Balance of payments, 4th quarter 2016:

Increased surplus in the current account

Statistical news from Statistics Sweden 2017-03-02 9.30

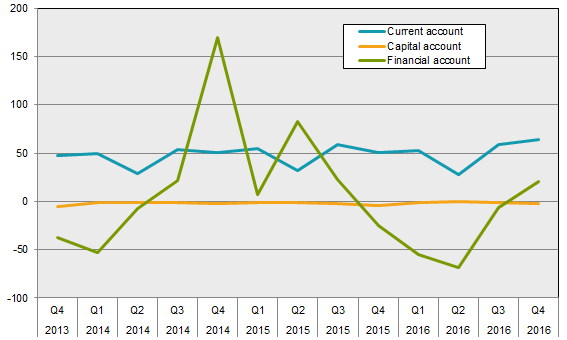

The current account showed a surplus of SEK 64 billion in the fourth quarter of 2016. The surplus in the corresponding quarter last year was SEK 51 billion. Increased surplus in the trade in services and crediting of EU VAT were the primary reasons for the net increase in the current account.

The trade balance resulted in a surplus of SEK 25 billion, which is unchanged compared with the corresponding quarter last year. Exports increased by SEK 22 billion and imports increased by SEK 21 billion compared with the fourth quarter last year.

Merchanting, which forms a part of the trade balance, contributed a surplus of SEK 24 billion and is on a level with the corresponding quarter last year. Merchanting refers to the sales margin that arises when Swedish enterprises buy goods abroad and sell them to another country without importing them to Sweden.

Strengthened trade in services balance

Balance of trade in services resulted in a surplus of SEK 30 billion. This can be compared with a surplus of SEK 25 billion in the corresponding quarter last year. Decreased import of services in the use of intellectual property rights was the primary contributor to the increased surplus.

Export of services amounted to SEK 169 billion and was on a level with the corresponding quarter last year. Import of services amounted to SEK 139 billion, and decreased by SEK 4 billion compared with the corresponding quarter last year.

Export of other business services and travel increased in comparison with the corresponding quarter last year, while export of use of intellectual property rights and financial services decreased.

Import of other business services, and telecommunications, data and information services increased, while use of intellectual property rights and travel decreased compared with the corresponding quarter last year.

Surplus continues to increase in primary income

Primary income showed a surplus of SEK 23 billion in the quarter, which was on a level with the corresponding quarter of last year. Compensation of employees resulted in a surplus of SEK 3 billion, while return on capital resulted in a surplus of SEK 20 billion.

Income on direct investments contributed a surplus of SEK 18 billion and there has not been any significant change compared with the previous quarter.

Income on portfolio investments contributed SEK 1 billion in surplus in the quarter, which is an increase compared with the fourth quarter of 2015. Interest payments abroad decreased by just over SEK 4 billion, while dividends from abroad increased by barely SEK 2 billion compared with the corresponding quarter last year.

Secondary income resulted in a deficit of SEK 13 billion, which can be compared with a deficit of SEK 22 billion in the corresponding quarter of the previous year. The deficit reduction was primarily due to crediting of intra-community VAT booked in the fourth quarter. This was a one-off case and was due to a change in the accrual of repayments. The capital balance resulted in a deficit of SEK 2 billion.

Capital outflow in the financial account

The financial account resulted in a capital outflow of SEK 21 billion. Direct investments, other investments and financial derivatives resulted in a capital outflow, while portfolio investments and reserve assets resulted in capital inflow.

Direct investments resulted in a capital outflow of SEK 33 billion. Swedish direct investments abroad increased by SEK 44 billion, while foreign direct investments in Sweden increased by SEK 11 billion. Equity in Swedish direct investment abroad decreased by SEK 11 billion.

Portfolio investment transactions resulted in a capital inflow of SEK 48 billion. Foreign investors decreased their portfolio investments in Sweden by SEK 18 billion, while Swedish investors decreased their portfolio investments abroad by SEK 66 billion.

Swedish investors decreased their holdings in foreign debt securities by SEK 41 billion, in which holdings in long-term debt securities accounted for the largest decrease, which corresponded to SEK 34 billion. Holdings in foreign shares decreased by SEK 54 billion during the quarter, in which net sales of British shares was the main contributor. At the same time, investments in foreign mutual funds increased by SEK 29 billion.

Foreign investors' holdings in Swedish short-term debt securities decreased by SEK 47 billion, of which short-term debt securities issued by banks decreased the most. The decrease was offset by increased holdings in Swedish long-term debt securities corresponding to SEK 26 billion, in which housing bonds accounted for the largest increase. Foreign investors' net purchases of Swedish shares amounted to SEK 5 billion and net purchases in Swedish funds amounted to SEK 1 billion.

Other investments resulted in a capital outflow of SEK 36 billion. Swedish other investments abroad decreased by SEK 130 billion, while foreign other investments in Sweden decreased by SEK 166 billion.

Reserve assets resulted in SEK 2 billion in capital inflow and financial derivatives resulted in just over SEK 2 billion in capital outflow.

Increased net assets in the international investment position

At the end of the fourth quarter of 2016, Sweden's international investment position showed net external assets of SEK 730 billion. This is an increase compared to the previous quarter, when net assets amounted to SEK 484 billion.

Sweden's largest net external assets are in direct investments, other investments and reserve assets. Sweden's largest net liabilities are in debt securities in portfolio investments.

Portfolio investments was the part that contributed most to the increase in net assets through a decrease, although it had a positive effect on the international investment position, primarily through a decrease of outstanding Swedish debt securities with foreign ownership.

| Table | 2016 | 2016 | 2015 | 2016 | 2015 |

|---|---|---|---|---|---|

| Q4 | Q3 | Q4 | |||

| Current account | 64.3 | 59.3 | 50.8 | 203.9 | 196.4 |

| Trade in goods | 25.1 | 20.2 | 24.6 | 100.9 | 113.9 |

| Trade in services | 29.8 | 23.6 | 25.4 | 93.3 | 93.1 |

| Primary income | 22.6 | 32.7 | 22.9 | 68.6 | 58.8 |

| Secondary income | ‑13.2 | ‑17.2 | ‑22 | ‑58.9 | ‑69.5 |

| Capital account | ‑2 | ‑1 | ‑4.2 | ‑3.6 | ‑8.3 |

| Financial account | 21 | ‑6.5 | ‑24.8 | ‑108.9 | 87.3 |

| Direct investments | 32.8 | ‑63.7 | ‑3.3 | 28 | 73.7 |

| Portfolio investments | ‑48.2 | 54.3 | ‑117.6 | 8 | ‑108.2 |

| Financial derivatives | 2.3 | ‑1.7 | ‑15.9 | ‑22.8 | ‑2.6 |

| Other investments | 36.2 | ‑6.7 | 109.9 | ‑158.6 | 113.5 |

| Reserve assets | ‑2.1 | 11.2 | 2.1 | 36.4 | 11 |

Revisions

The compilation of the balance of payments and the international investment position makes use of certain preliminary information. The statistics will be revised in line with more definitive figures in the updated statistics.

In connection with publication of the fourth quarter 2016, the time series for balance of payments and the international investment position was revised from 2013.

The table Revisions in balance of payments 2013Q1-2016Q3 contains the scope and description of revisions in balance of payments after account items.

The table Revisions in the international investment position 2013Q1-2016Q3 contains the scope and description of revisions in the international investment position after assets/liabilities and account items.

Publication

Next publishing will be

Balance of payments for the 1st quarter 2017 will be published on 2017-06-02.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.