Balance of payments, 2nd quarter 2019

Increased surplus in trade in goods led to stronger current account

Statistical news from Statistics Sweden 2019-09-03 9.30

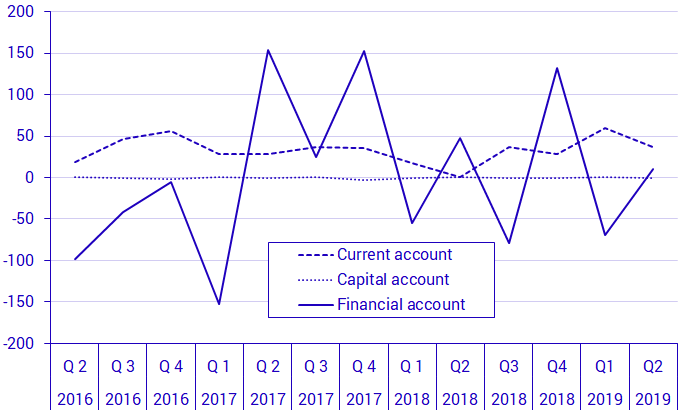

The current account recorded a surplus of SEK 37.0 billion in the second quarter of 2019. The surplus in the corresponding quarter in the previous year amounted to SEK 0.8 billion. An increased surplus in the trade of goods and a lower deficit in the primary income were the main contributing factors to the increased surplus in the current account.

The trade in goods resulted in a surplus of SEK 44.0 billion, which is an increase of SEK 27.9 billion compared with the corresponding quarter the previous year. Exports of goods increased by SEK 27.2 billion, while imports of goods decreased by SEK 0.7 billion. Merchanting, which is included in trade in goods, recorded an increased surplus of SEK 3.8 billion and amounted to just under SEK 26.5 billion.

Surplus in trade in services

Trade in services recorded a surplus of SEK 5.2 billion, up by SEK 0.3 billion compared with the corresponding quarter a year ago.

Exports of services amounted to SEK 177.3 billion, which is an increase of SEK 20.1 billion compared with the corresponding quarter the previous year. Imports of services amounted to SEK 172.0 billion and increased by SEK 19.7 billion in the same comparison.

Other business services, charges for the use of intellectual property and travel were the main types of services to contribute to increased exports. Professional and management consulting services, technical, trade-related and other business services accounted for the largest increase in other business services. Other business services was also the type of service to contribute the most to the increase in imports of services. Technical, trade-related and other business services accounted for the largest increase in this type of service.

Lower deficit in primary income

Primary income showed a deficit of SEK 3.8 billion in the second quarter. This item had a deficit of just over SEK 10.4 billion in the corresponding quarter last year. Investment income resulted in a deficit of SEK 7.2 billion, while compensation of employees resulted in a surplus of just under SEK 2.6 billion. Investment income exhibited a seasonal pattern and net return is generally lower in the second quarter, when many Swedish companies make distributions.

Income on direct investment contributed a surplus of just over SEK 17.4 billion, which is an increase of SEK 1.2 billion compared with the corresponding quarter last year.

Income on portfolio investments resulted in a deficit of just under SEK 25.6 billion, which can be compared with a deficit of SEK 30.3 billion during the corresponding quarter of the previous year. Dividends on shares and fund holdings resulted in a deficit of SEK 23.7 billion. This item showed a deficit of SEK 26.1 billion in the corresponding quarter in the previous year. The deficit decreased due to a larger increase in dividend payments from abroad compared with corresponding dividend payments from Sweden to abroad. Income on debt securities resulted in a decreased deficit compared with the corresponding quarter in the previous year.

Secondary income resulted in a deficit of SEK 8.5 billion, which can be compared with a deficit of SEK 9.8 billion in the corresponding quarter of the previous year.

Capital outflow in the financial account

The financial account resulted in a net capital outflow of SEK 10 billion. Other investments and reserve assets resulted in capital inflow, while portfolio investments, financial derivatives and direct investment resulted in capital outflow.

Direct investments resulted in capital outflow of SEK 18 billion. Swedish direct investment abroad increased by SEK 61 billion, while foreign direct investment in Sweden increased by SEK 44 billion.

Portfolio investment transactions resulted in just under SEK 43 billion in capital outflow. Foreign investors increased their portfolio investments in Sweden by SEK 30 billion, while Swedish investors increased their portfolio investments abroad by SEK 73 billion.

