Environmental accounts - Environmental taxes 2022 and industry allocated environmental taxes 2021

Environmental tax revenue decreases in 2022

Statistical news from Statistics Sweden 2023-06-01 8.00

In 2022, environmental tax revenue amounts to 97 SEK billion which is a decrease with 6.5 SEK billion compared with the previous year. Households contribute most to the revenue by paying energy taxes.

Sweden’s total environmental tax revenue amounts to 97 SEK billion in 2022, representing 1.6 percent of Swedish GDP. In 2022 governmental tax revenues from environmental taxes decrease with 6.5 SEK billion compared with 2021. This is mainly due to reduced revenue from the energy tax on fuels, as well as reduced revenue from the energy tax on electricity. On the contrary, the revenue from emission rights is three times higher in 2022 compared to 2021.

- Revenues from emissions trading have increased manifold following price increases on emission rights. However, looking at the total, emissions trading still makes up a small part of environmental taxes, says Dimitra Kopidou, analyst at Statistics Sweden's environmental accounts.

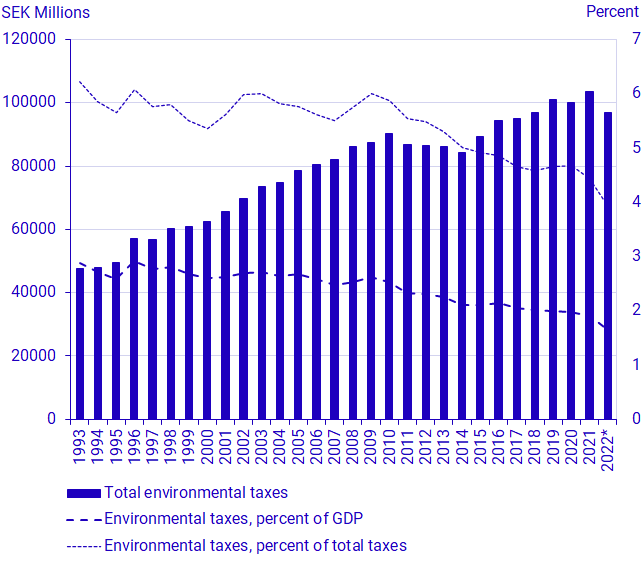

Between 1993 and 2022 the environmental tax revenue has more than doubled. However, as a percentage of GDP and of total taxes, environmental tax revenue has a decreasing trend since 1993. This indicates that environmental taxes do not increase at the same speed as the economy or as the total taxes.

The COVID-19 pandemic of 2020 and 2021 affected the amount of revenues from some environmental taxes in those years. An example is the tax on air travel which decreased because of reduced air travelling. However, in 2022 the tax on air travel is almost as high as in the years before the pandemic.

* GDP and total taxes are preliminary.

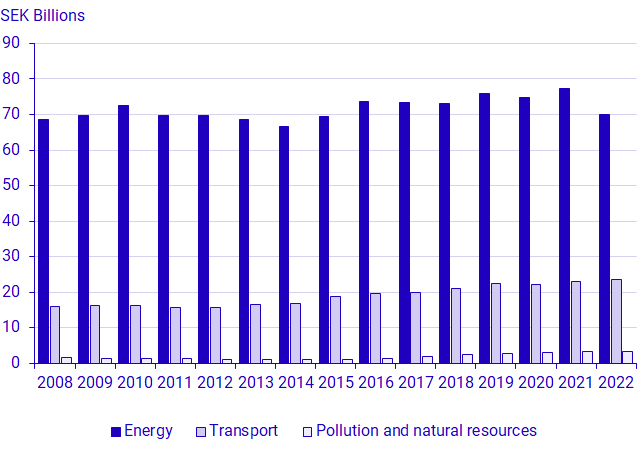

Energy taxes contribute most to environmental tax revenue

The environmental taxes are divided into four categories: energy, transport, pollution, and natural resources. Energy taxes contribute the most to the environmental tax revenue. They account for 72 percent of total environmental taxes in 2022. Energy taxes consist among others of energy tax on fuels, carbon dioxide tax and energy tax on electricity. Thereafter, transport taxes come next in contribution. Transport taxes account for 24 percent of total environmental tax revenue in 2022 and they consist among others of vehicle tax, congestion tax and tax on air travel.

