Balance of payments, 2nd quarter 2022

Increase in imports of goods and services decreased Sweden’s current account balance

Statistical news from Statistics Sweden 2022-09-01 8.00

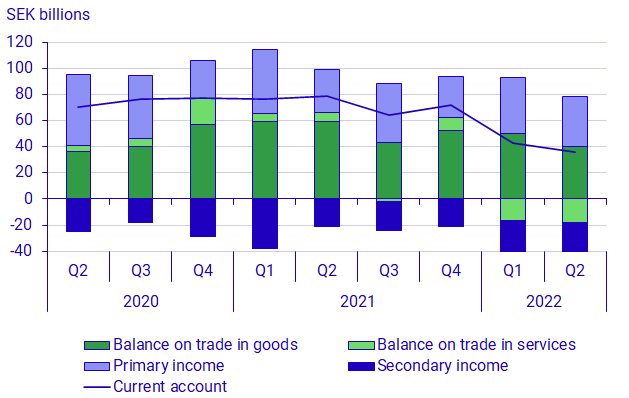

The current account surplus amounted to SEK 36.0 billion during the quarter. It is a decrease of SEK 42.5 billion compared with the corresponding quarter a year ago. A lower trade in services contributed to this reduction.

“The main reason to why the surplus in current account balance is decreasing is that we import more services than we export” says Isak Werner, economist at the Balance of Payments unit.

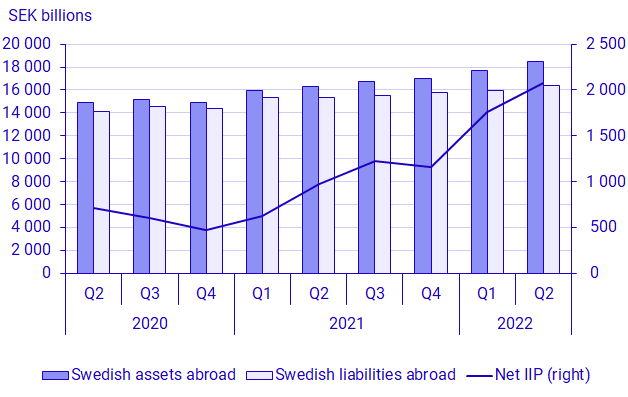

Sweden’s net external assets position amounted to SEK 2 074.4 billion at the end of second quarter of 2022. This is, compared to previous quarter, an increase of SEK 309.0 billion. Changes in exchange rates had a noticeable impact on the net external assets position during the quarter. The financial account shows that net borrowing with the rest of the world amounted to SEK 77.2 billion during the quarter.

What is the balance of payments?

The balance of payments is a statement of all Swedish transactions with the rest of the world. It presents exports and imports of goods and services. It also includes a description of changes in financial assets and liabilities with the rest of the world. The balance of payments consists of the current account, the financial account, and the capital account. The component parts of the balance of payments and related terms are explained under Definitions and explanations, at the end of this item of statistics news.

Current account surplus as share of Sweden’s GDP

In the second quarter of 2022, Sweden’s current account as a share of GDP decreased to 3.8 percent of Sweden’s GDP, calculated as a moving average over the last four quarters.

Comparisons between periods in the current account are made using the corresponding quarter the previous year.

Exports and imports of goods increased

Trade in goods showed a surplus of SEK 40.0 billion in the second quarter of 2022. This is a decrease of SEK 19.5 billion compared with the first quarter of 2021. Exports of goods amounted to SEK 549.8 billion, which is an increase of SEK 99.1 billion compared with the corresponding quarter a year ago. Imports of goods amounted to SEK 509.8 billion, up by SEK 118.6 billion in a corresponding comparison.

Surplus in merchanting, which is included in the balance on trade in goods, increased by SEK 3.0 billion compared with the second quarter of 2021. The surplus thus amounted to SEK 35.6 billion in the second quarter of 2022.

Imports of services increased more than exports of services

Trade in services noted a deficit of SEK 17.9 billion. This can be compared with a surplus of SEK 6.9 billion in the corresponding quarter last year.

Imports of services amounted to SEK 226.9 billion, up by SEK 69.0 billion compared with the second quarter of 2021. At the same time, exports of services noted an increase of SEK 44.2 billion in a corresponding comparison and amounted to SEK 209.0 billion.

Primary income surplus widened

Primary income, which consists mainly of compensation of employees and investment income, presented a surplus of SEK 38.4 billion in the second quarter of 2022. This surplus widened by SEK 5.5 billion compared with the corresponding quarter a year ago. Investment income is the main part of primary income that contributed to this change through an increased surplus. The surplus in investment income went from SEK 30.2 billion in the second quarter of 2021 to SEK 35.9 billion in the second quarter of 2022.

Portfolio investment contributed a surplus of SEK 10.8 billion to investment income, an increase of SEK 4.7 billion compared with the corresponding quarter a year ago. Investment income on direct investment contributed a surplus of SEK 27.7 billion, which is an increase of SEK 2.1 billion in a corresponding comparison.

Secondary income deficit widened

Secondary income, which includes international cooperation and donations and contributions to the EU, presented a deficit of SEK 24.5 billion. This deficit increased by SEK 3.7 billion compared with the corresponding quarter a year ago.

