Financial accounts, 3rd quarter 2016:

Housing credit institutions finance themselves to a greater extent via bank deposits

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2016-12-21 9.30

Households' loans with housing credit institutions continued to increase, albeit at a slower rate. Housing credit institutions financed this primarily by issuing bonds, but deposits from banks has become an increasingly important source of financing. Central government borrowing requirements decreased at the same time as the Riksbank continued to purchase government bonds as a support measure.

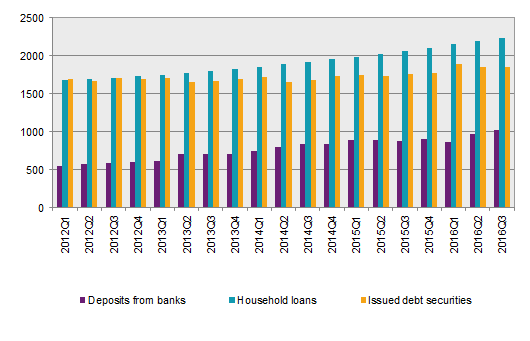

Around two-thirds of households’ loans are with housing credit institutions. In the third quarter 2016, these loans increased by SEK 33 billion and amounted to SEK 2 227 billion in total at the end of the quarter. This was the first time in four years that households' loans with housing credit institutions increased at a slower rate, that is, had a decreasing annual growth rate.

Housing credit institutions financed their lending primarily by issuing debt securities with longer maturity - bonds. In 2012, the outstanding debt securities were in line with households’ loans with housing credit institutions. Since then, the loans have increased more than issued securities and housing credit institutions have to a greater extent financed themselves via deposits from the bank sector. These deposits have nearly doubled since 2012, from SEK 552 billion in the first quarter of 2012 to SEK 1 019 billion at the end of the third quarter in 2016. Housing credit institutions’ borrowing via short-term debt securities vanished entirely in the third quarter.

Source: Statistics Sweden

Two-thirds of housing bonds are held by Swedish sectors, and one-third is held by foreign investors. The largest Swedish owners are insurance corporations and pension funds, who together hold 25 percent of the outstanding stock. Banks hold 19 percent and investment funds hold 15 percent.

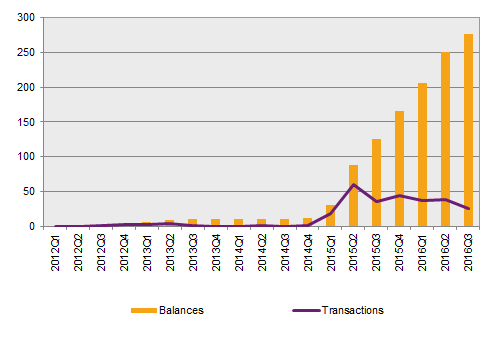

At the end of the third quarter, outstanding central government securities, which mainly consisted of government bonds, amounted to SEK 1 404 billion. As a result of maturity and repurchase, outstanding central government securities decreased by SEK 65 billion during the quarter. At the same time, the Riksbank purchased government bonds as a support measure. In total, holdings amounted to SEK 277 billion, which was an increase of SEK 26 billion during the quarter. These two effects decreased the supply of government securities on the market by SEK 91 billion during the third quarter.

Source: Statistics Sweden

Revisions

In connection with this publication, some life insurance corporations have been reclassified as pension funds from 2009 onwards. In addition, the balance of unlisted shares for non-financial corporations has been revised from 2014. More information about revisions is available in the Statistical Report.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The non-financial national accounts calculate financial savings as the difference between income and expenses. Financial accounts and the non-financial national accounts are based on different sources, which give rise to differences.

Publication

A more detailed presentation of the survey and significant revisions is available in the Statistical Report.

The national wealth is also updated in connection with the publication of the financial accounts.

Next publishing will be

The next statistical news in this series is scheduled for publication on 2017-03-23 at 9:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.