Savings Barometer, 4th quarter 2022

Decline in the growth rate of household saving

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2023-02-16 8.00

The end of 2022 concluded the first full year since the pandemic. The years 2020 and 2021 were heavily affected by extensive restrictions which changed the household savings behavior. The high household savings that were registered during the pandemic years are now decreasing. For the fourth quarter of 2022, Savings Barometer focuses on some parts of households' total savings to better reflect this development.

2022 - A turbulent year for tenant-owned apartments

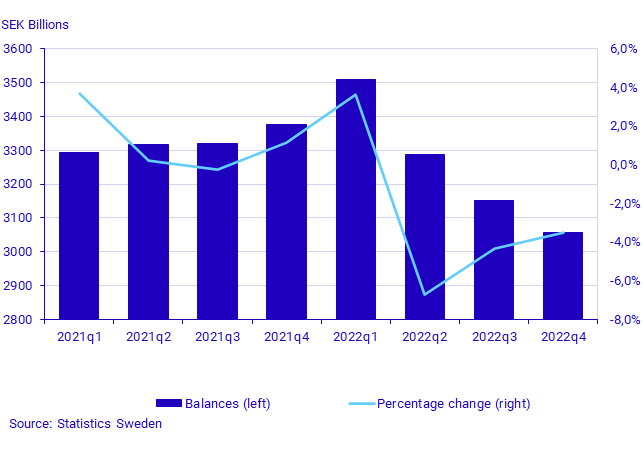

In the fourth quarter, interest rates continued to increase while the market value of tenant-owned apartments fell by 3.5 percent.

The annual growth rate of household loans has also continued to decline, but more sharply. At the end of 2022, the growth rate was historically low and amounted to 3.8 percent.

At the end of 2022, households' assets in tenant-owned apartments amounted to SEK 3,057 billion, which was a decrease of SEK 96 billion, compared with the previous quarter. At the fourth quarter of 2022, the market value of tenant-owned apartments was back to similar levels as before the pandemic.

Although both the market value of tenant-owned apartments and the household lending have decreased, the completion of newly built tenant-owned apartments was higher than the third quarter of 2022. The number of completed tenant-owned apartments during the fourth 2022 was 5,002 and for the previous quarter this figure was 2,796 tenant-owned apartments.

Households' purchases of new tenant-owned apartments, which consist of new constructions and conversions, amounted to SEK 15 billion. This is almost twice the amount compared to the previous quarter. However, the number of households’ purchases of new tenant-owned apartments tend to be higher during the fourth quarter. Over the previous three years, households' purchases of new tenant-owned apartments for the fourth quarter were between SEK 14 and 23 billion.

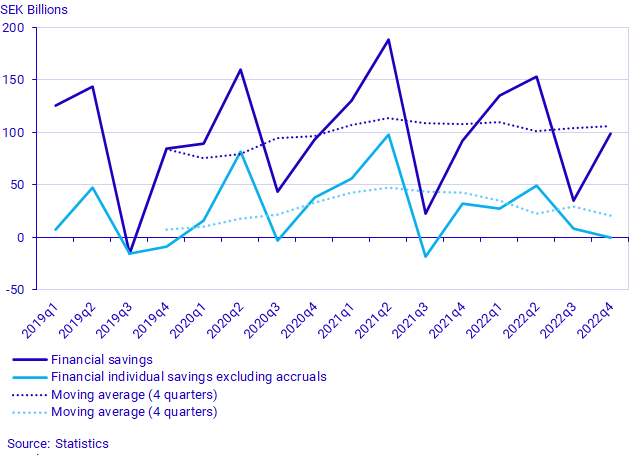

Household behavioral savings decreased

The household total savings for the fourth quarter of 2022 amounted to SEK 99 billion. Given a high inflation and rising interest rates, this may appear to be a significantly higher level of savings. However, the household total savings consist of many variables that change differently over time. Some variables change a lot from quarter to quarter and relate more closely to household behavior and reactions in each quarter such as the financial saving excluding accruals. Examples of variables that change rapidly and follow household behavior in the shorter run are deposits in bank accounts, purchases of shares, housing, and similar activities.

Other variables change more slowly, in the longer run, or do not correspond as clearly with everyday household economic activities. Variables that are more time invariant include pensions, which change alongside shifts of unemployment or retirements, among other things.

The two measures: financial savings and financial savings excluding accruals, differ significantly in level. Over the past 10 years, households' total savings have been on average 55 billion higher per quarter than the financial total savings, excluding accruals. Historically, the two measures have had a positive correlation. However, for the fourth quarter of 2022, the correlation is negative between the two measurements.

The financial savings excluding accruals for the fourth quarter of 2022 were SEK zero billion. This indicates that households have a low saving rate, which further declined compared to the previous quarter.

Households' financial savings excluding accruals provide a better picture of households' current situation. The focus of the Savings Barometer will henceforth be more on financial savings excluding accruals.

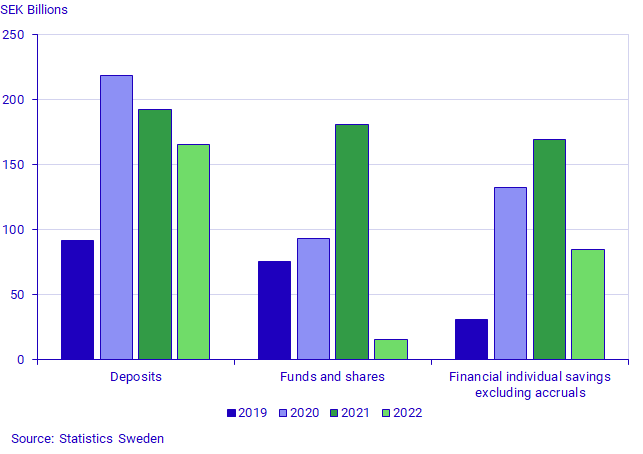

Decline in Households saving after the pandemic

In several aspects, households increased their savings during the pandemic. These savings decreased during the fourth quarter of 2022. Deposits went from 92 billion in 2019, to 218 billion in 2020, 193 billion in 2021 and fell in 2022 to 166 billion. The same pattern, an increase from the year immediately before the pandemic and then falling during the full year after, is also seen for equities and funds and financial savings excluding accruals.

Households' financial assets also increased during 2020-2021 to fall during the first three quarters of 2022 but rose in the fourth quarter of 2022 as a result of a stock market rise of 10.8 % according to Affärsvärlden's General Index.

Electricity subsidiary effects the Savings Barometer

The electricity subsidiary that will be paid in February 2023 will affect household savings for the fourth quarter of 2022. The management of how the electricity subsidiary is accounted for has been coordinated with other statistical products. The electricity subsidiary will increase households' savings for the fourth quarter of 2022 by SEK 17 billion.

For more information on how electricity subsidies are handled in National Accounts, read Hur elstöd från Svenska kraftnät ska redovisas i offentliga finanser (pdf).

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take account of inflation.

Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included however, since they constitute real assets. Information on households’ total assets in dwellings is available in the publication National Wealth.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the third quarter of 2022, the time series is updated as of the first quarter of 2019 with the revisions introduced into the Financial Accounts’ publication on 22 of September.

More detailed descriptions of major revisions are provided in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2023-08-24 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.