Savings Barometer, 1st quarter 2021

Households’ savings in shares and funds remain high

Statistical news from Statistics Sweden 2021-05-20 9.30

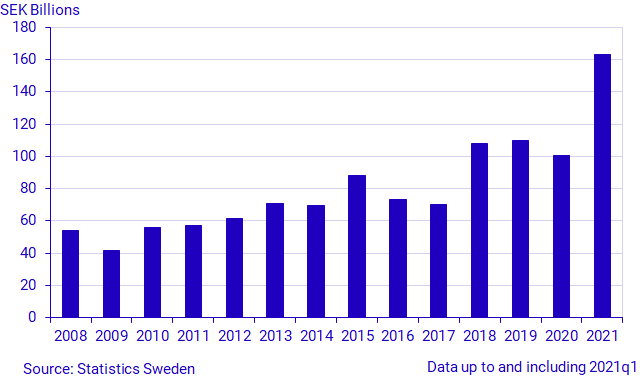

Households’ financial savings amounted to SEK 163 billion in the first quarter of 2021. Savings levels in shares and funds were high during the quarter, although the main contribution to the high level of savings was tax accrual and insurance savings.

During the first quarter of 2021, new savings in financial assets amounted to SEK 221 billion, while debts increased by SEK 58 billion, which resulted in SEK 163 billion in financial savings. Households’ financial savings are usually higher in the first two quarters of the year, and savings in the first quarter of 2021 was at the highest level in a single quarter since the beginning of the time series in 1996.

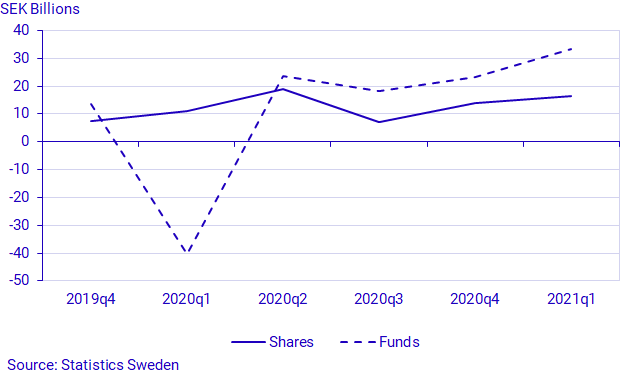

During the quarter, households made net purchases of shares and funds for SEK 17 billion and SEK 33 billion, respectively. Deposits in banks remained high, while net purchases in tenant-owned apartments were low. Private insurance savings were unusually high, while occupational pensions were on a level with the corresponding period last year. The positive effect of tax accruals contributed to the high level of savings. Tax accrual refers to taxes and social contributions that are booked at the time they arise rather than when they are actually paid.

High level of savings in shares and funds

In the first quarter of the year, households continued to make net purchases of shares and funds, and net purchases of listed and unlisted shares amounted to SEK 7 billion and SEK 10 billion, respectively. Households’ savings in funds were mainly in equity funds, as well as the fund category other funds. Other funds includes fund-of-funds and hedge funds. Households’ net purchases of equity funds and other funds amounted to SEK 19 billion and SEK 14 billion, respectively.

Lower bank deposits after a record year

Households’ net deposits in bank accounts amounted to SEK 29 billion in the first quarter of 2021, which is SEK 57 billion less than in the same quarter a year ago, when households’ net deposits in bank accounts were at a record high level. Although deposits in bank accounts were low compared with the same quarter a year ago, net deposits were higher than the average for a first quarter in the last five years.

Highest recorded insurance savings

In the first quarter of 2021, the level of savings in private insurance was high and amounted to SEK 25 billion, which is SEK 15 billion more than in the corresponding quarter a year ago. Private insurance savings is usually high in the first quarter of the year; in the first quarter of 2021, private insurance savings was the highest on record in a single quarter since the start of the time series in 1996.

Level of net purchases of new tenant-owned apartments remained low

Households’ net purchases of new tenant-owned apartments amounted to SEK 8 billion in the first quarter of 2021, which is barely half as much as in the corresponding quarter a year ago and the lowest level in a single quarter in the past five years. New tenant-owned apartments consist of apartments with changing rights of tenancy to tenant-owned apartments and newly produced tenant-owned apartments. Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included, since they constitute real assets. Information about households’ total assets in housing is available in the National Wealth. Read more about National Wealth under More information.

Growth rate for households’ loans continued to increase

Households’ net borrowing, that is, new loans minus amortisations, amounted to SEK 62 billion in the first quarter of 2021, which is SEK 9 billion more than in the corresponding quarter a year ago.

The annual growth rate of loans continued to increase also in the first quarter of 2021. The growth rate for loans was 5.7 percent at the end of the first quarter, which is 0.5 percentage points more than in the corresponding quarter in 2020. The growth rate for loans has increased consistently since the end of the of the fourth quarter of 2019. Households’ loans, which consist primarily of loans in banks and housing credit institutions, amounted to SEK 4 761 billion at the end of the first quarter of 2021. Among households’ total loans, 92 percent were in banks and housing credit institutions, and the remaining 8 percent were in other lenders. Other lenders include central government via student loans, mortgage credit companies, and other financial institutions.

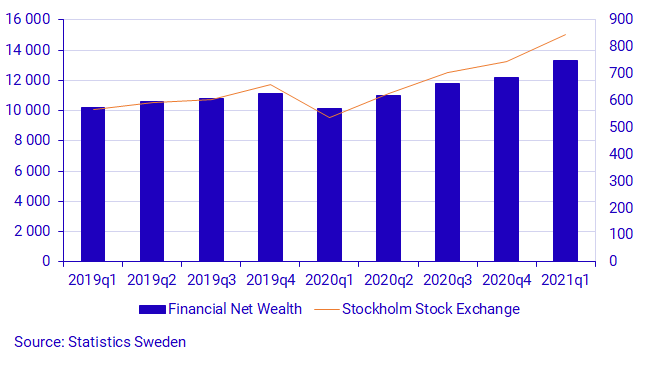

Net wealth continued to increase

At the end of the first quarter 2021, households’ financial net wealth, that is, financial assets minus debts, reached a new peak at SEK 13 334 billion. The increase in the financial net wealth mainly came from the rise in the stock exchange during the quarter, as well as the positive financial savings. In the first quarter of the year, households’ financial net wealth increased by SEK 1 169 billion, of which SEK 163 billion came from positive financial savings and SEK 1 006 billion came from value increase. The value increase mainly derived from value change in tenant-owned apartments and the value change in direct and indirect ownership of shares. During the quarter, the Stockholm Stock Exchange increased by 13.6 percent, according to the OMX Affärsvärlden general index.

Definitions and explanations

Financial savings is calculated as the difference between transactions in financial assets and transactions in liabilities.

The Savings Barometer does not publish any revisions or methodological changes other than the revisions introduced in connection with the latest publication of the Financial Accounts. The time series are revised in connection with the publication of the Financial Accounts, in which there is more scope for calculation and reconciliation with other sectors and in which revision documentation is published.

In connection with this publication of the Savings Barometer on the first quarter of 2021, the entire time series will be updated from the first quarter 2017 onward with the revisions introduced in the Financial Accounts’ publication on 18 March. In connection with the current publication, new statistics were introduced on households’ loans in mortgage credit companies, included in the item “other loans”. Data has been implemented from the fourth quarter 2018 and onward.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Next publishing will be

2021-08-26 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.