Financial Accounts third quarter 2023

Households continued to save in the third quarter

Statistical news from Statistics Sweden 2023-12-14 8.00

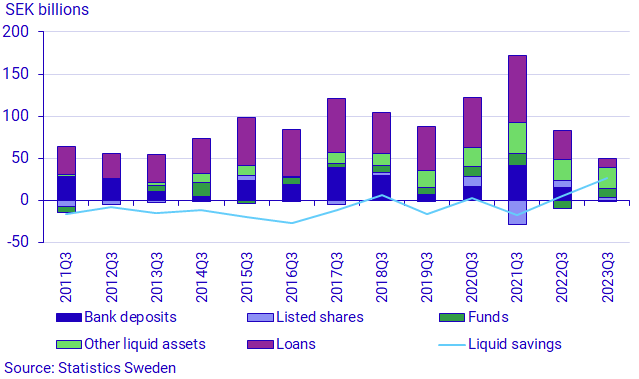

Household liquid savings were comparatively high in the third quarter of 2023, which was characterised by a continued decline in borrowing and net withdrawals from bank accounts.

Household liquid savings for the third quarter of 2023 amounted to SEK 27 billion, which is high for a third quarter and SEK 21 billion higher than the corresponding quarter last year.

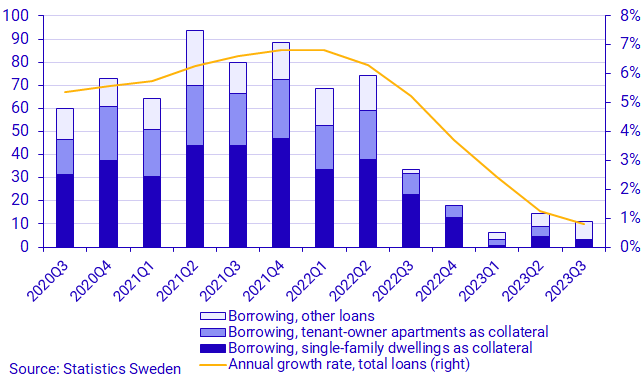

During the quarter, households continued to exercise restraint in taking out new loans. Over the past five quarters, household net borrowing, i.e. new loans minus amortisation, has slowed down considerably. Net borrowing amounted to SEK 10 billion in the third quarter, which was SEK 23 billion lower than in the corresponding quarter last year.

Net borrowing can affect liquid savings in different ways, depending on whether the loans are used for consumption and real investment or financial investment.

Single-family dwellings refer to detached one- and two-dwelling houses as well as semi-detached houses, terraced houses and linked houses.

Since houses are a real asset and are not included in the Financial Accounts, the reduced net borrowing with single-family houses as collateral has contributed to increasing liquid savings. Tenant-owned apartments, on the other hand, are a financial asset and are included in the Financial Accounts, which means that the purchase of tenant-owned apartments does not affect liquid savings, since both the financing and the asset are financial. Households are also not taking out loans for house renovations to the same extent as before, which also has a positive effect on liquid savings.

In addition to the decrease in borrowing, households had net withdrawals from bank accounts in the third quarter, while shares and funds were net purchased.

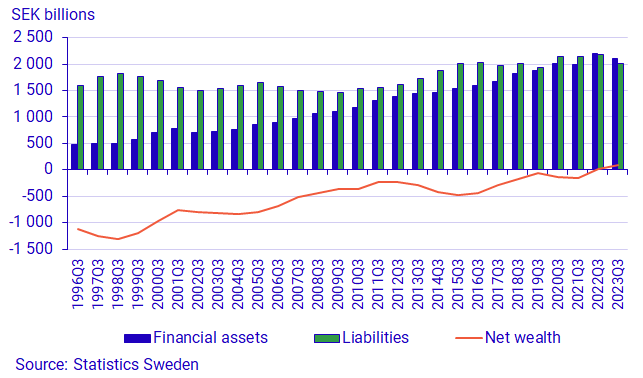

Positive net financial wealth for the central government

The central government net financial wealth, financial assets minus liabilities, has been on an upward trend for a long time. This increase can be explained by the fact that financial assets have increased to a greater extent than liabilities. Central government's net wealth turned positive in the third quarter of 2022, for the first time in the time series, and has continued to grow positively since then.

