Instructions – what to report

On this page you will find information about common questions that may arise when completing the Intrastat form. The content is sorted in alphabetical order.

A complete guide is available here:

Advertising material

Advertising material should only be reported to Intrastat if the goods are a subject of a commercial transaction, i.e. when an invoice has been issued. If the goods are delivered free of charge with the sole intention to prepare for or support an intended subsequent trade transaction by demonstrating its characteristics, it should not be included.

Commodity code

The commodity code (also called CN-code) consists of the first eight digits shown in the customs tariff.

The statistical commodity codes may be given on the invoice by the supplier. If so, it may be written in different formats, such as custom code, tariff code, or taric code.

For further information and how to search for commodity codes, please see Commodity codes (CN).

Correction of information

- Have you accidentally reported arrivals as dispatches or vice versa, or submitted data for the wrong reference period? Please contact us by e-mail or phone and we will assist you.

- Do you need to correct individual items in an already submitted declaration? Please fill in our correction form (xlsx) and e-mail it to us. The correction form may be used for

- incorrectly reported, incorrectly billed, or price adjusted goods

- significant errors concerning commodity code, country code, transaction type, net weight, other supplementary unit, country of origin, and Partner-ID.

- Do you need to make corrections due to credit notes? See our handbook about credit notes, Credit notes (pdf).

- Please observe that the correction form if only intended for correcting individual items in an already submitted report. If a large part, or the report as a whole is incorrect, please submit a new report and notify us by e-mail that the incorrect report is to be deleted.

Country of origin

- The variable Country of Origin is only a requirement for dispatches.

- The country of origin refers to the country where the product was produced or manufactured.

- If the product has been manufactured in two or more countries, the country of origin is the country where the last significant and economically justified processing took place.

- If you do not know the country of origin

- use QV if the product originates from another EU member state

- use QW if you know that the goods originate from a third country.

- use the country of dispatch (SE) if the country of origin if completely unknown.

Credit notes

For more information about credit notes and returns, please see Credit notes (pdf).

EC sales list

The EC sales list which is declared to the Swedish Tax Agency (Skatteverket) requires information about VAT-number, partner country and value. However, it does not specify the type of goods or the volumes involved. This information is included in the Intrastat survey.

Extension of deadline

If you are unable to submit your report before the final deadline, you can apply for an extended deadline. To request an extension, please send an email to intrastat@scb.se. In your e-mail, include

- your corporate registration number

- whether it concerns arrivals and/or dispatches

- to what date you wish to extend your deadline.

Freight

- If the cost of freight (and insurance) is included in the invoiced value according to the terms of delivery, it can be included in the report.

- If the cost is stated on its own, it should not be reported to Intrastat.

Invoiced value

The invoiced value may be given in one of two different ways:

- In Swedish krona (SEK)

- In another specified currency (the reporting tool will convert it to SEK)

Is there no invoiced value? Please report the goods to the amount which reflects the value which would have been invoiced given a normal sale/purchase (market price). Value-added tax and excise duty are not to be included. For more information about invoiced value, see Variables we collect (pdf).

Licences

- If licence fees are included in the package, these should be reported to Intrastat as part of said package (i.e. software installed in a product). The licence fee should be included in the value of the product.

- Recurring payments for licences (renewals) should not be reported.

Net mass

Specify the net weight of the item in kilograms. It is possible to report up to three decimal places. The weight should be given excluding packaging. If weight information is unavailable, provide a reasonable estimate.

Nil declaration

Even if you have not received or sent any commodities from/to another EU-member state during a reference period, you still need to submit a declaration to Intrastat.

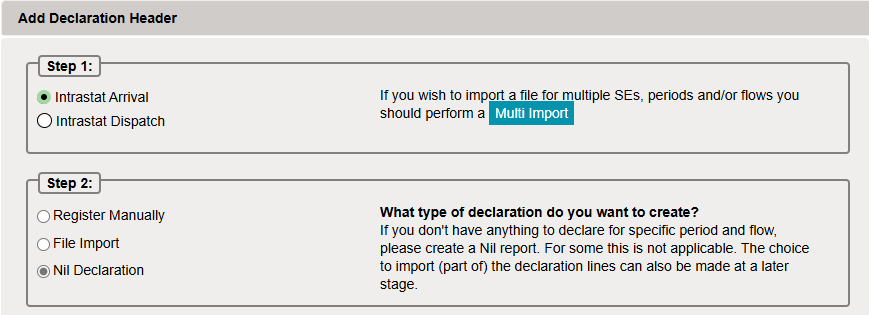

The nil declaration is created as follows:

- Log in as usual

- Create a new declaration

- Choose either arrivals or dispatches

- Choose the option ”Nil Declaration”

Other supplementary unit

- Is to be given only for certain commodity codes. For information about what commodity codes are concerned, see Commodity codes (CN).

