Shareholder statistics, December 2019

Households’ share wealth continued to increase

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2020-03-05 9.30

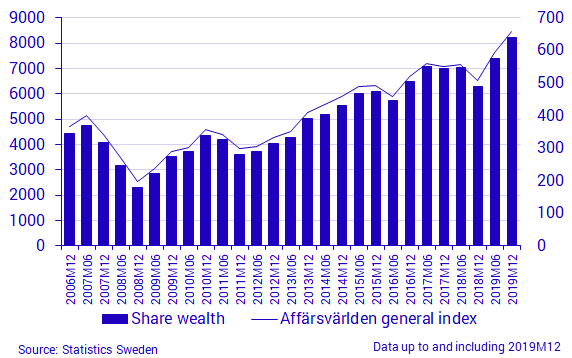

Total share wealth in shares listed on Swedish marketplaces increased by 12 percent in the second half of 2019 and amounted to SEK 8 233 billion.

In the second half of 2019, the Swedish stock market rose to record levels and total share wealth increased by SEK 856 billion from the first six months of 2019. OMX Stockholm rose by 11 percent according to Affärsvärlden general index, and there were 889 listed companies on Swedish marketplaces. In the second half of 2019 and during the full year, the number of listed companies increased by 12 companies and 25 companies respectively.

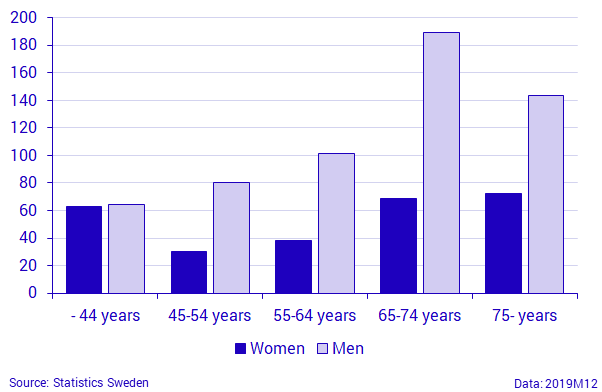

Large gaps between women and men persist

Household sector holdings in shares on Swedish marketplaces amounted to SEK 974 billion at the end of December 2019, SEK 104 billion more than in June 2019. Households’ total share wealth corresponded to 12 percent of total share wealth.

Over time, distribution of share assets between the sexes has not changed substantially. At the end of 2019, men still held two-thirds of households’ share assets, while women held one-third. Among men and women up to the age of 44 years, the difference in share wealth between the sexes is minimal. Among shareholders over 44 years, the difference between the sexes is more marked. The major difference between men and women is noted in the age group 65-74 years, in which men hold nearly three times as much as women.

Households’ total share wealth, by sex and age, SEK billions

There are relatively large differences between various income groups, both with regard to average portfolio value and percentage of total share wealth for households. At the end of 2019, shareholders with an annual income of at least SEK 1 million held an average share portfolio of SEK 6.5 million and, as a group, owned 58 percent of households’ total share wealth. Shareholders with an annual income between SEK 200 000 and SEK 599 999 had an average portfolio of SEK 307 000 and, as a group, owned 23 percent of total wealth in that sector.

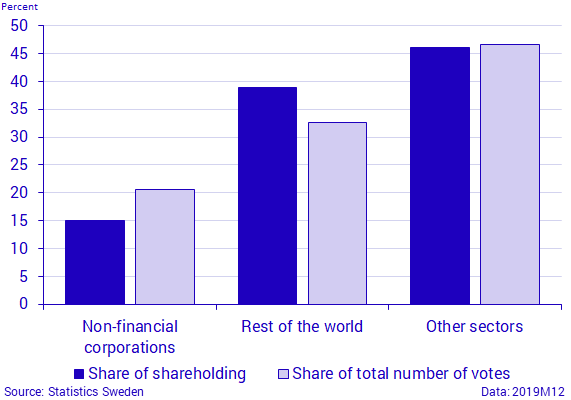

Non-financial corporations increased ownership share on the stock market

The shifts in shareholder structure on Swedish marketplaces in the past 20 years have been minor. Holdings among non-financial companies increased by 0.5 percentage points during the period, and by 1.1 percentage point for the full year 2019.

At the end of 2019, foreign owners were the largest owner sector, accounting for 39 percent of total share wealth on Swedish marketplaces, 0.3 percentage points less than at the end of the first six months of 2019. The United States and the United Kingdom remained the two largest owner countries and together accounted for 53 percent of total foreign ownership. The United States decreased its percentage of holdings by 3 percent, while holdings by the United Kingdom remained unchanged from the end of June 2019.

In most sectors, the percentage of total share wealth on Swedish marketplaces reflects the percentage of voting rights for that sector. However, this does not apply to the sectors rest of the world and non-financial corporations, in which the percentage of total share wealth and the percentage of total voting rights differ. At the end of 2019, the rest of the world sector had 33 percent in total voting rights on Swedish marketplaces, which was 6 percentage points less than the percentage of its share wealth. Among non-financial corporations, the proportions were reversed, that is, voting rights were 6 percentage points more than share wealth. Thus, non-financial corporations to a greater extent held shares with more voting rights, while the rest of the world sector to a greater extent held shares with fewer voting rights.

Definitions and explanations

Information on the final owner is not available concerning ownership in security accounts via Swedish nominees if holdings are less than 501 shares in an enterprise, which means that these holdings are not included in a breakdown of households’ income and age. Information on foreign nominees’ final owners is not available, as these are not included in the public shareholders’ register. At the end of December 2019, households’ ownership in shares registered in security accounts amounted to 13 percent of total shareholdings.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM, and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the marketplaces mentioned above are included in the statistics from 2000 onwards.

In connection with this publication, new tables have been added that correspond to the statistics reported in the Statistical Report in the Statistical Database.

Next publishing will be

Next publication date 2020-09-03.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.