Financial accounts third quarter 2021

Central government savings remain negative

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2021-12-16 9.30

In the wake of the COVID-19 pandemic, central government financial savings remained negative in the third quarter of 2021. At the same time, the Riksbank continued to purchase debt securities. Households’ financial savings were exceptionally high for a third quarter, and households made net sales of shares for the first time since the outbreak of the pandemic.

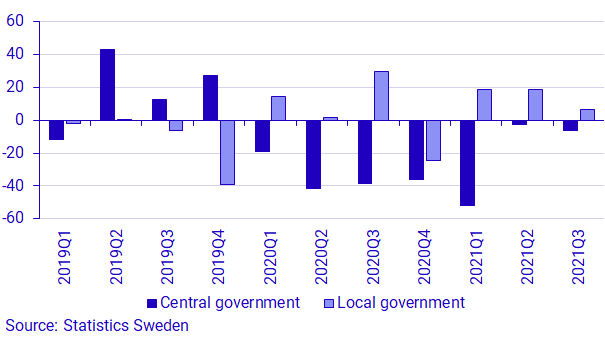

Central government savings remained negative

As a result of central government support provided during the COVID-19 pandemic, primarily to local government, central government savings have been negative throughout all quarters in 2020 as well as the first three quarters of 2021. Taken together, these seven quarters showed negative financial savings in central government amounting to SEK 195 billion. The government support led to a reverse situation for local government. With the exception of the fourth quarter of 2020, savings in local government noted positive figures during the period. In the two most recent quarters, central government financial savings have been less dramatic.

Household savings were exceptionally high

Households’ net financial savings amounted to SEK 119 billion in the third quarter, which is an unusually high level of savings for a third quarter. Contributions to households' positive savings included a high net tax accrual, at SEK 82 billion, as well as households' bank deposits and insurance savings. Households' yearly growth rate in loans continued to rise and net borrowing amounted to SEK 80 billion in the third quarter of 2021. This is the highest net borrowing noted in a third quarter since the start of the time series.

Notable for the third quarter of 2021 was the fact that households made net sales of Swedish-listed shared valued at SEK 27 billion. In the five most recent quarters, households made net purchases of shares and funds for on average SEK 49 billion per quarter.

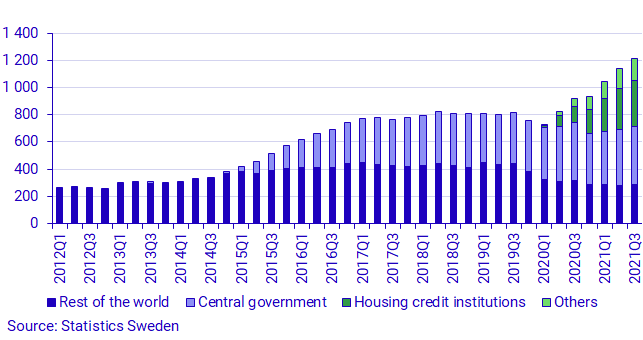

The Riksbank holdings in debt securities continued to increase

The Riksbank rescue purchase programme of debt securities continued during the third quarter and at the end of the quarter, the Riksbank holdings in short-term and long-term debt securities amounted to SEK 1 218 billion. This is SEK 76 billion more than in the previous quarter. Holdings consisted primarily of bonds, in which government bonds account for one-third of the Riksbank bonds portfolio, followed by mortgage bonds and foreign bonds that each account for one-fourth of the portfolio. Mainly mortgage bonds were purchased during the quarter, as well as government bonds. Interest in foreign bonds remained low.

Revisions

In conjunction with the production of the third quarter 2021, yearly and quarterly statistics have been revised for the period 2017-2021Q2. Holdings in debt securities and holdings in foreign shares and funds have been revised as from the first quarter 2021 with data from the database on securities holdings (VINN). This may lead to a break in the time series between the fourth quarter of 2020 and the first quarter of 2021. Further information on the introduction of VINN is available under “More information” on the Financial Accounts product page. Furthermore, the rest of the world sector was revised as from the first quarter of 2017 with new information from the Balance of Payments. For public administration, revisions were made from 2017 and forward. For 2020 and onward, the revisions primarily relate to updated taxes, and minor adjustments and updated information has been added for previous years.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, the financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial Accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they comprise of the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

Further information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from Financial Accounts and are thereby consistent with the values published in Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news item in this series is scheduled for publication on 2022-03-17 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.