Shareholder statistics, December 2018

Foreign ownership decreased on the Swedish stock market

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-03-07 9.30

Total share wealth in shares listed on Swedish marketplaces decreased by 10 percent in the second half of 2018 and amounted to SEK 6 290 billion at the end of the period. In the second half of 2018, Swedish sectors’ shares on Swedish marketplaces increased, while foreign investors’ shares decreased.

OMX Stockholm rose by 6.8 percent in the third quarter, according to the Affärsvärlden general index. However, in early October, this changed and the stock market fell by 14.6 percent in the fourth quarter, which is the sharpest fall in a single quarter since 2011. Overall, shares listed on the Swedish marketplace, including unlisted classes of shares, were valued at SEK 6 290 billion at the end of December 2018. This was a decrease of SEK 725 billion in the second half of 2018 and corresponds to a 10 percent decline. At the end of 2018, there were 864 listed companies, which is 12 more compared with the end of June of the same year.

Foreign investors’ share on the Swedish stock market decreased

Foreign investors’ shareholdings on Swedish marketplaces, measured as a percentage of the total, decreased by 2.4 percentage points in the second half of 2018, and at the end of the year, shareholdings by foreign investors accounted for 39.1 percent of total share wealth.

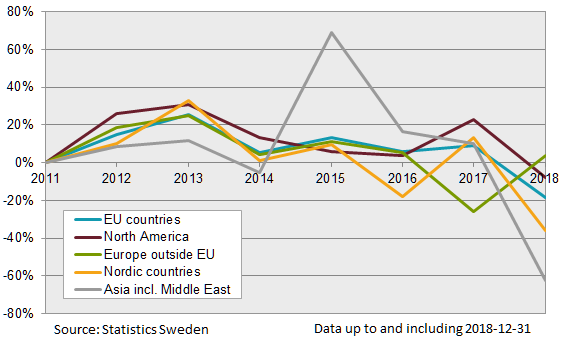

Foreign ownership on Swedish marketplaces consists mainly of investors from countries in the EU and North America. Taken together, their share wealth decreased by SEK 354 billion in the second half of 2018. Investors from Asia and the Middle East accounted for the largest decline in share wealth. Their shareholdings were more than halved and fell from SEK 73 billion to SEK 28 billion. However, this region accounted for only one percent of foreign shareholdings at the end of 2018.

The United States, the United Kingdom and Luxembourg continue to be the major foreign owner countries on Swedish marketplaces. Taken together, they account for 70 percent of foreign owners sector shareholdings on Swedish marketplaces. The United Kingdom decreased holdings on Swedish marketplaces by one fourth in the second half of 2018. Both Denmark and Ireland more than halved their shareholdings, while investors in the United States and Luxembourg increased their market shares on the Swedish stock market.

Small number of households owned large portion of shares

The household sector owned 12 percent of share wealth on Swedish marketplaces at the end of December 2018. The five percent in the household sector with the greatest share wealth together owned four fifths of households’ total share wealth. Households’ median portfolio, that is, the middle portfolio in terms of size, among private individuals residing in Sweden was valued at SEK 30 000 at the end of 2018. The value of the mean portfolio was SEK 553 914, considerably higher.

Women’s savings in major enterprises

OMX Stockholm and First North were the two marketplaces with the largest number of listed companies. Taken together, they accounted for 70 percent of all listed companies on Swedish marketplaces. The market value of companies listed on OMX Stockholm Large Cap comprised 86 percent of the market value of all listed companies on Swedish marketplaces. Women owned 12 to 14 percent of the market value on minor lists, compared with 36 percent on OMX Stockholm Large Cap. The market value of companies listed on marketplaces other than OMX Stockholm had a stock market value of three percent of the total market value of companies listed on Swedish marketplaces.

Definitions and explanations

Information on the final owner is not available concerning ownership in security accounts via Swedish nominees if holdings are less than 501 shares in an enterprise, which means that these holdings are not included in a breakdown of households’ income and age. Information on foreign nominees’ final owners is not available, as these are not included in the public shareholders’ register. At the end of December 2018, households’ ownership in shares registered in security accounts amounted to 16 percent of total shareholdings.

Swedish marketplaces refers to OMX Stockholm, Spotlight Stock Market, NGM and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the marketplaces mentioned above are included in the statistics from 2000 onwards.

Publication

A more detailed report of this survey is published in a Statistical Report.

Next publishing will be

Next publication date 2018-09-04.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.