Financial accounts, 2nd quarter 2018:

High levels of household savings in the second quarter

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2018-09-20 9.30

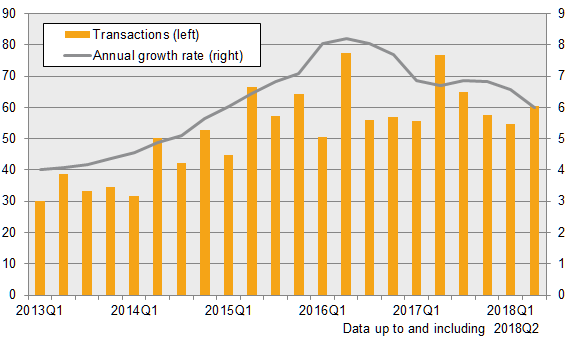

Households’ financial savings amounted to SEK 59 billion in the second quarter of 2018 and were primarily focused in bank accounts and occupational pensions. Loans increased by SEK 60 billion, but the growth rate in loans diminished.

Households’ financial savings, new savings minus increase in debt, amounted to SEK 59 billion in the second quarter of 2018. Normally, households’ savings are high in the second quarter, as most share dividends are distributed then. Households’ savings were primarily in bank accounts and occupational pensions, SEK 53 billion and SEK 44 billion respectively, which is in line with the previous year. Savings in shares and funds amounted to SEK 7 billion. Net purchases of tenant ownership rights slowed and amounted to SEK 8 billion, which is SEK 4 billion less than in the corresponding period last year.

From a historical perspective, households’ increased borrowing has been highest in the second quarter, and this year borrowing amounted to SEK 60 billion, compared with SEK 77 billion in increased loans in the corresponding quarter in both 2016 and 2017. The most recent amortisation requirement, introduced on 1 March this year, limited households’ borrowing capacity. The annual growth rate in households’ loans has slowed and was 2 percentage points lower in the second quarter of 2018 than the 8.2 percent listing two years previously.

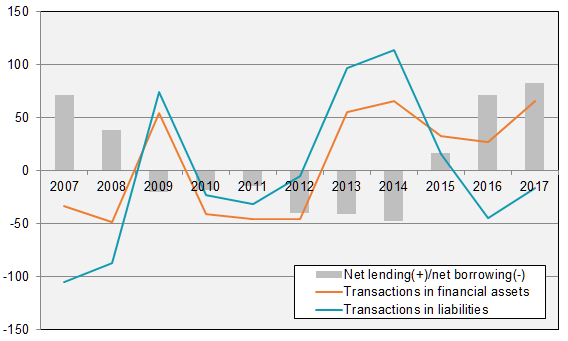

Financial savings of central government were high

Central government financial savings amounted to SEK 34 billion in the second quarter of 2018. In 2017, financial savings of the central government amounted to SEK 83 billion, which is the highest annual listing since 2001.

Non-financial corporations’ borrowings increased

In the second quarter of 2018, non-financial corporations continued to increase borrowing, both in issued debt securities and through loans in monetary financial institutions. Borrowing increased by SEK 83 billion in total, of which SEK 59 billion was loans via monetary financial institutions. Non-financial corporations’ loans in monetary financial institutions amounted to SEK 2 263 billion and liabilities in issued debt securities amounted to SEK 1 170 billion at the end of the quarter.

Revisions

In connection with this publication, revisions were made for the period 1995-2018. Some of the major revisions refer to redistribution between sectors of holdings of Swedish-registered funds, revisions of non-financial corporations’ loans to households, and several revisions with regard to general government. In the primary statistics, nominee-registered funds are registered on the managing institution rather than the final owner. Last year, revisions were made to correct this concerning the years 2009-2017. Now, the period 1998-2008 has also been revised. The revisions mainly affected banks, resulting in decreased holdings in funds, and insurance corporations, pension institutions and households, resulting in increased holdings. The time series for non-financial corporations’ loans to households has been revised with yearly data from the survey Structural Business Statistics and supplementary calculations. Several revisions have also been made with regard to general government. Central government administration accrual of taxes has been revised for 2003-2015, primarily as a result of adjusted energy taxes on electricity. A longer time series on municipal administrations’ transactions and balance in foreign investment fund shares has been added. New calculations of municipalities’ holiday pay liabilities has been introduced and affects the quarterly pattern in the accrual item from 2002 onwards. A more detailed report on revisions with regard to public administration (only available in Swedish)is available in the detailed information on Financial accounts.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing are measured as the difference between income and costs in the non-financial accounts, which, like the financial accounts, form part of the national accounts. However, financial accounts and real sector accounts are based on different sources, which gives rise to differences.

Publication

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial accounts. Financial assets and liabilities are collected from the Financial accounts and are thereby consistent with the values published in the Financial accounts.

For further information:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next press release in this series is scheduled for publication on 2018-12-19 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.