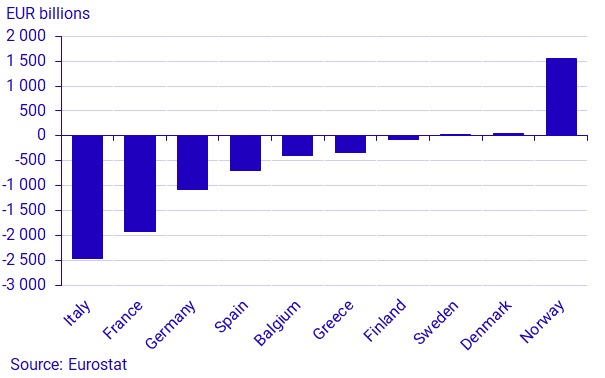

Sweden is one of five countries in Europe with a positive net financial wealth. The diagram below shows the net financial wealth of a sample of European countries.

In addition to financial assets, the central government also has real assets, which are reported in the National Wealth.

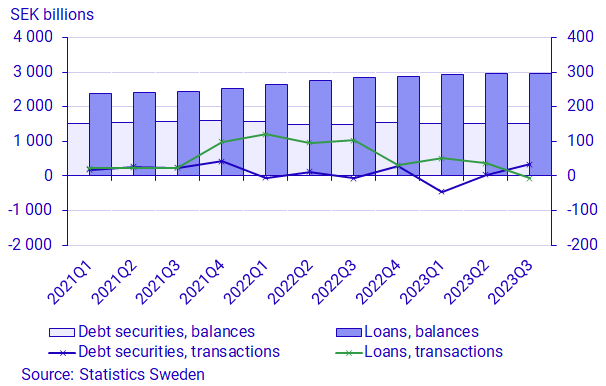

Financing of non-financial corporations

In the third quarter of 2023, non-financial corporations' net transactions in loans, new loans minus amortisation, in monetary financial institutions were minus SEK 7 billion. This was SEK 45 billion lower than in the previous quarter and SEK 110 billion lower than in the corresponding quarter last year.

Financing through debt securities, new issues minus maturities and repurchases, amounted to SEK 34 billion. This was SEK 30 billion higher than in the previous quarter and SEK 41 billion higher than in the corresponding quarter last year.

Total loans from monetary financial institutions amounted to SEK 2 960 billion at the end of the quarter. The value of issued debt securities amounted to SEK 1 507 billion.

Revisions

During the calculation of the third quarter of 2023, the annual and quarterly statistics have been revised for the period 2019–2022 and 2019Q1–2023Q2.

Non-financial corporations' assets and liabilities in the financial instruments unlisted shares and group loans have been revised for 2023 Q1 and Q2 due to new directives for which companies are included in a group. There is currently a major break in the time series for these financial instruments between 2022 and 2023.

The delivery of the balance of payments to the Financial Accounts includes a new outcome of the annual survey for direct investments, which entails relatively large revisions. Gross transactions in derivatives for 2023 Q2 have also been revised due to previous erroneous gross reporting by an individual reporting agent.

Occupational pension transactions have been revised. It mainly concerns pension institutions from 2022 Q1 onwards. The revision affects household financial saving.

The revision of the AP Funds' holdings in foreign funds that took place last quarter has been withdrawn due to the fact that the Financial Accounts need to divide the funds on a gross basis.

Definitions and explanations

In the statistical news, reference is made to the liquid savings of households. It is calculated as the difference between transactions in financial assets and liabilities excluding accruals (tax accruals, occupational pensions and other technical provisions). For more information, see the Financial Accounts Quality Declaration, section Variables 1.2.2.

The purpose of financial accounts is to provide information on financial assets and liabilities, as well as changes in net lending and financial wealth for different sectors of society. The statistics are presented in current prices and do not take inflation into account.

Net lending in financial accounts is calculated as the difference between transactions in financial assets and liabilities. In the Real Sector Accounts, which, like the Financial Accounts, are part of the National Accounts, net lending is calculated as the difference between income and expenses. However, financial accounts and real sector accounts are based on different sources, which gives rise to differences between products.

In the Financial Accounts, central government debt is calculated differently from the most commonly reported measure of government debt, which is calculated according to the convergence criteria, the so-called Maastricht debt. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented at nominal value and the liabilities for government administration are consolidated. Central government debt in the Financial Accounts is not consolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain state foundations and certain state-owned companies. Central government does not include units of the old-age pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, as well as certain municipal foundations and certain municipally or regionally owned companies.

Further information: National wealth

In connection with the publication of the Financial Accounts, the National Wealth is also published, which contains annual data for both real and financial assets. The financial assets and liabilities are derived from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publishing on 2024-02-15 at 08.00

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.