Savings Barometer, 4th quarter 2021

Households’ borrowings on the rise

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2022-02-17 8.00

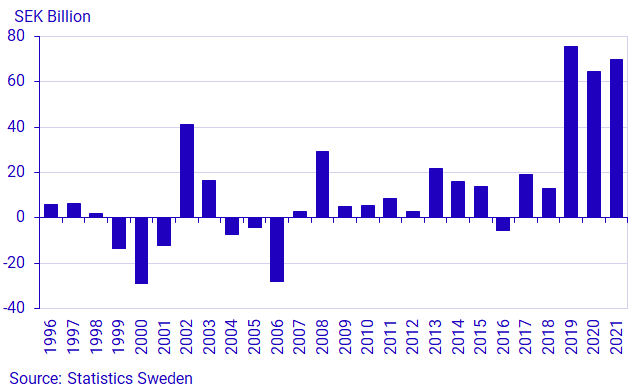

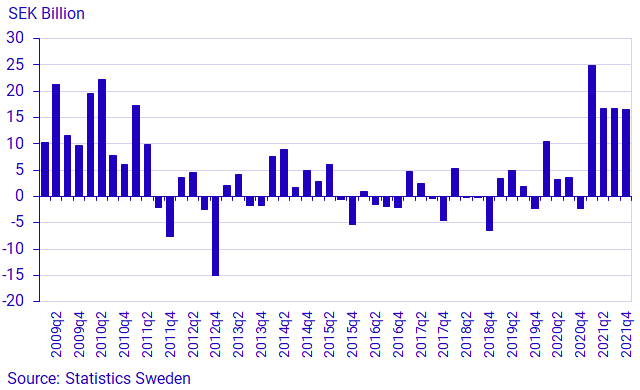

In the fourth quarter, households’ financial savings amounted to SEK 70 billion, which was in line with the same quarter of the past two years. The increase in loans was high in the quarter, at SEK 89 billion. The annual growth rate for loans rose further, and has not been at a corresponding level for four years.

New savings in financial assets were SEK 164 billion, while total debts increased by SEK 95 billion in the fourth quarter of 2021, which resulted in SEK 70 billion in financial savings. At the end of 2021, households’ financial savings largely consisted of savings in bank accounts, in occupational pensions and in funds. Out of the total increase in debt, the majority consisted of loans, i.e. new loans minus amortisation. In the past three years, households’ financial savings for the fourth quarter have been at a much higher level than in previous years.

Households’ financial savings have been high since the outbreak of the COVID-19 pandemic. Savings amounted to SEK 407 billion for full-year 2021, which can be compared with savings of SEK 340 billion for 2020.

Sustained high savings in bank accounts

At the end of the fourth quarter, households had net savings of SEK 37 billion in bank accounts. This was in line both with the previous quarter and the same quarter of the previous year. A contributory factor to the high savings level of households since the start of the COVID-19 pandemic is net savings in bank accounts. Households’ deposits in bank accounts have, in 2021, been almost as high as for full-year 2020. In 2021, households’ net deposits amounted to SEK 185 billion, which is SEK 28 billion lower than in 2020 but SEK 93 billion higher than in 2019.

Households made net purchases of shares and funds

After net-selling shares in the third quarter, households resumed buying shares in the fourth quarter of 2021. Households bought directly owned shares to a value of SEK 16 billion, with unlisted shares making up the majority. In the fourth quarter, households made net purchases of funds, but not to the same extent as in the previous quarters of the year. Net purchases of equity funds and other funds, which include hedge funds and fund-of-funds, amounted to SEK 6 billion and SEK 5 billion, respectively. At the same time, for the first time since 2014, households made net purchases of bond funds. For the full-year of 2021, households made net purchases of shares and funds to a value of SEK 176 billion, which can be compared with SEK 74 billion in 2020.

Premium bonds were phased out as a form of saving during the quarter and SEK 3 billion was paid back to households.

High private insurance savings

Private insurance savings were high in the fourth quarter and amounted to SEK 17 billion. Households’ private insurance savings have been high throughout the whole of 2021; compared to 2020, savings were three times higher. Private insurance savings have not been at such elevated levels since 2011.

Savings in new tenant-owned apartments took off again

Households’ net purchases of new tenant-owned apartments were low in 2021, but increased in the fourth quarter of the year, amounting to SEK 16 billion. New tenant-owned apartments consist of apartments with changing rights of tenancy to tenant-ownership rights, and newly produced tenant-owned apartments. It was chiefly the high number of completed apartments that formed the basis of households’ net purchases of new tenant-owned dwellings. At the end of the fourth quarter, households’ assets in tenant-owned dwellings amounted to SEK 3 350 billion. For the full-year of 2021, the value of households’ tenant-owned apartments increased by 11 percent.

Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included however, since they constitute real assets. Information on households’ total assets in dwellings is available in the National Wealth. Read more about the National Wealth under More information.

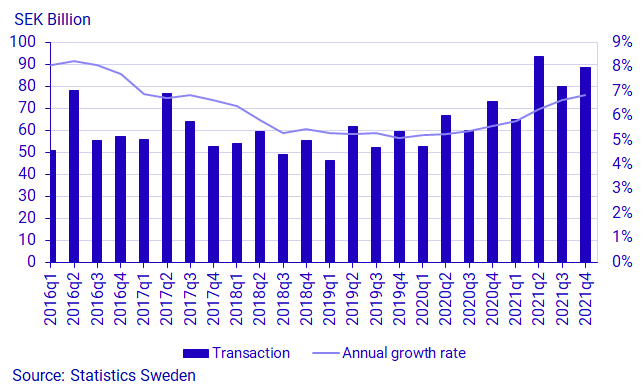

The growth rate for loans rose yet another quarter

Households’ loans increased by SEK 89 billion in the fourth quarter. It was the highest recorded increase in loans in a fourth quarter since the beginning of the time series. The increase in loans has been high throughout the whole of 2021, amounting to SEK 327 billion, which was SEK 74 billion more than in 2020 and SEK 108 billion more than in 2019.

For the ninth consecutive quarter, the annual growth rate for households’ loans continued to rise. In the fourth quarter of 2021, the growth rate was 6.8 percent, which was 0.2 percentage points higher than in the previous quarter.

Households’ loans, which chiefly consist of loans with banks and housing credit institutions, as well as loans from the Swedish National Board of Student Aid (CSN), amounted to SEK 5 022 billion at the end of the fourth quarter.

Yet another quarter of higher financial net wealth

At the end of the fourth quarter, financial net wealth amounted to SEK 15 351 billion, which is SEK 2 894 billion higher than last year. It was primarily the surge in the stock market that generated the increased financial net wealth, as a large proportion of households’ financial assets are equity-linked. For the full year of 2021, the Stockholm Stock Exchange gained 35.5 percent according to the Affärsvärlden general index. Besides the equity-linked assets, it was primarily savings in bank accounts and the value growth in tenant-ownership rights that contributed to the higher net wealth.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take account of inflation.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the fourth quarter of 2021, the entire time series is being updated from the first quarter 2017 onwards with the revisions introduced in the Financial Accounts' publication on 16 December. At the time of the publication of the latest Financial Accounts, new sources and methods were introduced for compiling statistics on fixed-income securities, shares and funds.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2022-05-19 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.