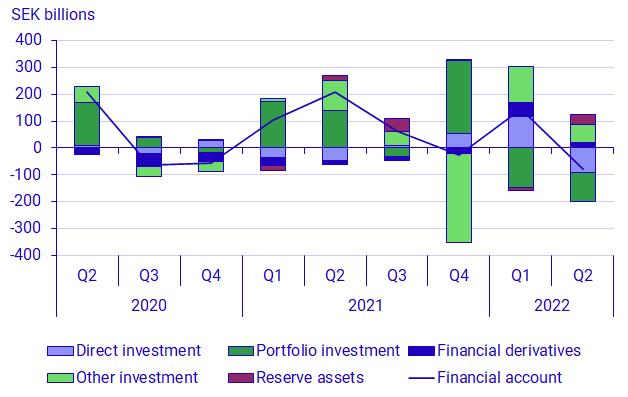

Net borrowing in the financial account

The financial account presented net borrowing amounting to SEK 77.2 billion in the second quarter of 2022. Net lending and net borrowing refer to the overall balance on the financial account.

In the financial account, financial derivatives, other investment and reserve assets noted net lending, while direct investment and portfolio investment noted net borrowing.

Direct investment increased both in Sweden and abroad

Net borrowing in direct investment amounted to SEK 92.4 billion during the quarter. Foreign direct investment in Sweden increased by SEK 172.9 billion and Swedish direct investment abroad increased by SEK 80.5 billion.

Portfolio investment increased in Sweden and decreased abroad

Net borrowing in portfolio investment amounted to SEK 108.3 billion during the quarter. Foreign investors increased their portfolio investment in Sweden by SEK 23.7 billion, and Swedish investors decreased their portfolio investment abroad by SEK 84.5 billion.

Other investment increased in Sweden and abroad

Net lending in other investment corresponded to SEK 66.5 billion. Swedish other investment abroad increased by SEK 286.2 billion, and foreign other investment in Sweden increased by SEK 219.7 billion.

Financial derivatives and reserve assets

Net lending in financial derivatives and reserve assets amounted to SEK 20.9 billion and SEK 36.0 billion, respectively.

Continued increase of Swedish net assets abroad

Sweden’s net external assets position amounted to SEK 2 074.4 billion, which is an increase compared with SEK 1 765.4 billion in the previous quarter.

Exchange rate changes had a noticeable impact during the quarter, particularly the value of Swedes’ assets abroad increased due to the depreciation of the Swedish krona. This led to a positive increase in the net assets abroad, as the external assets in foreign currency are greater than the external liabilities in foreign currency.

Swedish external assets and liabilities increased

Swedish external assets amounted to SEK 18 481.2 billion, an increase of SEK 741.1 billion compared with the previous quarter. Swedish external liabilities increased by SEK 432.1 billion compared with the previous quarter and amounted to SEK 16 406.8 billion.

Direct investment, financial derivatives and other investment increased both in Sweden and abroad. Reserve assets increased abroad. Portfolio investment decreased both in Sweden and abroad. The largest net external assets were in reserve assets, direct investment and other investment.

Continued implementation of new data sources

Since the publication of the second quarter of 2021, the Balance of Payments uses data from the database on securities holdings (VINN) and the Swedish securities database (SVDB) as from the first quarter of 2021. At the time of this publication of Q2 2022, these data sources have been used from 2019 onwards.

The following changes are implemented in this release:

- As of the first quarter of 2019, data for balances and transactions in the statistics on securities is collected from the database of on securities holdings (VINN) and the Swedish securities database (SVDB).

- As of the first quarter of 2019, the VINN database is used for debt securities in the reserve assets.

These changes will lead to a time series break between the fourth quarter of 2018 and the first quarter of 2019. Statistics Sweden will gradually address the break in the time series.

For further information and previously implemented changes, see New data sources for statistics on securities and Implementation of new data sources for statistics on securities continues, 2021-11-18.

Revisions

The time series for the Balance of Payments and the international investment position has been revised from Q1 2019.

The Balance of Payments adheres to a predetermined revision policy, see Section 2.3 in the 2022 Quality Declaration.

Kvalitetsdeklaration, Betalningsbalans och utlandsställning, 2022 (scb.se).

In a compilation of the balance of payments and the international investment position, data based on forecasts are used in some cases. These statistics will be updated as results are received. If new data is added or in the case of any methodological changes, further revisions are carried out as necessary.

Revisions carried out in connection with publication of the second quarter of 2022 are listed in the tables on revisions by account item for the balance of payments and the international investment position, respectively.

Definitions and explanations

The current account and the financial account record real and financial transactions with regard to the rest of the world. Only proper transactions are recorded; value changes, such as exchange rate fluctuations are excluded.

The current account shows the trade in goods (foreign trade in goods), the trade in services (foreign trade in services), primary income (compensation to employees, investment income, other primary income), and secondary income (current transfers). Surplus and deficit in the current account refer to the difference between Sweden’s exports and Sweden’s imports. A positive outcome results in a surplus, while a negative outcome results in a deficit. Comparisons between periods in the current account are always made using the corresponding quarter the previous year, due to seasonal patterns in data.

The financial account consists of direct investment, portfolio investment, financial derivatives, other investment, and reserve assets. Sweden can acquire and dispose of financial assets abroad. All transactions during the quarter concerning external assets show Sweden’s change in net external assets. Sweden can also borrow and repay financial external liabilities. All transactions during the quarter concerning external liabilities show Sweden’s change in net external liabilities. The difference between Sweden’s change in net external assets and Sweden’s change in net external liabilities can be positive or negative, and shows net lending and net borrowing, respectively.

The capital account records Sweden’s capital transfers and transfers of non-financial assets with regard to the rest of the world. Compared with other parts of the balance of payments, amounts in the capital account are usually small.

The difference between Sweden’s financial external assets and liabilities position is the net of Sweden’s international investment position, which can be positive or negative.

An increase or decrease in assets describes Sweden’s external assets. An increase or decrease in liabilities describes Sweden’s external liabilities.

Merchanting, which forms a part of the trade in goods, refers to triangular trade in which goods are purchased and sold abroad without the good crossing a Swedish border.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.