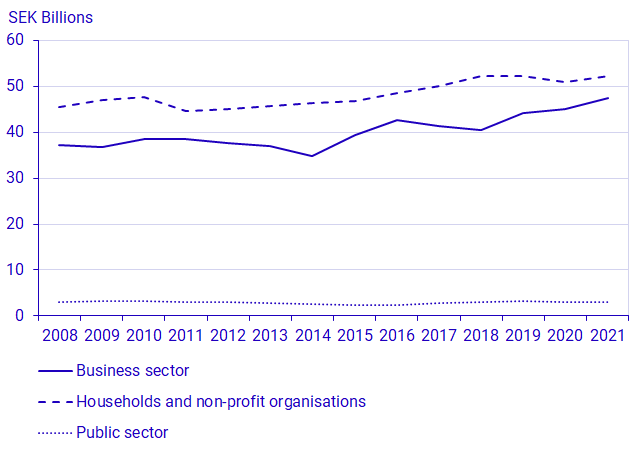

Households contribute the most towards carbon and energy tax revenues

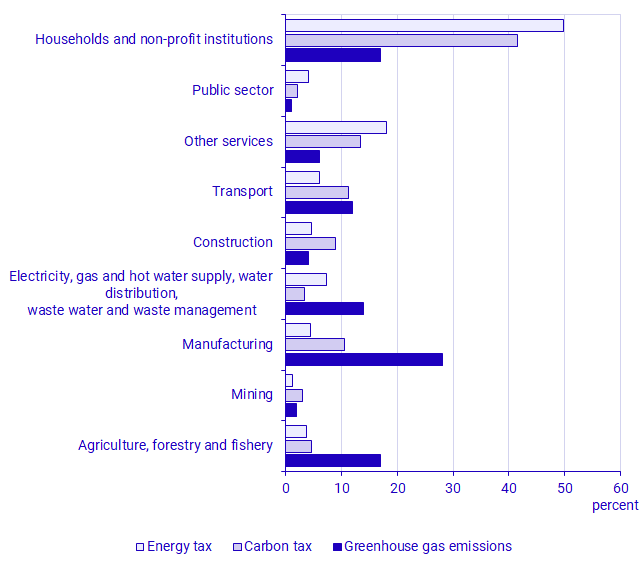

The last reference year for the industry allocated environmental taxes is 2021, where households keep paying almost half of the total environmental taxes. Households pay 41 percent of the carbon tax and 50 percent of the energy tax during 2021, while they account for only 17 percent of Sweden’s greenhouse gas emissions in this year.

Meanwhile, the manufacturing sector emits 28 percent of Sweden’s greenhouse gas emissions in 2021, but it pays only 11 percent of the carbon tax and 4 percent of the energy tax. This disparity is due to special tax exemptions from energy and carbon taxes applied for the manufacturing sector.

Revisions

In the production of environmental taxes in 2023, four new individual taxes were added: Chemicals tax, tax on traffic insurance premiums, flight tax and congestion tax. These have previously been reported under "other environmental taxes".

Furthermore, in the production of environmental taxes in 2023, the electricity tax for the NACE E and R sectors for the years 2008–2014 was also revised.

Definitions and explanations

The definition of an environmental tax used by Statistics Sweden derives from the definitions of Eurostat and the OECD. It is found in the global statistical standard for environmental accounts, SEEA Central Framework, and enables comparative studies between different countries. Eurostat's definition of an environmental tax is:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in ESA as a tax."

According to this definition, it is the tax base and not its motive or name that determines whether the tax is an environmental tax. ESA refers to the European System of Accounts and refers to the guidelines for calculating National Accounts.

Next publishing will be

June 2024.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.