Financial accounts third quarter 2019

Local government debt continued to grow

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-12-19 9.30

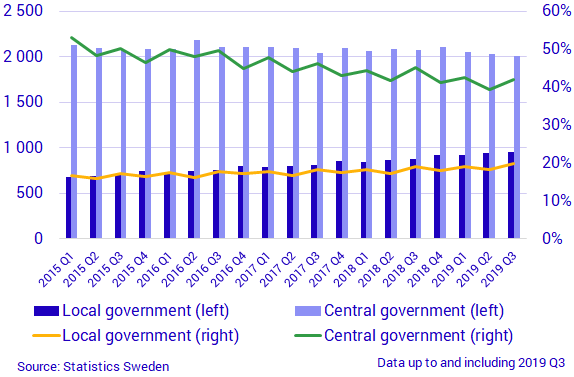

In the third quarter of 2019, local government debt increased by SEK 5 billion. This debt has increased by SEK 275 billion since the first quarter of 2015.

Local government debt continued to grow and amounted to SEK 949 billion at the end of the third quarter. In addition to municipalities, local government also includes county councils and other municipal units. Local government debt in relation to GDP has increased from 17 percent to 20 percent since the first quarter of 2015. In the same period, central government debt fell by SEK 124 billion, and in relation to GDP, central government debt fell from 53 percent to 42 percent.

The debts according to the figure do not correspond to the Maastricht debt. For more information, see the section “Definitions and explanations” below.

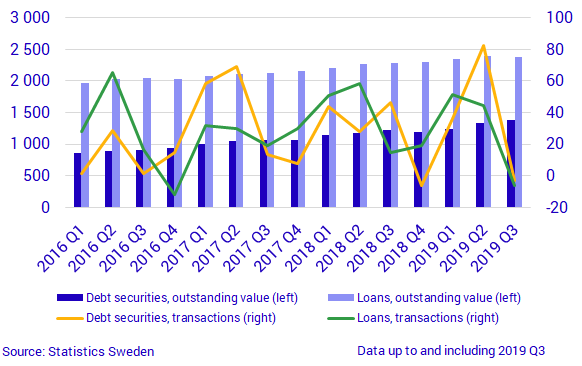

Local government financing is managed, above all, via issued debt securities and loans. Although financing via issuing of debt securities has increased, loans remain a significant part of local government total liability. At the end of the third quarter, debt securities and loans accounted for 22 percent and 42 percent, respectively, of total local government debt.

Central government debt continued to diminish

Since 2015, central government debt has moved in the opposite direction compared to local government. In the first three quarters of 2019, central government net transactions amounted to SEK -164 billion, and at the end of the third quarter, central government debt amounted to SEK 2 007 billion. At the end of the second quarter 2016, central government debt was at a peak level. However, since then, central government debt has decreased by SEK 171 billion.

Non-financial corporations recorded decreased borrowing

In the third quarter of 2019, non-financial corporations’ net borrowing via loans in monetary financial institutions was negative for the first time in nearly three years. This means that non-financial institutions paid back more than they borrowed during the quarter. Borrowing via issued debt securities also decreased during the quarter, following two quarters of high levels of net borrowing.

At the end of the third quarter, total debt through loans in monetary financial institutions and issued debt securities amounted to SEK 3 764 billion. This is an increase of SEK 37 billion compared with the previous quarter. The increase in debt despite negative net borrowing is largely explained by a weaker Swedish krona compared with most currencies during the quarter and by the fact that half of the issued debt securities liability is issued in foreign currency.

Savings in households’ bank accounts and in shares and funds decreased

Households’ financial savings amounted to SEK 7 billion in the third quarter, which is in line with the third quarter average over the past ten years. Financial savings in the third and fourth quarters have often been lower than in the first and second quarters.

The relatively low level of savings was due, in part, to lower levels of investment in new tenant-owned apartments, cautious savings in funds and shares, and lower levels of net deposits in bank accounts. Net purchases of new tenant-owned apartments amounted to SEK 9 billion, the lowest level in three years. Net purchases of shares and funds amounted to SEK 2 billion, which was SEK 9 billion less than in the previous quarter. Deposits in bank accounts amounted to SEK 9 billion, the lowest level in more than two years.

In the third quarter, households’ debts increased by SEK 48 billion. The annual growth rate amounted to 4.8 percent in the third quarter and has decreased by 1.1 percentage points since the second quarter of 2018. Households’ loans consist mainly of loans in banks and housing credit institutions, as well as student loans.

Households’ financial net wealth amounted to SEK 10 534 billion at the end of the quarter, which was an increase of SEK 242 billion compared with the previous quarter. Households’ financial wealth consists largely of stock market-related assets and, in percentage terms, households’ financial net wealth developed in line with the surge on the stock market during the quarter. According to the Affärsvärlden General Index, the Stockholm Stock Exchange rose by 1.9 percent in the third quarter.

Revisions

In connection with this publication, revisions were made for all quarters in 2019. In addition, revisions of 2015-2018 were introduced in the rest of the world sector and public administration was updated from 2017 and forward.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, Financial Accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial Accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and debts for central government are consolidated. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value.

More information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of Financial Accounts. Financial assets and liabilities are collected from Financial accounts and are thereby consistent with the values published in Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publication on 2020-03-19 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.