Impacts on household finances in the national budget 2026:

Better economy for the majority in 2026

Statistical news from Statistics Sweden 2025-12-03 8.00

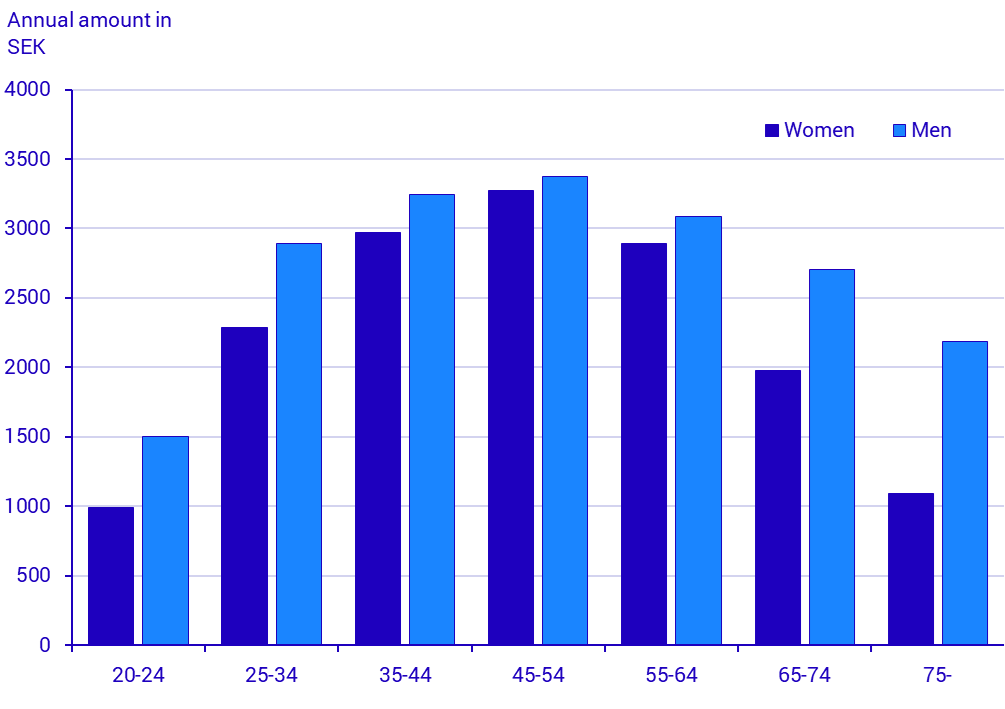

The 2026 central government budget contains several different changes that affect household finances. Men benefit most from the proposals because they have, on average, higher earned income than women. Low-income earners with children, who are entitled to housing allowance, are the household type that gains the most from the reforms.

Men benefit most from the proposals

In the central government budget both women and men will receive, on average, increased disposable income. The change to the Earned Income Tax Credit affects people in work and the increased basic deduction increases the disposable income for pensioners.

– Men benefit most from the proposals as they have higher earned income on average than women, says Mattias Bågling, statistician at Statistics Sweden.

Source: SCB, FASIT, STAR

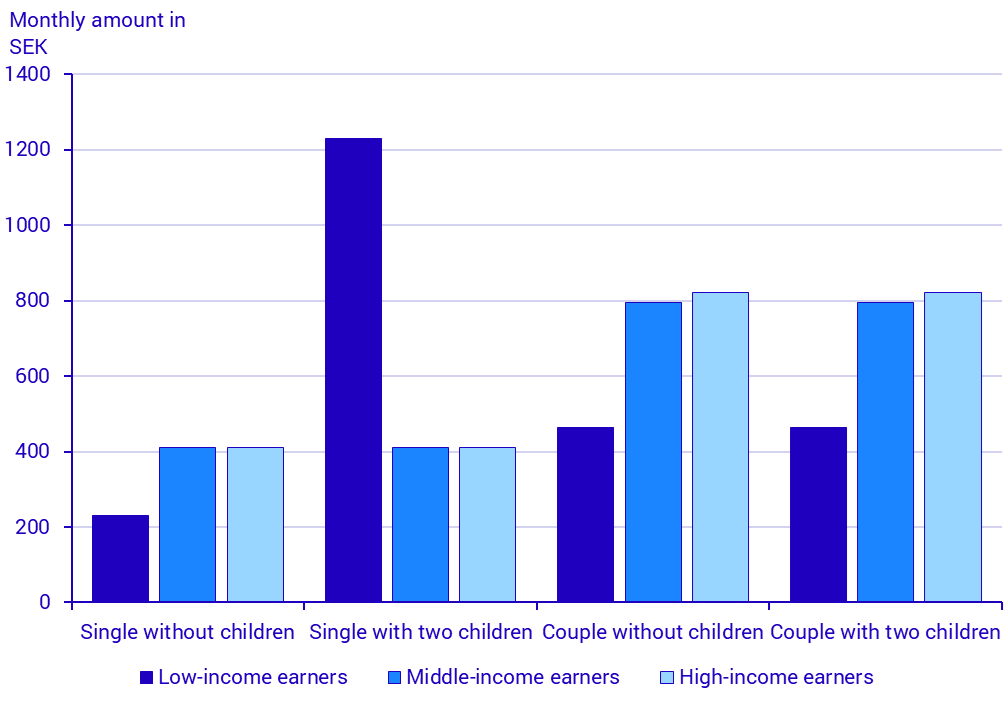

Greatest improvement for single parents with low income

The budget reforms have been analysed using typical households. A single low-income earner with children receives the largest increase, which is due to the increased housing allowance. In other household types, low-income earners will receive a smaller increase than middle- and high-income earners, since the strengthening of the Earned Income Tax Credit benefits these groups to a greater extent than low-income earners.

Source: SCB, FASIT, Typfall

The reported results are based on simulations carried out in the microsimulation model FASIT. You can read more about the effects in the publication below.

Publication

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.