Financial accounts, 1st quarter 2017:

The Riksbank issued more bills

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2017-06-21 9.30

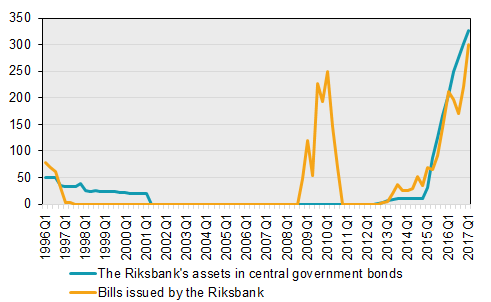

The Riksbank’s support measure of purchasing government bonds continued in the first quarter of 2017. The Riksbank simultaneously issued short-term debt securities, bills, which were nearly exclusively purchased by Swedish banks. At the end of the quarter, the bills issued by the Riksbank were at a higher level than during the financial crisis.

In recent years, the Riksbank increased its activities in the financial markets by purchasing government bonds as a support measure. The intention was to put downward pressure on long-term interest rates and keep the Swedish krona weak, thereby fuelling inflation. The support purchases of government bonds were financed by the issuing of bills as well as deposits on accounts in the Riksbank.

The net of new issues and matured bills was SEK 80 billion in the first quarter of 2017. At the end of the quarter, the value of the bills was record high at SEK 301 billion. At the end of the quarter, liabilities in outstanding Riksbank bills and deposits with the Riksbank totalled SEK 394 billion. At the same time, the Riksbank held assets in the form of government bonds with a value of SEK 326 billion.

Source: Statistics Sweden

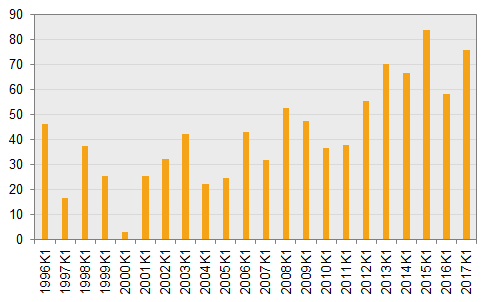

High household savings

The households’ financial savings were SEK 76 billion in the first quarter of 2017, which were the second highest savings in a first quarter since the beginning of the time series in 1996. The highest financial savings in a first quarter occurred in 2015. In the first quarter of 2017, households chose to invest in funds while investments in tenant-ownership rights remained high. This is primarily due to the high production of new owner-occupied dwellings.

Source: Statistics Sweden

Revisions

In connection with this publication, revisions were made for 2016. At the September publication the whole time series will be revised.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ net lending/net borrowing is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial accounts, which, like the financial accounts, are part of the national accounts. However, financial accounts and non-financial accounts are based on different sources, which give rise to differences.

Publication

A more detailed presentation of the survey and significant revisions is available in the Statistical Report.

Next publishing will be

2017-09-22 at 9:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.