Industry allocated environmental taxes 2015:

Industry allocated environmental taxes 2015

Statistical news from Statistics Sweden 2017-10-04 9.30

Environmental tax revenue to the government increased by SEK 6 billion in 2015. 89 percent of the increase is from the household and business sectors payment of the vehicle tax and energy taxes. The increase comes after a few years of decreasing or stable environmental tax revenues.

During 2015 and 2016 environmental tax revenue to the government increased. New industry allocated statistics gives more insight to the increase in 2015. It is mostly the revenue from energy tax on fuels and electricity, CO2 tax and vehicle tax that cause the increase in government revenue. These taxes have seen increasing tax rates and also some tax exemptions for farming and manufacturing have been lowered.

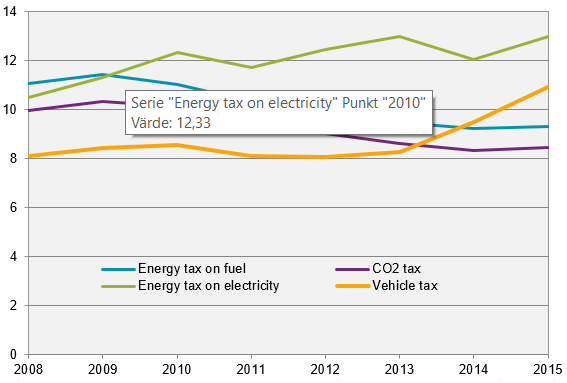

A time series for environmental taxes is available from 2008 and onwards. It shows that revenues from vehicle and energy taxes (including CO2 tax) have increased in 2015 after a previous decrease or standstill.

For the households the increase in 2015 is SEK 2.6 billion, which is primarily from the vehicle tax and energy tax on electricity (also includes the fee for nuclear fuel waste). The revenue increase for the vehicle tax is SEK 1.7 billion for all of Sweden and the households alone stand for SEK 1.4 billion of this. The revenue increase from the vehicle tax from households began in 2014.

In the figure the energy tax on electricity is combined with the fee for nuclear waste.

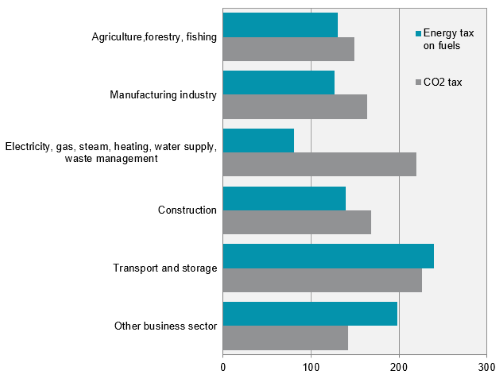

For the business sector the increase in government revenue of SEK 2.9 billion is instead mainly from the energy tax on fuels and CO2 tax. The later caused increased government revenue of SEK 1.3 billion for all of Sweden, of these almost SEK 1.1 billion was from the business sector. Within the business sector the increase in environmental tax revenue comes from agriculture, manufacturing, energy production and land transportation industries.

In the figure the energy tax on electricity is combined with the fee for nuclear waste.

Energy tax on fuels and electricity, the fee for nuclear waste, vehicle tax and CO2 tax together stand for 88 percent of all environmental taxes.

Information about revision

New statistics are available on energy use by industry; this provides the basis for distribution of environmental taxes to economic actors. Previously published statistics are revised from 2009.

Definitions and explanations

Environmental taxes

The definition of an environmental tax used by Statistics Sweden was developed by Eurostat and the OECD. Today it forms part of the international statistical standard in the SEEA Central Framework and enables comparative studies between different nations. Eurostat’s definition is:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in the European System of Accounts (ESA) as a tax.”

According to the definition, the tax base - not the intention or the name of the tax - determines whether the tax is environmental. The ESA is a framework of guidelines for calculating national accounts used by members of the European Union.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.