Shareholder statistics, June 2022

Share wealth declined for the first time in two years

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2022-09-01 8.00

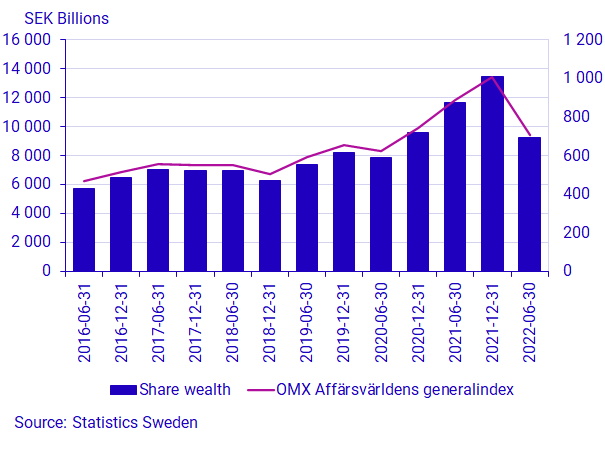

In the first six months of 2022, share wealth declined for the first time since the outbreak of the covid-19 pandemic, amounting to SEK 9,300 billion at the end of June. This is a decrease of 31 percent compared with the end of December 2021. The total number of shareholders in the household sector continued to decline, in line with the prior six-month period.

In the first six months of 2022, the OMX Affärsvärlden General Index declined 30 percent, and the market value of Swedish shares listed on Swedish marketplaces fell SEK 4,182 billion. This is the first time that share wealth decreased since the outbreak of the covid-19 pandemic. The downturn was from high levels, as share wealth rose 71 percent between the end of June 2020 and December 2021.

At the end of June 2022, there were 1,047 listed companies on Swedish marketplaces, which is an increase of 1,4 percent since last of December 2021.

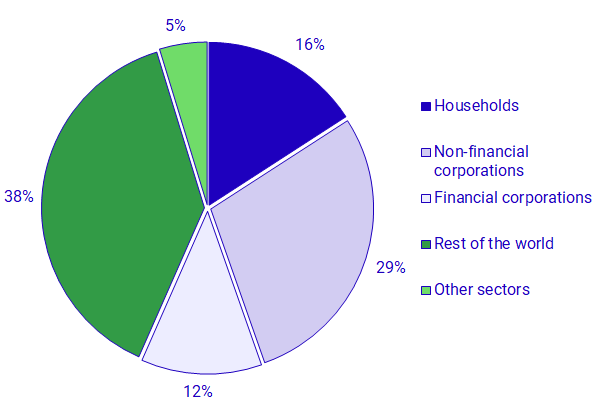

International shareholders still the largest segment

At the end of June 2022, rest of the world shareholders were the largest owner segment on Swedish marketplaces with share wealth of SEK 3,590 billion. This equals 39 percent of market value, followed by non-financial corporations and households, which held 29 and 16 percent, respectively.

Household sector shareholdings on Swedish marketplaces amounted to SEK 1,123 billion at the end of June 2022, distributed across 1.15 million shareholders. This was a decrease of 33,000 shareholders since the turn of the year, meaning that around one Swede in ten is a shareholder with a portfolio of at least 501 shares in one and the same company.

Median portfolio equalised between the sexes

The median portfolio of households amounted to SEK 55,000 in all age groups at the end of the period, which was a decline of 18 percent since the turn of the year. At the end of June 2022, women had a median portfolio of SEK 54,000 and men SEK 55,000. Since publication of the median portfolio commenced in 2017, there has been a great difference between the median portfolios of men and women. In the past five years, the average difference between the sexes has been SEK 11,000, which in the first half of 2022 has levelled. Out of the total share wealth on Swedish marketplaces, men own two thirds and women one third.

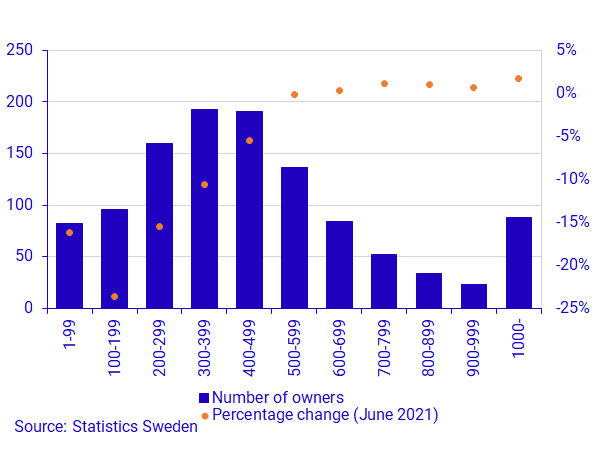

Rise in shareholders among high-income earners

In a breakdown of shareholders into income groups, most shareholders were found in the annual income bracket SEK 300,000 – SEK 399,999 at the end of the first six months of 2022. This income group represents one sixth of the total number of shareholders among households. Individuals who earned SEK 1 million or more owned 55 percent of the total portfolio value within the household sector.

The number of shareholders has declined in income groups with an annual income of up to SEK 599,000 compared to June 2021. The greatest decline was in the income group in the annual income bracket SEK 100,000 – SEK 199,000, in which the number of shareholders dropped by one quarter. For the income groups with an annual income of SEK 600,000 or more, the number of shareholders increased slightly. In the income group with an annual income of at least SEK 1 million, which increased the most, the number of shareholders rose 1.7 percent. A change in the number of shareholders in an income group can occur both because owners have gone from one income bracket to another, or they have sold off their shareholding.

Definitions and explanations

Information on end owners is not available for nominee-registered ownership through Swedish nominees if the holding is less than 501 shares in a company. Because of this, these holdings are not included when households’ shareholdings are broken down by income and age. Information on foreign nominees’ end customers is not available, as these are not included in the public shareholders’ register. At the end of June 2022, households’ nominee-registered shareholdings were 14 percent of total assets in shares.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies that are listed on the aforementioned marketplaces are included in the statistics from 2000 onwards.

Next publishing will be

Next publication date xxxx-xx-xx

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.