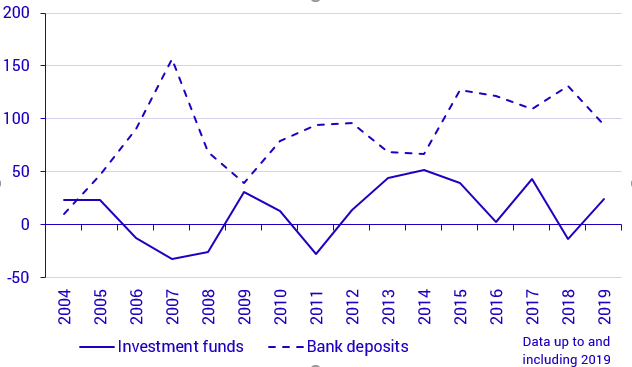

In the fourth quarter of 2019, households made net purchases of equity funds and other funds amounting to SEK 7 billion and SEK 6 billion respectively, while bond and money market funds were net sold for SEK 1 billion. During the whole year 2019, households made net purchases of funds amounting to SEK 25 billion, compared with SEK 13 billion in net sales of funds in 2018.

Households’ levels of net deposits on bank accounts were the lowest in more than four years and amounted to SEK 3 billion in the fourth quarter of 2019. In recent years, households have made large net deposits in bank accounts despite low interest rates. However, in the third and fourth quarters of 2019, deposits were considerably lower. In the past decade, average net deposits in bank accounts amounted to SEK 25 billion per quarter. Net deposits in 2019 amounted to SEK 94 billion, compared with SEK 131 billion in 2018. In the last 15 years, there has been a clear negative correlation between net purchases of funds and net deposits in bank accounts.

Source: Statistics Sweden

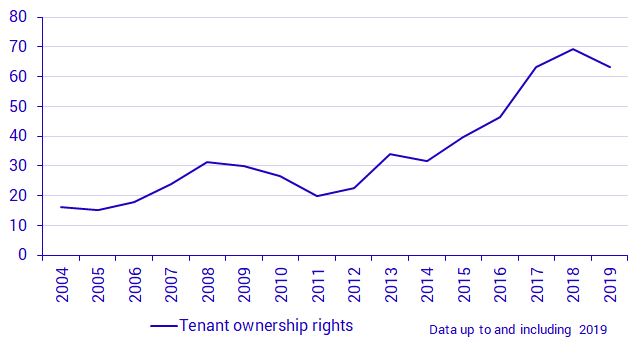

Major net purchases of new tenant-owned apartments

Households’ net purchases of new tenant-own apartments amounted to SEK 21 billion in the fourth quarter of 2019, which is the highest value ever in a single quarter. In 2019, households’ net purchases of new tenant-owned apartments amounted to SEK 63 billion, which was lower than in 2018, but on par with 2017. New tenant-owned apartments consist of apartments with changing rights of tenancy to tenant-owned apartments and newly produced tenant-owned apartments. Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included, since they constitute real assets. Households’ assets in tenant-owned apartments amounted to SEK 2 852 billion at the end of the quarter.

Source: Statistics Sweden

Annual growth rate of loans

Households’ net borrowing, that is, new loans minus amortisations, amounted to SEK 59 billion in the fourth quarter 2019, which is in line with net borrowing in the corresponding quarter a year ago. The annual growth rate of loans amounted to 4.8 percent. In 2016 the growth rate of loans was about eight percent, and has been steadily slowing since then. In 2019, the growth rate of loans continued to decline, although not at the same pace as before. Households’ loans, which consist primarily of loans in bank and housing credit institutions, as well as student loans, amounted to SEK 4 434 billion at the end of the fourth quarter.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities.

The Savings Barometer comprises a preliminary calculation of the household sector. A more complete calculation of the household sector is carried out in conjunction with the publication of the Financial Accounts.

The statistics in the Savings Barometer concerning households’ funds is distinct from the statistics on the product Investment funds, assets and liabilities. The Savings Barometer includes ownership in investment fund shares registered in nominee accounts. Furthermore, households’ retained dividend payments are recorded as purchases of new investment fund shares.

The Savings Barometer does not publish any revisions other than the revisions introduced in the latest publication of the Financial Accounts. In connection with this publication of the Savings Barometer, the entire time series will be updated from the first quarter 2015 onward with the revisions introduced in the Financial Accounts’ publication on 19 December.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Next publishing will be

2020-05-20 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.