Direct investment 2022 – assets and income

Income on Swedish direct investment assets abroad increased in 2022

Statistical news from Statistics Sweden 2023-12-12 8.00

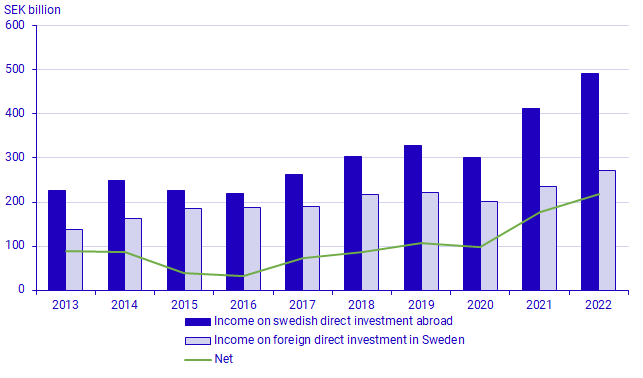

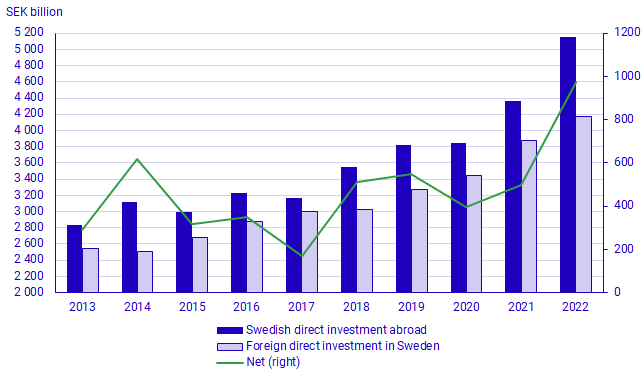

Income on Swedish direct investment assets abroad amounted to SEK 491 billion in 2022, which is an increase by 19 percent compared to 2021. In the same period, income on foreign direct investment assets in Sweden increased by 15 percent and amounted to SEK 272 billion. At the end of 2022, Swedish direct investment assets abroad amounted to SEK 5 150 billion, which is an increase of SEK 782 billion compared with the previous year. Foreign assets in Sweden increased by SEK 303 billion and amounted to SEK 4 174 billion at the end of 2022.

Income increased on direct investment assets

Income on Swedish direct investment assets abroad increased by SEK 78 billion in 2022 compared with 2021 and amounted to SEK 491 billion in total. The largest contribution came from companies manufacturing “petroleum, chemical and rubber and plastic products”. Income on foreign direct investment assets in Sweden increased by SEK 36 billion in a corresponding comparison, and amounted to SEK 272 billion. The largest contributor to this increase was also companies operating in the manufacturing “petroleum, chemical and rubber and plastic products”.

Swedish direct investment assets abroad increased

Swedish direct investment assets abroad amounted to SEK 5 150 billion at the end of 2022. This is an increase of SEK 782 billion compared with the end of 2022. Equity accounted for SEK 4 406 billion of total Swedish direct investment assets abroad, which was an increase of 14 percent compared with the end of 2021. Net claims against foreign subsidiaries, fellow subsidiaries, and associated companies amounted to SEK 744 billion, an increase of 47 percent compared with 2021.

