Financial accounts third quarter 2020

COVID-19 support schemes depressed central government financial savings

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2020-12-17 9.30

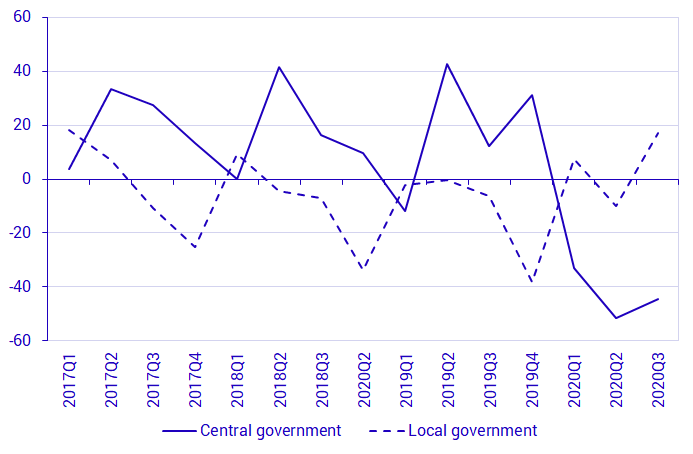

The coronavirus (COVID-19) pandemic continued to impact the financial accounts in the third quarter of 2020. Households’ savings were relatively high once again; emergency measures depressed central government financial savings and increased savings in local government.

Coronavirus (COVID-19) support schemes have had an impact on central government financial savings. In the first three quarters of 2020, total financial savings were negative and amounted to SEK minus 129 billion. The situation was reversed in local government, where central government supported with coronavirus measures. Financial savings in local government amounted to SEK 17 billion in the third quarter of 2020. Municipalities’ large bank deposits was the main contributor to the high level of savings.

Source: Statistics Sweden

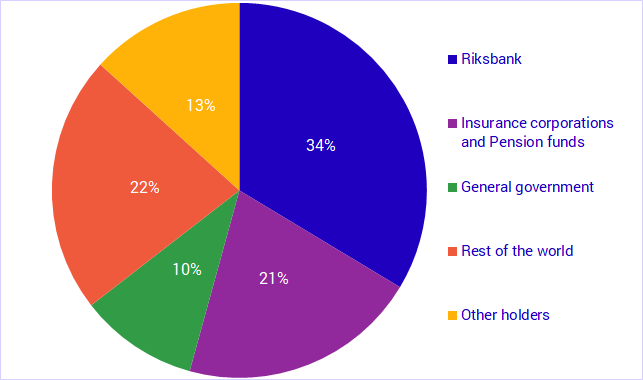

The government financed coronavirus support schemes by issuing securities. In the first and second quarter, mainly short-term securities were issued, while in the third quarter, mainly bonds were issued, that is, securities with longer maturities. One-third of the outstanding securities issued by the government, corresponding to SEK 426 billion, was held by the Riksbank at the end of the third quarter. Insurance companies and pension institutions together held just over one-fifth. This is on a par with foreign investors’ equity, while one-tenth was held by general government.

Source: Statistics Sweden

Market-valued central government debt amounted to SEK 2 190 billion at the end of the third quarter of 2020, which is an increase of SEK 201 billion since the end of 2019.

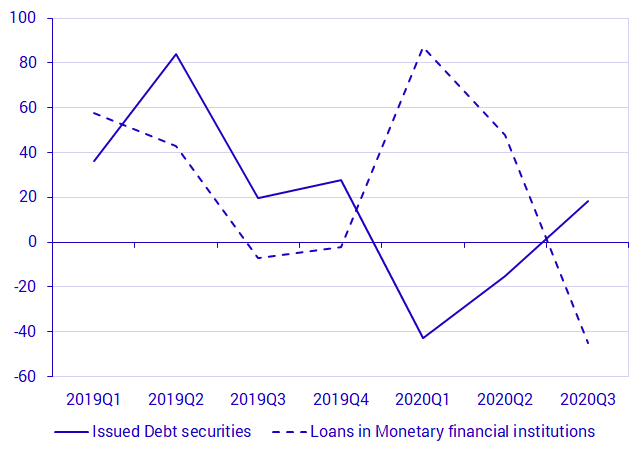

Non-financial corporations reverted to issuing securities

As early as March, in connection with the first coronavirus restrictions, the Riksbank offered loans up to SEK 500 billion in total to non-financial companies, through on-lending from banks and other credit market institutions. In the first quarter, non-financial companies borrowed SEK 87 billion, mainly in the form of short-term loans, followed by SEK 48 billion in the second quarter. Non-financial companies’ borrowing via issued securities decreased by SEK 58 billion in the same period. In the third quarter, the roles were reversed, as loans in banks decreased by SEK 45 billion, while borrowing via securities increased by SEK 18 billion.

Source: Statistics Sweden

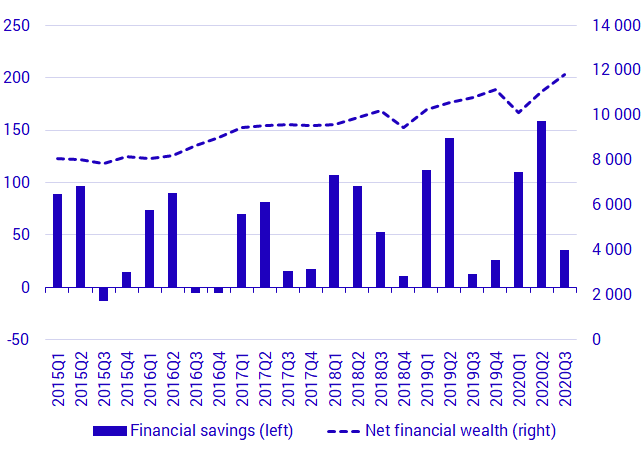

High savings among households persisted

Households’ financial savings continued to be relatively high and amounted to SEK 36 billion in the third quarter. In the past 20 years, savings have only been higher in a single third quarter, in 2018.

Savings consisted mostly of savings in bank accounts and purchases of equity funds, which amounted to SEK 17 billion and SEK 15 billion respectively. Households invested in unlisted shares, while listed and foreign shares noted net sales.

Households’ financial savings and the strong development on the stock market in the second and third quarter of 2020 led to a recovery from the sharp decline in households’ financial net wealth in the first quarter. Households’ financial net wealth amounted to SEK 11 821 billion at the end of the third quarter, which is an increase of almost SEK 700 billion in three quarters.

Source: Statistics Sweden

The annual growth rate for households’ loan stock continued to increase somewhat and was 5.2 percent at the end of the third quarter.

Revisions

In connection with the calculation of the third quarter of 2020, annual and quarterly statistics were revised from the first quarter of 2017 up to and including the second quarter of 2020. Transactions in funds were revised from 2017 for all sectors due to new calculations of retained dividends. The foreign owners sector was revised with new information from the Balance of Payments from the first quarter of 2017 onwards. This mainly involves major revisions of foreign investment in Swedish unlisted shares and Swedish investment in foreign unlisted shares. A number of revisions were also made with regard to general government. Central government has revised tax accrual from the first quarter of 2019 onwards. Local government has altered reporting of flows between other mortgage institutions and general government for 2019. Local government has also revised financial derivatives for 2019 and pension rights from 2019 onwards.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, the financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial Accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial Accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they constitute the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

Further information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from Financial Accounts and are thereby consistent with the values published in Financial Accounts.

For further information, see:

Next publishing will be

The next statistical news in this series is scheduled for publication on 2021-03-18 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.