Financial accounts first quarter 2021

Central government savings at a record low

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2021-06-17 9.30

Continued pandemic support contributed to an unprecedented dent in central government finances. At the same time, central government support had a positive impact on savings for local government. Households’ financial savings reached record high levels and the Riksbank continued to purchase bonds in the first quarter of 2021.

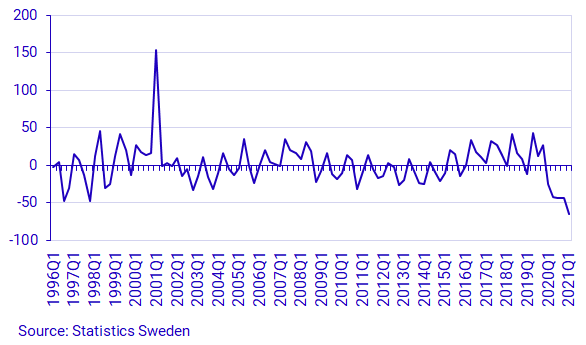

General government net lending/net borrowing was negative and amounted to SEK 38 billion in the first quarter of 2021. This is not an overview of the general government subsectors. Central government net lending/net borrowing amounted to SEK -64 billion and is the highest net borrowing noted throughout the time series. Local government noted positive net lending/net borrowing amounting to SEK 27 billion, while social security funds noted a deficit of just under SEK 1 billion. The high level of savings in local government is largely explained by the redistribution of funds, both those linked to the pandemic and ordinary central government grants, from central government for expenditures for this quarter and future quarters. Central government net lending/net borrowing over the last five quarters amounted to SEK -216 billion.

The market-valued central government debt continued to increase and amounted to SEK 2 356 billion at the end of the first quarter of 2021, which is an increase of SEK 58 billion since the beginning of the year. Just over half of the central government debt was held in issued debt securities. The Riksbank was the largest owner with holdings of SEK 399 billion.

Riksbank continued to purchase bonds

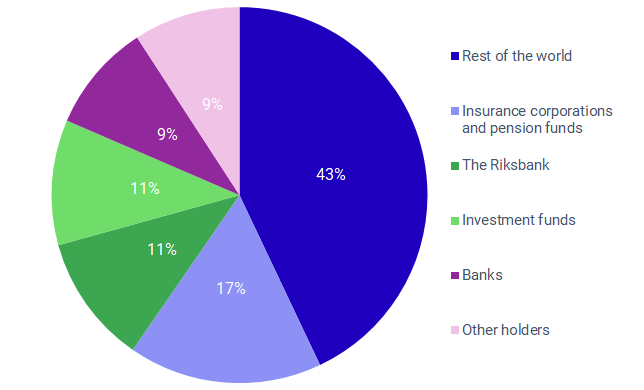

Since the outbreak of the COVID-19 pandemic, the Riksbank has taken action with several measures to maintain abundant liquidity in the Swedish financial market, including purchases of bonds. Taken together, Swedish financial and non-financial corporations as well as central government and municipalities’ issued debt securities amounted to SEK 8 482 billion at the end of the first quarter of 2021. Four-fifths consisted of bonds and the remainder consisted of short-term securities. The Riksbank was the third largest holder of Swedish bonds at the end of the quarter. Holdings amounted to SEK 751 billion, up by 17 percent during the quarter. Foreign actors owned 43 percent and the sector insurance companies and pension funds together accounted for 17 percent of issued Swedish securities.

The Riksbank portfolio has been restructured and holdings in government bonds have decreased in the last two quarters, while holdings in mortgage bonds have increased. In the first quarter of 2020, the Riksbank purchase mortgage bonds for the first time and the purchases amounted to SEK 10 billion. One year later, the Riksbank portfolio contained mortgage bonds amounting to SEK 290 billion, which accounted for 28 percent of bond holdings. The proportion of assets in foreign bonds were on the same level. Government bonds remain the Riksbank’s largest holdings in bonds.

Households are holding onto their purse strings

Throughout one more quarter during the pandemic, households maintained a tight grip on their purse strings. Household consumption remained low in the first quarter of 2021 and the high level of net lending/net borrowing was unprecedented. Both private insurance savings and savings in bonds were at a record high level during the quarter as the Stockholm Stock Exchange rose by 14 percent, according to the Affärsvärlden general index.

Following the major flight from the fund market in the first quarter of 2020, when the stock exchange fell by 18 percent, interest in fund investment has returned. At the time, households made net sales of directly-owned funds amounting to SEK 40 billion. Since then, households have made net purchases of funds for roughly SEK 20 billion per quarter. In the first quarter of 2021, households made net purchases amounting to SEK 34 billion, which is the highest level ever noted. Net savings of SEK 25 billion in private insurance savings also reached a record level.

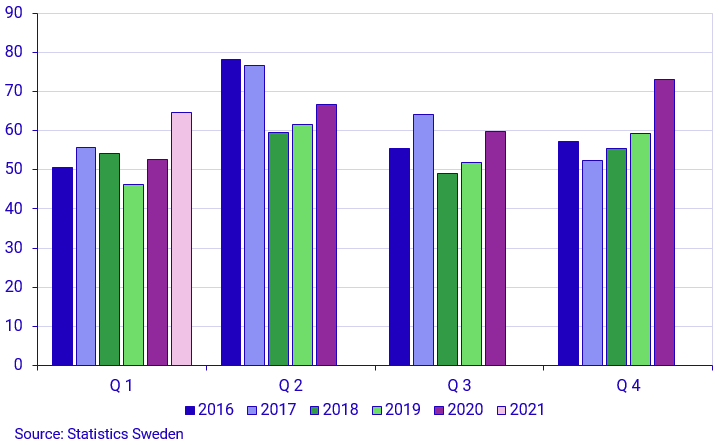

In the first quarter of 2021, households’ new borrowing minus amortisations amounted to SEK 65 billion, which is the highest rate of loan increase in a first quarter ever. This can be compared with the average for the first quarter in the years 2016-2020, which was SEK 52 billion. Households’ loans amounted to SEK 4 764 billion at the end of the first quarter of 2021.

Households’ financial wealth was at a record high level

Households’ financial wealth amounted to a record high SEK 13 447 billion at the end of the first quarter of 2021. Households’ financial assets have increased by 24 percent compared with a year ago and were valued at SEK 18 392 billion at the end of the quarter. A major contributing factor to the increase in assets was the increase on the Stockholm Stock Exchange, which rose by 57 percent in the same period. At the same time, liabilities amounted to SEK 4 945 billion.

Revisions

In connection with the calculation of the first quarter of 2021, annual and quarterly statistics were revised from the first quarter of 2019 up to and including the fourth quarter of 2020. Households’ tax accrual, which is a correction in which taxes and social contributions are booked at the time they arise rather than when they are actually paid, has been revised for all quarters of 2020.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they comprise of the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

More information: the National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thereby consistent with the values published in the Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next item of statistical news in this series is scheduled for publication on 2021-09-22 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.