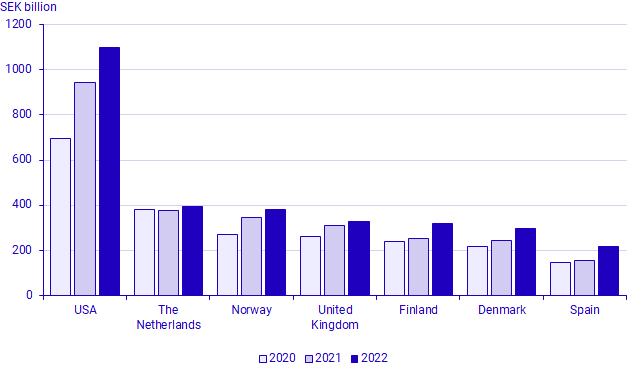

Sweden’s largest direct investment assets abroad are located in the United States. There are also large Swedish direct investment assets in several European countries, such as the Netherlands, Norway and the United Kingdom. Swedish direct investment assets in the United States amounted to SEK 1 100 billion at the end of 2022, which is an increase of 17 percent compared with the end of 2021. The United States is also the country where the Swedish direct investment assets increased most in value in 2022. Part of the increase could be explained by a weakened Swedish krona against the US dollar, which was 15,4 percent. The largest assets abroad are held by Swedish companies manufacturing “metal and mechanical products”, and by companies operating in “financial and insurance activities”.

Among total direct investment assets abroad, SEK 112 billion was controlled by “special purpose entities” (SPEs). SPEs are enterprises that are ultimately controlled from abroad and, beyond owning assets and liabilities, have limited activities in Sweden. Reporting SPE data separately provides a useful measure of a country’s incoming and outgoing direct investments, by making it possible to exclude capital that only passes through a country on its way to other destinations.

Development of the Swedish krona

In 2022, the Swedish krona was weakened by about 7,5 percent compared with other currencies, according to the KIX index. The Swedish krona was weakened by 8,8 percent against the euro, and also by 15,4 percent against the US dollar. A weakened Swedish krona contributes to increased asset value on Swedish direct investment abroad, expressed in Swedish kronor.

Foreign direct investment assets in Sweden increased

Foreign direct investment assets in Sweden increased by SEK 303 billion at the end of 2022 compared with 2021, and amounted to SEK 4 174 billion. In 2022, equity increased by 5 percent to SEK 3 576 billion. At the end of 2022, net liabilities to foreign owner groups amounted to SEK 597 billion, which was an increase by 25 percent compared with the previous year.

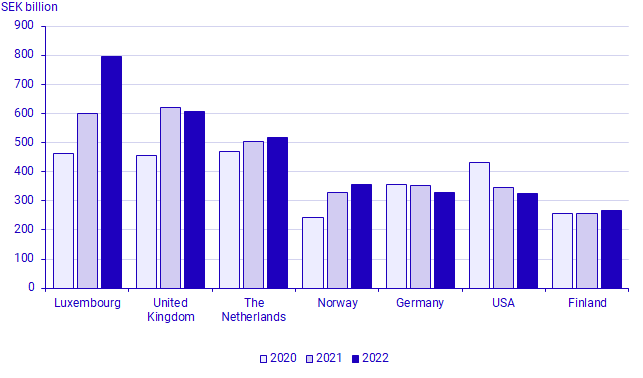

In terms of foreign direct investment assets in Sweden, Luxembourg has surpassed the United Kingdom as the largest holder country. Luxembourg’s assets in Sweden amounted to SEK 796 billion at the end of 2022, while the United Kingdom’s assets amounted to SEK 608 billion. Luxembourg’s assets increased by SEK 195 billion compared with the end of 2021 and this accounted for the largest increase.

The largest foreign assets in Sweden are noted in the industry groups “financial and insurance activities”and “legal, professional, scientific and technical activities”. Companies operating in “legal, professional, scientific and technical activities” increased their assets most in Sweden in 2022. Among total direct investments in Sweden, investments in Swedish SPEs accounted for SEK 170 billion.

What is direct investment?

A direct investment arises when someone, usually a company, directly or indirectly controls 10 percent or more of the number of votes in a company or commercial property located in another country. The annual direct investment survey measures assets such as total equity, financial claims and liabilities within a direct investment relationship, and directly-owned commercial property. Information on direct investments published in the SCB’s Statistical Database includes holiday homes and internal trade credits. This information is also included in the international investment position, which shows Sweden’s assets and liabilities in relation to other countries.

Income on direct investment is calculated as profit/loss after financial items, adjusted for write-downs (net, including credit losses), capital gains/losses and taxes. Total income, published in the Statistical Database, also includes interest income and costs on direct investment loans, and income on holiday homes. Income on direct investment is booked in the current account.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.