- The unit is dependent on the commodity code.

Packaging

The cost for packaging is to be included in the invoiced value, however, the weight should not be included.

Partial invoicing

Partial invoicing refers to situations where payment for a product is, for various reasons, divided into several separate occasions. In such cases you must

- report the total value for the month in which the goods are delivered

- use a commodity code that describes the goods in their complete condition

- report the total price of the goods as the value.

Partial deliveries

Partial deliveries/staggered consignments of commodities refers to commodities which have been dismantled into partial components and delivered partially due to technical transport reasons or other reasons. For example, deliveries of machinery. Usually, invoicing also takes place on several occasions.

- Report the total value of the commodity once the final delivery has been received or sent.

- Use a commodity code which described the commodity in its complete state.

- Use the commodity’s total price as the value.

Partner-ID

- The Partner-ID is only a requirement for dispatches.

- Refers to the VAT identification number of the trading partner to whom the goods are sold to and/or who receives the goods (in another EU-member state).

- For more information and examples, please see Partner-ID (pdf).

- To check the validity of a VAT identification number, please see VIES. (European Commission)

Partner Country

- Arrivals – use the sending country’s country code.

- Dispatches – use the receiving country’s country code.

See the country codes for the EU member states below.

| AT - Austria | FR - France | MT - Malta |

| BE - Belgium | DE - Germany | NL - Netherlands |

| BG - Bulgaria | GR - Greece | XI - Northern Ireland |

| HR - Croatia | HU - Hungary | PL - Poland |

| CY - Cyprus | IE - Ireland | PT - Portugal |

| CZ - Czech Republic | IT - Italy | RO - Romania |

| DK - Denmark | LV - Latvia | SK - Slovakia |

| EE - Estonia | LT - Lithuania | SI - Slovenia |

| FI - Finland | LU - Luxembourg | ES - Spain |

Some areas are part of the EU but are not included in its value-added tax (VAT) area. Commodities to and from these areas are not to be included in Intrastat reports. Examples of such areas are Åland, Ceuta, Melilla, the Canary Islands, Gibraltar, the Faroe Islands and Greenland.

Processing under contract

Deliveries of commodities with a view to or following processing under contract should be reported to Intrastat. Processing under contract includes (among others) transformation, construction, assembling, and enhancement or renovation, that aims to bring about a new or improved item. The processing company does not own the materials or items.

For more information about processing under contract and what transaction type to use, please see chapter 16 in the handbook.

Reference period

Commodities are to be reported for the period in which the delivery takes place, regardless of whether the invoice is dated earlier or later. As a result, the total amount reported for a period may differ between Intrastat and the VAT return (row 20 or 35).

Register an agent

- The enterprise can either provide information itself or do so via an agent.

- Once an agent has been registered, SCB will send reminders to the agent instead of the company, if the report has not been submitted in due time.

- Please note that the enterprise is still responsible for the accuracy of the information provided by the agent.

To register an agent, the enterprise sends a complete agent registration form to intrastat@scb.se. You can find the form here.

If the enterprise wish to register a new agent or begins reporting on its own, please notify us by e-mail at intrastat@scb.se.

Repairs, restoration, and service

Commodities delivered for or received after repairs, restoration or service are not to be included. For more information, please see chapter 16 in our handbook.

Samples

Samples should only be reported to Intrastat if the goods are a subject of a commercial transaction, i.e. when an invoice has been issued. If the goods are delivered free of charge with the sole intention to prepare for or support an intended subsequent trade transaction by demonstrating its characteristics, it should not be included.

Transaction type

The variable is collected to describe the nature of transaction for each commodity item. For arrivals, only one digit is required, but for dispatches two digits are required. You can find more information about transaction types here Transaction types (pdf).

Triangular trade

Triangular trade refers to commodity transactions where three enterprises in two or three EU member states are active in the transaction. For more information and examples, please see Triangular trade (pdf).

Variables

You need to report the following variables for arrivals and dispatches.

| Arrivals | Dispatches |

|

|

For more information about the variables we collect, please see Variables we collect (pdf).

Contact

- Telephone

- +46 10 479 44 00

- Weekdays

09:00–16:00, closed for lunch 12:00–13.00 - intrastat@scb.se