Swedish investors increased their holdings in foreign debt securities by just under SEK 20 billion. Holdings in long-term debt securities issued in foreign currency accounted for the largest increase, which corresponded to just under SEK 18 billion. Swedish investors made net purchases of foreign shares and fund holdings valued at SEK 53 billion. Share purchases accounted for the largest increase, which corresponded to SEK 51 billion.

Foreign investors increased their holdings in Swedish debt securities by just under SEK 13 billion. Holdings in short-term debt securities increased by SEK 40 billion, while holdings in long-term debt securities decreased by SEK 27 billion. Short-term debt securities increased because borrowing abroad in debt securities issued in foreign and Swedish currency increased by SEK 21 billion and SEK 19 billion respectively. This increase is distributed over several sectors. The decrease of long-term debt securities is mainly due to decreased borrowing in government bonds issued in foreign currency. Foreign investors purchased Swedish shares and fund holdings valued at just under SEK 18 billion net.

Other investments resulted in net capital inflow of SEK 53 billion. Other investments abroad decreased by SEK 200 billion, while foreign other investments in Sweden decreased by SEK 147 billion.

Financial derivatives resulted in capital outflow of SEK 23 billion. Reserve assets resulted in capital inflow of SEK 20 billion during the quarter.

Decreased net assets in the international investment position

At the end of the second quarter of 2019, Sweden's international investment position showed net external assets amounting to SEK 908 billion. This is a decrease compared with the previous quarter, when net assets amounted to SEK 952 billion.

Swedish liabilities abroad increased by SEK 239 billion, while Swedish assets abroad increased by SEK 195 billion. In the international investment position, portfolio investment contributed the most to the decreased net assets through increased net liability, while direct investments resulted in increased net assets. Other investments and reserve assets shows decreased net assets, while at the same time, net assets in financial derivatives increased.

Direct investments, reserve assets and other investments accounts for the largest net external assets. The largest net liabilities are in debt securities in portfolio investments.

Differences between the balance of payments and the National Accounts

The estimation of foreign trade differs between the Balance of Payments and the National Accounts. The Balance of Payments and the National Accounts work together in a long-term approach to coordinate statistics.

Revisions

The time series for the Balance of Payments and the international investment position has been revised from Quarter 1 2017.

The Balance of Payments conforms with a predetermined revision policy, see Section 2.3 of the Quality Declaration 2019.

Quality Declaration 2019 (pdf)

In a compilation of the balance of payments and the international investment position, data based on forecasts are used in some cases. The statistics will be updated as results come in. If new data is added or in the case of any methodological changes, further revisions are carried out as necessary.

Revisions carried out in connection with publication of the second quarter 2019 are listed in the tables on revisions by account item for the balance of payments and the international investment position respectively.

| 2019 | 2019 | 2018 | 2018 | 2017 | ||

|---|---|---|---|---|---|---|

| Q 2 | Q 1 | Q 2 | ||||

| Current account | 37 | 59.1 | 0.8 | 83.2 | 128.8 | |

| Trade in goods | 44 | 44.8 | 16.1 | 74.7 | 94.2 | |

| Trade in services | 5.2 | 4.4 | 4.9 | 15.2 | 37.4 | |

| Primary income | ‑3.8 | 42.9 | ‑10.4 | 73.9 | 67.9 | |

| Secondary income | ‑8.5 | ‑32.9 | ‑9.8 | ‑80.7 | ‑70.6 | |

| Capital account | ‑0.4 | 0.0 | 0.0 | ‑0.6 | ‑3.1 | |

| Financial account | 10.2 | ‑69.3 | 47.8 | 45.6 | 179.0 | |

| Direct investments | 17.5 | 24.9 | ‑10.0 | 96.1 | 91.9 | |

| Portfolio investments | 42.6 | ‑13.3 | ‑11.4 | ‑88.7 | 27.5 | |

| Financial derivatives | 23.1 | ‑2.0 | 14.2 | 47.5 | ‑68.9 | |

| Other investments | ‑53.1 | ‑90.0 | 51.5 | ‑6.4 | 125.3 | |

| Reserve assets | ‑19.9 | 11.1 | 3.5 | ‑2.8 | 3.0 | |

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.