Balance of payments, second half of 2018

Holdings in foreign portfolio assets declined

Statistical news from Statistics Sweden 2019-09-13 9.30

Swedish holdings in foreign portfolio assets declined in the second half of 2018. At the end of 2018, total holdings amounted to SEK 5 148 billion, which was a decrease of 8.3 percent compared with the end of June 2018. Several factors contributed to a decrease in Swedish investors’ holdings abroad, but the large percentage decline in long-term debt securities was particularly prominent.

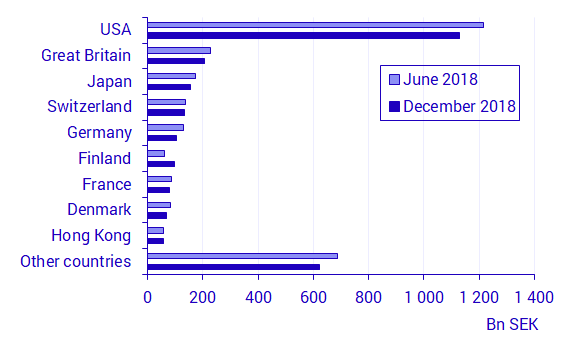

Portfolio assets consist of foreign shares, investment fund shares, and long-term and short-term debt securities. Swedish holdings in shares amounted to SEK 2 654 billion at the end of 2018, which was a decrease of 7.2 percent compared with the end of June 2018. Swedish investors’ largest holdings were in US shares, in which total holdings amounted to SEK 1 130 billion.

This bar graph shows in which countries Swedish investors had most shareholdings at the end of June 2018 and December 2018 respectively.

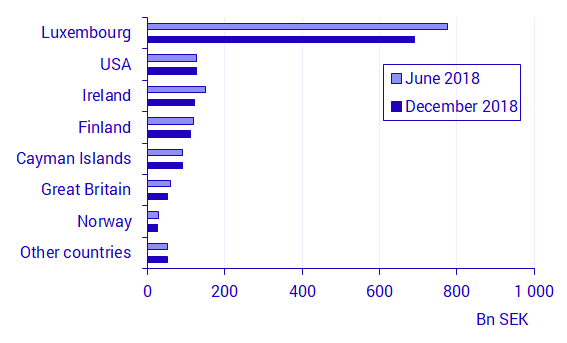

Holdings in investment funds amounted to SEK 1 401 billion at the end of 2018, which was a decrease of 9.7 percent compared with the end of June 2018. The largest holdings of investment funds were in Luxembourg, where they amounted to SEK 691 billion.

This bar graph shows in which countries Swedish investors had most holdings of investment funds at the end of June 2018 and December 2018 respectively.

Other financial institutions remain the largest holder sector

The largest holder sector was the other financial institutions sector, which accounted for 68.1 percent of total holdings in 2018. The other financial institutions sector includes securities companies, fund management companies and insurance companies. This sector holds mainly shares and investment fund shares, but also has the largest holdings of debt securities.

Decreased holdings in long-term debt securities

Total holdings in long-term debt securities in Sweden amounted to SEK 1 172 billion, which was a decrease of 9.5 percent. In terms of percent, this was the largest decrease during a single six-month period in the past five years. The main reason for the decline was a downturn in Danish debt securities, which decreased from SEK 190 billion to SEK 87 billion, while the downturn was more evenly distributed among other countries. Total holdings in short-term debt securities amounted to SEK 57 billion, which was an increase of 2.6 percent compared with the previous six months. At the end of December 2018, Swedish holdings in foreign government securities amounted to SEK 587 billion. This corresponds to 47.8 percent of the total SEK 1 226 billion held in foreign securities issued.

Increased holdings in debt securities denominated in Swedish kronor

Holdings in debt securities denominated in Swedish kronor amounted to SEK 297 billion in total at the end of 2018, which was an increase of 16.1 percent compared with the previous six months. At the same time, holdings in securities denominated in euros decreased by 17 percent, to SEK 325 billion at the end of 2018. At the end of 2018, Swedish investors’ holdings in debt securities were dominated by securities denominated in US dollars, euros and Swedish krona; these currencies together accounted for 82.9 percent of total holdings.

Definitions and explanations

This study is part of the IMF’s biannual international survey and measures Swedish holdings of foreign portfolio assets with regard to foreign shares, investment fund shares and debt securities. Sweden has taken part in this survey since 2001. Assets in the first six months of the year are measured at the end of June, and in the second half of the year, assets are measured at the end of December.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.