Savings barometer, 4th quarter 2016:

Households’ loans increasing at a slower rate

Statistical news from Statistics Sweden 2017-02-23 9.30

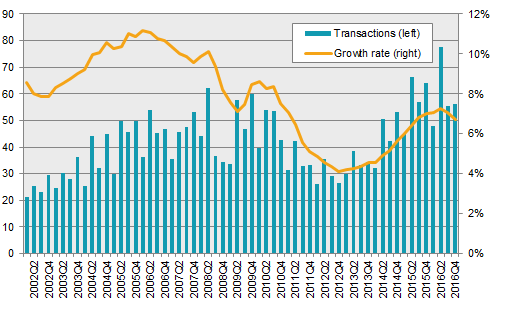

Households’ loans had a 6.7 percent annual rate of increase in the fourth quarter of 2016, which is 0.4 percentage points lower than in the third quarter. This is the second quarter in a row that the rate of increase has dropped. Households' financial savings, new savings minus increase in debt, amounted to SEK 13 billion in the fourth quarter of 2016, and were slightly lower than in the corresponding quarter in the last three years.

Households’ loans increased by SEK 56 billion in the fourth quarter of 2016 and amounted to SEK 3 729 billion at the end of the quarter. During the entire year of 2016, households’ loans increased by SEK 235 billion, which is SEK 6 billion more than the increase in 2015.

Source: Statistics Sweden

The rate of increase for loans dropped in the last two quarters. Amortisation requirements on new loans were introduced on 1 June 2016, and may have affected new loans in the second half of 2016. Household loans consist, to nearly 80 percent, of housing loans in banks and housing credit institutions. The category ‘Other loans’ consists mainly of loans from financial companies and amounted to SEK 72 billion at the end of the fourth quarter in 2016. In the first three quarters of 2015, the annual rate of increase was negative for other loans, but since the fourth quarter of 2015 it has been positive, and was on average 8 percent.

Households made deposits in bank accounts

Despite low interest rates, households continued to save in bank accounts, albeit at a slightly slower rate. Net deposits amounted to SEK 9 billion in the fourth quarter and were the lowest in a fourth quarter since 2009. The trend of less cash in the economy accelerated after 2014. From the beginning of 2015 to the end of 2016, households’ holdings of bank notes and coins issued by the Riksbank decreased by 25 percent. The Riksbank’s replacement of new banknotes and coins during these years may be part of the explanation.

Large net purchases of tenant ownership rights

Households’ purchases of newly produced tenant-owned apartments and apartments with changing rights of tenancy to tenant-owned apartments are a financial asset. Tangible assets such as one- or two-dwelling buildings with ownership rights are not included in the Savings Barometer. In the fourth quarter, net purchases of tenant ownership rights amounted to SEK 13 billion, which together with the corresponding quarter in the 2015, was the highest listing for a fourth quarter since the beginning of the time series. One of the main reasons for this is the high level of new production of dwellings, mainly in Greater Stockholm.

Lower level of financial savings but increased financial net wealth

New savings in financial assets was SEK 74 billion, while debts increased by SEK 61 billion in the quarter, which provided SEK 13 billion in financial savings. This is a slightly lower level of financial savings than in the most recent years. The average savings in the fourth quarter in the last three years was SEK 20 billion. Financial net wealth, that is, financial assets minus liabilities, amounted to SEK 8 427 billion at the end of the quarter. This is an increase of SEK 153 billion since the end of the third quarter. The increase is largely due to a three percent increase in the Stockholm Stock Exchange and a one percent increase in prices of tenant ownership rights.

Individual financial savings excluding accruals, which show savings in more liquid assets, were significantly lower, and amounted to minus SEK 34 billion. The reason why these savings are lower than the total savings is mainly due to significant deposits to occupational and premium pensions, as well as households' accrual of taxes that are excluded from individual savings.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities.

No significant revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the fourth quarter of 2016, the entire time series will be updated from the first quarter 2009 onwards with the revisions introduced in the Financial Accounts' publication on 21 December. In addition, minor revisions from the first quarter 2016 onwards have been included (in accordance with the revision policy). More detailed descriptions of these revisions and other larger revisions are described in the Statistical Report for Financial Accounts 3rd quarter 2016.

Next publishing will be

2017-05-23 at 09:30.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.