Financial accounts, 2nd quarter 2017:

Non-financial corporations issued more debt securities

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2017-09-22 9.30

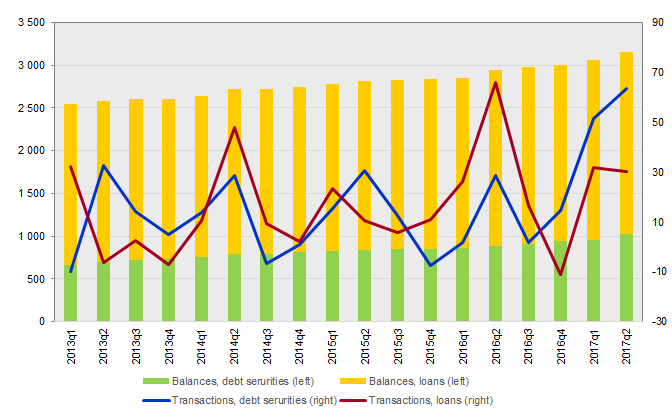

The non-financial corporations increased their borrowing in both issued securities and loans in monetary financial institutions during the second quarter 2017. During the three latest quarters, borrowing through issued securities has increased more than loans issued by monetary financial institutions.

Borrowing through debt securities has become an increasing part of the non-financial corporations financing during recent years. In the second quarter of 2017, the non-financial corporations have increased their borrowing in issued debt securities by SEK 74 billion, where SEK 64 billion is transactions and SEK 10 billion is due to value change. In total, the non-financial corporations’ liability in debt securities amounted to SEK 1 024 billion by the end of the second quarter. Loans issued by monetary financial institutions increased by SEK 30 billion and by the end of the quarter the loans amounted to SEK 2 124 billion. During the last four years non-financial corporations liability in debt securities have increased by 47 percent and loans issued by monetary institutions have increased by 14 percent.

Source: Statistics Sweden

Even though the non-financial corporations borrowing through issued debt securities has increased more than loans the last couple of years, loans in banks and other monetary institutions still remain the largest form of financing.

Households´ savings continued to be high

The households’ financial savings amounted to SEK 81 billion in the second quarter of 2017, which is still at a high level. The second quarter has seasonally high savings since most of the dividends occur this quarter. Households’ assets in tenant-ownership rights continued to increase, primarily due to purchases in newly produced tenant-ownership rights. Net purchases during the second quarter of 2017 amounted to SEK 17 billion, which was a significant increase. During the second quarter of the previous year investments in tenant-ownership rights amounted to SEK 14 billion and to SEK 9 billion during the same quarter of 2015. Household loans increased by SEK 77 billion during the second quarter which was in line with the record level from the same period last year. The annual growth rate was 6.7 percent and loans amounted to SEK 3 860 billion by the end of the quarter.

Revisions

In connection with the calculations of the second quarter of 2017, annual and quarterly statistics of the financial accounts have been reviewed and revised for the entire time series. Some of the major revisions are households’ transactions in unlisted shares and issued debt securities by banks and non-financial corporations. Further information about revisions is available in the Statistical Report.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ net lending/net borrowing are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing are measured as the difference between income and costs in the non-financial accounts, which, like the financial accounts, are part of the national accounts. However, financial accounts and non-financial accounts are based on different sources, which give rise to differences.

Publication

A more detailed presentation of the survey and significant revisions is available in the Statistical Report.

Revisions in the National Wealth

In connection with the publishing of the financial accounts, the National Wealth is updated for 2016 as well as for revisions of previous years. The financial assets and liabilities thus have the same values in both time series. In addition, the annual figures for non-financial assets for 2015 are now based on more detailed statistics than the previous estimation for that year.

For further information, see Nationalförmögenheten och Nationella balansräkningar and National wealth in the Statistical Database.

Nationalförmögenheten och Nationella Balansräkningar (in Swedish) (pdf)

Next publishing will be

2017-12-21 at 9:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.