Financial accounts, 3rd quarter 2017:

Increased interest from households for investment funds

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2017-12-21 9.30

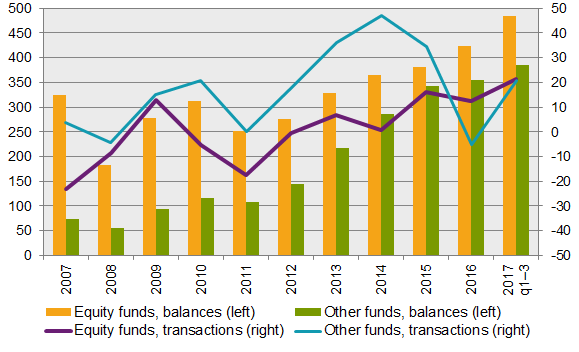

During the last few quarters, households have increased their interest in investment funds. The households’ net investments in funds amounted to SEK 8 billion in the third quarter of 2017. During the first three quarters of 2017, net purchases have been significantly higher than during the corresponding period in 2016 but lower than the peak in 2014.

In recent years, households have started to invest more in Swedish-registered equity funds and other funds, such as fund of funds, hedge funds and mixed funds. Households invested mostly in other funds during the period 2010 to 2015 while equity funds were the most popular fund category 2016 and 2017, with the exception of a few quarters. For the past decade, equity funds have been the largest fund category, however, other funds have grown from 17 to 41 percent of household holdings of Swedish-registered funds.

Source: Statistics Sweden

Households’ net lending/net borrowing amounted to SEK minus 4 billion in the third quarter of 2017. The households are still net borrowers, however, to a lesser extent compared to the same period in 2015 and 2016. In addition to fund investments, households deposited an additional SEK 38 billion in bank accounts, invested SEK 8 billion in tenant ownership rights and borrowed an additional SEK 61 billion.

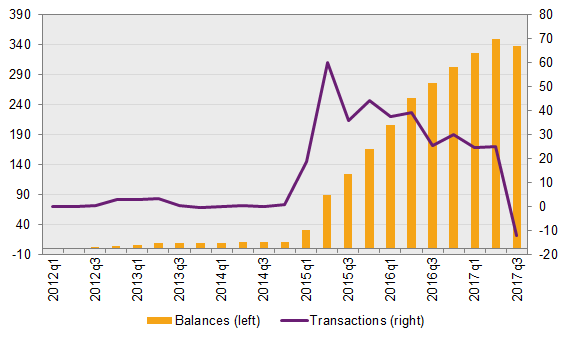

The Riksbank sold government bonds

The Riksbank’s net selling of government bonds amounted to SEK 12 billion during the third quarter of 2017, which was a break in the trend compared to the previous quarters. In recent years, the Riksbank has, as a measure of quantitative easing, continuously bought government bonds. The Riksbanks’ total holdings of government bonds amounted to SEK 338 billion by the end of the third quarter 2017.

Revisions

There are no major revisions in this publication of the financial accounts. Compared to previous publication, year 2015 and onwards have been updated.

Definitions and explanations

Both financial and non-financial accounts constitute a part of the national accounts system. The financial accounts aim to provide information about financial assets and liabilities as well as changes in net lending/net borrowing and wealth for different economic sectors. The net lending/net borrowing in the financial accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. In the non-financial accounts, net lending/net borrowing is measured as the difference between income and expenditure. However, since the financial and non-financial accounts are, for some sectors, based on different sources, there are differences between the two estimates of net lending/net borrowing.

Publication

A more detailed presentation of the survey and significant revisions is available in the Statistical Report.

In connection with the publishing of the financial accounts, the times series for the National Wealth has been updated. The financial assets and liabilities thus have the same values in both time series.

For further information, see Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf) and National wealth in the Statistical Database

Next publishing will be

2018-03-20 at 9:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.