Shareholder statistics, June 2019

Share wealth reaches new record level

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-09-04 9.30

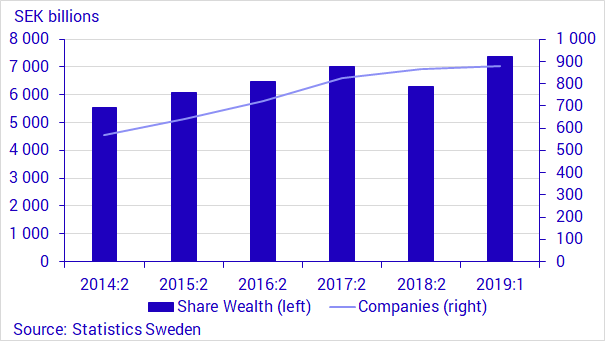

The overall share wealth of shares listed on Swedish marketplaces increased by 17 percent in the first six months of 2019, as the Swedish stock market recovered and the number of listed companies increased. Share wealth amounted to SEK 7 377 billion at the end of the period, reaching a new record level.

In the first six months of 2019, the Swedish stock market recovered from the 9 percent drop in the previous six months. At the end of June 2019, shares listed on Swedish marketplaces, including the companies' unlisted classes of shares, were valued at SEK 7 377 billion. This was an increase of SEK 1 087 billion during the period, in which, according to the Affärsvärlden general index, the stock market rose by 17 percent.

At the end of June 2019, share wealth rose to a new record level; there were 878 listed companies on Swedish marketplaces, which is a net increase of 14 companies compared with the end of 2018. The number of listed companies has increased by more than 50 percent in five years.

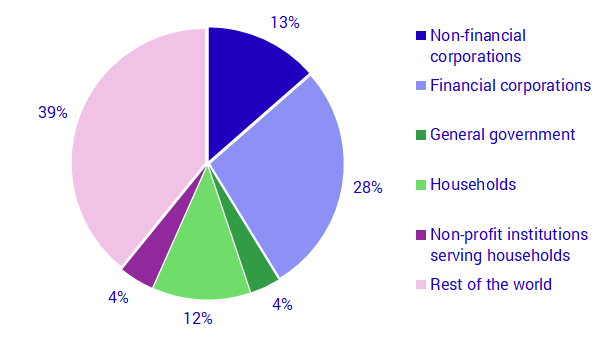

The shifts in shareholder structure on Swedish marketplaces in the past 20 years have been minor. At the end of June 2019, foreign owners were the largest owner sector, accounting for 39 percent of shareholdings. Holdings among non-financial companies increased by 0.6 percentage points during the period, while shareholdings among other financial companies, including banks, decreased by 0.2 percentage points.

US and UK holdings decreased

Shareholdings on Swedish marketplaces in the foreign owners sector remained unchanged at 39 percent and amounted to SEK 2 889 billion at the end of June 2019. This is an increase of SEK 430 billion compared with the end of 2018. The dominating owner countries, the United States and the United Kingdom, decreased their overall shareholdings in the first six months of 2019 by 2 percentage points to 56 percent. UK holdings have been declining for the past two years, but the US decrease is a break in the trend. At the same time, investors in Luxembourg and Switzerland increased their shareholdings by 3 percentage points.

Households' median portfolio increased

Household sector shareholdings on Swedish marketplaces amounted to SEK 870 billion at the end of June 2019, which corresponds to 12 percent of total market value. Among households, shareholders are mainly older persons. Nearly one in five persons aged 65 years and older owns shares. Their holdings represented more than half of the share wealth in the household sector.

The distribution between men and women has not changed dramatically. Men own two thirds of households' share assets and women own one third. Households' total median portfolio, that is, the middle portfolio in size, among private persons living in Sweden, was valued at SEK 42 000. Among men, the corresponding portfolio was valued at SEK 47 000, while among women, the median portfolio was valued at SEK 35 000 at the end of June 2019.

Definitions and explanations

Information on the final owners is not available with regard to ownership in security accounts via Swedish nominees if holdings are less than 501 shares in a company, which means that these holdings are not included in a breakdown of households' income and age. Information on foreign nominees' final owners is not available, as these are not included in the public shareholders' register. At the end of June 2019, households' ownership in shares registered in security accounts amounted to 13 percent of total assets in shares.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the marketplaces mentioned above are included in the statistics from 2000 onwards.

In connection with the publication of shareholder statistics in June 2019, a review was carried out on the number of shareholders, and their mean and median portfolios. All equity portfolios with a market value of zero Swedish kronor were cleared away and their owners were excluded from the statistics. Revisions have been carried out for all published years and the results are contained in the accompanying Statistical Report. No values in the Statistical Database are affected by the correction.

Publication

A more detailed report of this survey is published in a Statistical Report.

Next publishing will be

Next publication date 2020-03-05.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.