Industry allocated environmental taxes 2016

Environmental tax revenue increased in 2016

Statistical news from Statistics Sweden 2018-10-10 9.30

Environmental tax revenue to the Government increased by SEK 5 billion in 2016 compared with the previous year. The increase is due to increased revenue from the energy tax on fuel and electricity. The increase appears in both the business sector and among households.

New statistics on industry-allocated environmental taxes in 2016 are now available. In 2016, the environmental tax revenue to the Government increased by SEK 5 billion to SEK 98 billion, compared with SEK 93 billion in the previous year. This increase is mainly due to increased revenues from energy-related taxes, which make up nearly 80 percent of total environmental tax revenues.

The energy tax on fuels increased by SEK 3 billion and the energy tax on electricity increased by SEK 1 billion out of the total increase of SEK 5 billion. Other energy-related tax revenues, such as the fee to the nuclear fund and tax on the thermal effect of nuclear power, also increased. The carbon dioxide tax, which is also an energy tax, continues to bring in the largest revenue among environmental taxes, although the 2016 revenue decreased by SEK 0.5 billion.

In addition to energy taxes, the transport sector makes up a large part of the environmental tax revenue, approximately 20 percent. Transport-related taxes also increased in 2016, by nearly SEK 1 billion. This increase is mainly due to the increased congestion tax.

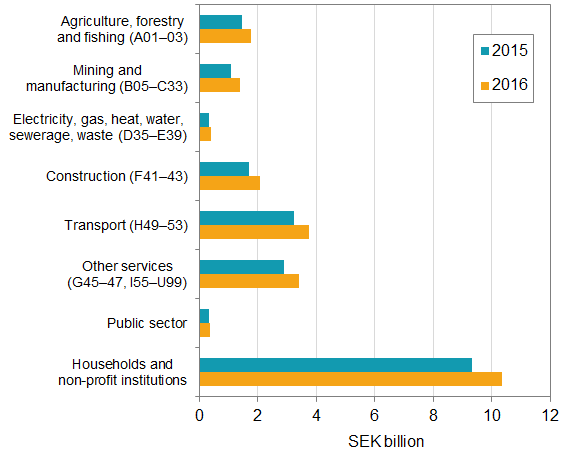

Environmental tax by industry

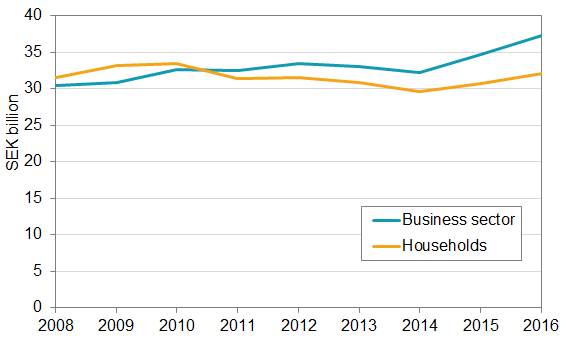

The new industry-allocated statistics give more insight to the increase in 2016. The figure below illustrates energy-related taxes (energy tax, electricity tax, carbon dioxide tax and sulphur tax), which make up around 75 percent of total environmental tax revenues. The increase in 2016 is present among both households and the business sector, although the increase in the business sector is larger, both in absolute numbers and in percentages.

In 2016, the energy tax rate on certain fuels increased, for example on fuel oil and petrol, which is one explanation for the increased environmental tax revenues from the energy tax. In the business sector, revenues increased by more than 2 SEK billion, mainly from the service sector and the transport industry. Among households, revenues from the energy tax on fuels increased by more than 1 SEK billion.

Revisions

New statistics are available on energy use by industry. This provides basis for distribution of environmental taxes to economic actors. New methodology on allocation of energy tax and carbon dioxide tax for certain fuels with tax rates and tax rate reductions gives large revisions throughout the time series, from 2008 and forward.

More information (in Swedish) on the revisions is available on the Environmental Accounts’ product page under Documentation.

Definitions and explanations

Environmental taxes

The definition of an environmental tax used by Statistics Sweden was developed by Eurostat and the OECD. Today it forms part of the international statistical standard in the SEEA Central Framework and enables comparative studies between different nations. Eurostat’s definition is:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in the European System of Accounts (ESA) as a tax.”

According to the definition, the tax base - not the intention or the name of the tax – determines whether the tax is environmental. The ESA is a framework of guidelines for calculating national accounts used by members of the European Union.

European statistics

Next publishing will be

The next statistical news on industry-allocated environmental tax revenues for 2017 will be published in autumn 2019.

Preliminary total environmental taxes for 2018 will be published in spring 2019.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.