Housing costs 2024

Households in rented dwellings spend largest share of their income on housing

Statistical news from Statistics Sweden 2025-11-19 8.00

In 2024, about 23 percent of the disposable income was used for housing costs. The shares differ between different types of tenure. Households in rented dwellings spent about 27 percent of their disposable incomes on housing. Households in owner-occupied apartments spent 21 percent, while households in owner-occupied one- or two-dwelling houses spent 18 percent.

The percentage among households in rented dwellings is larger not because they have higher housing costs, but because on average they have lower disposable incomes.

The share of disposable income is relatively constant over time, with only minor changes the last 10 years. The largest change is for households in owner-occupied one- or two-dwelling houses where the share has increased from 15 to 18 percent.

– The share of income that households use for housing is quite stable over time, despite major events such as pandemic and variations in prices and interest rates says Marcus Vingren, statistician at Statistics Sweden.

| 2015 | 2017 | 2020 | 2021 | 2024 | |

|---|---|---|---|---|---|

| Rented dwelling | 28 | 28 | 27 | 27 | 27 |

| Owner-occupied apartments | 21 | 20 | 21 | 19 | 21 |

| Owner-occupied one- or two-dwelling houses |

15 | 16 | 16 | 16 | 18 |

| All types of tenure | 21 | 21 | 22 | 21 | 23 |

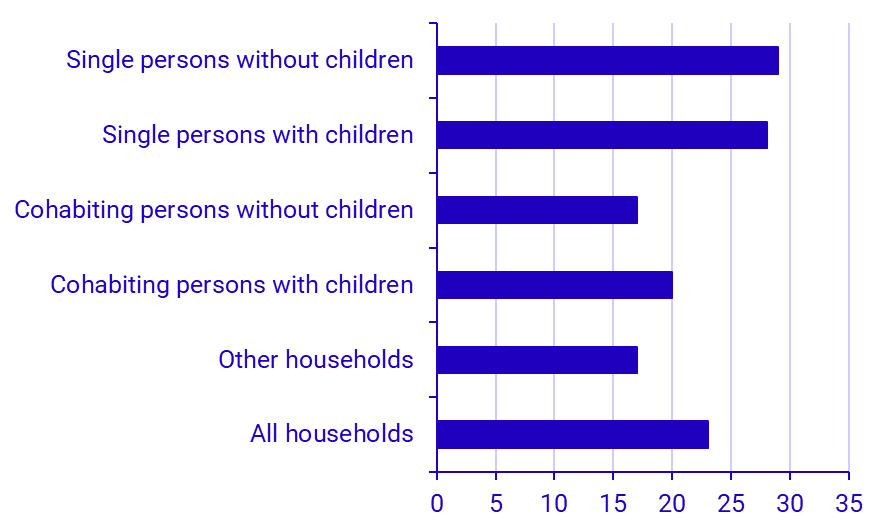

The highest share is among single persons, both with and without children, at 28 and 29 percent. When grouping single persons by sex and age we see that Single women over age 64 spend the largest proportion on rented dwellings – 37 percent of their disposable income. The corresponding percentage for this household type in owner-occupied apartments is 28 percent and in owner-occupied one- or two-dwelling buildings it is 26 percent.

Households with more adults, and thereby more potential incomes, on average spend a smaller proportion of their income on housing. Household types cohabiting persons without children and other households (for example households including adult children) spend the smallest proportion, about 17 percent.

Definitions and explanations

Owner-occupied one- or two-dwelling houses refer to detached single family houses, semi-detached houses, terraced houses or link-attached houses that the household owns.

Owner-occupied apartment: An owner-occupied apartment is an apartment situated in a one- or two-dwelling house or multi-dwelling building that is owned by an owners' association, in which one is a member.

Rented dwelling refers to a rented dwelling where the tenant has a first-hand contract, both in one- or two-dwelling houses and multi-dwelling buildings.

Disposable income is the sum of taxable and tax-free income minus taxes and negative transfers.

The presented household types are based on the housekeeping unit concept. Housekeeping units refer to people who live in the same dwelling and have a joint economy. A housekeeping unit also includes children aged 20 years and older who are living with their parents. A housekeeping unit can consist of several generations, siblings or friends who live together and have a joint economy.

Housing costs

Rented dwelling: Housing costs consist of the sum of the rent and individual fees for maintenance and repairs.

Owner-occupied apartment: Housing costs refer to the sum of fees to the tenant-owners' society, interest fees and amortisation as well as individual fees for maintenance and repairs. These costs are adjusted with consideration to tax effects.

Owner-occupied one- or two-dwelling houses: Housing costs refer to the sum of interest fees, amortisation, operating costs (such as heating, water, sewerage and garbage collection) and fees for maintenance and repair. These costs are adjusted with consideration to tax effects. Tax effects refer to a decrease or increase in tax due to tax reduction for capital losses and for maintenance and repair related to the dwelling and the household's property tax for the dwelling. In addition, any interest on deferred capital from housing sales of a previous dwelling is included for 2015-2020.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.