Savings Barometer, first quarter 2025

Household liquid savings decreased

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2025-05-15 8.00

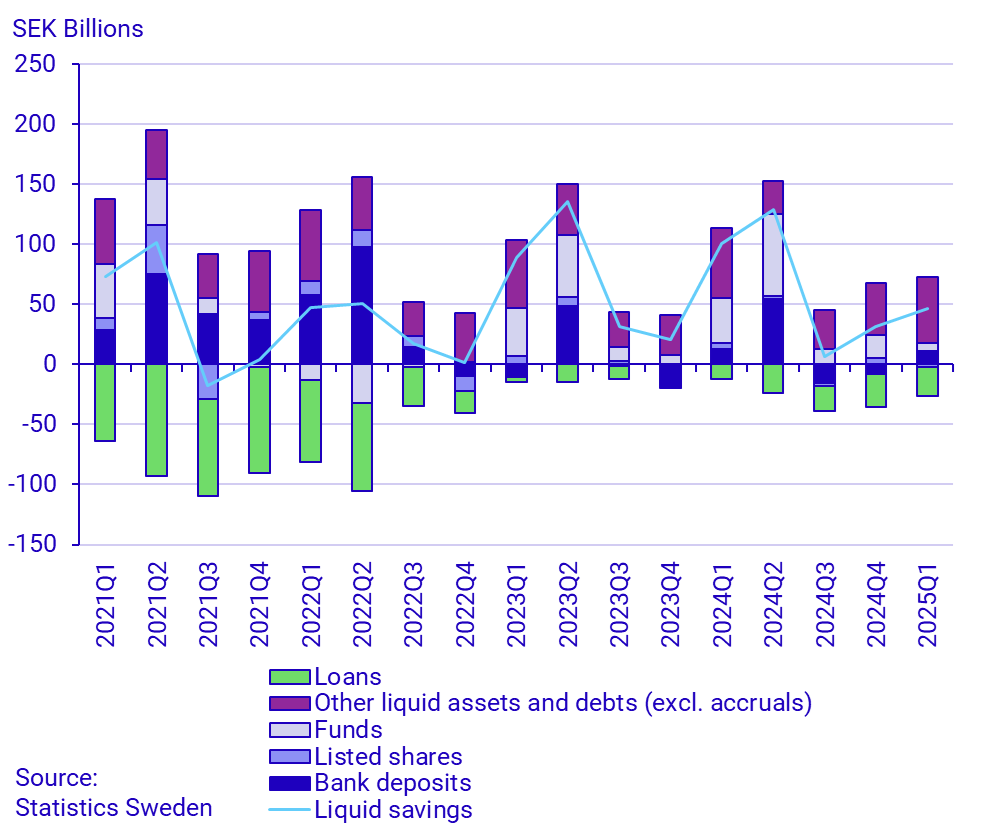

Household liquid savings amounted to SEK 46 billion at the end of the first quarter of 2025. This is SEK 54 billion lower compared to the same period last year. At the same time, the annual growth rate of household loans was 1.9 percent.

At the end of the quarter, household new savings in liquid assets amounted to SEK 71 billion. At the same time, loans increased by SEK 24 billion. The liquid savings thus amounted to SEK 46 billion.

Household saving in shares, funds and deposits

During the quarter, households net sold listed shares for SEK 2 billion and purchased funds to a value of SEK 7 billion.

Households’ net deposits in bank accounts amounted to SEK 11 billion, which is a decrease of SEK 2 billion compared with the same period last year.

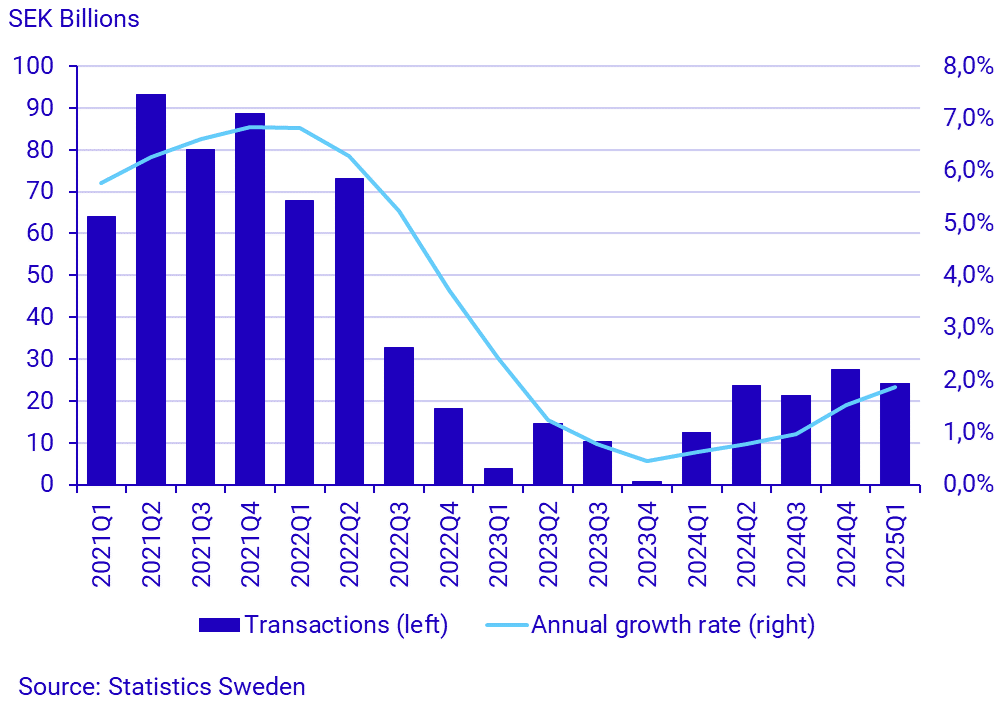

Household loans and annual growth rate

At the end of the quarter, household total loans amounted to SEK 5,341 billion, giving an annual growth rate of 1.9 percent.

Household net borrowing during the quarter amounted to SEK 24 billion. This is an increase of SEK 12 billion compared to the same period last year.

Definitions and explanations

Liquid savings are calculated as the difference between transactions in financial assets and liabilities excluding accruals (tax accruals, occupational pensions, and other insurance technical reserves). The statistics are presented at current prices and do not take inflation into account.

In the Savings Barometer, household liquid savings are a key measure of household savings in financial assets because it reflects household financial decisions in the short term. Liquid savings include currency, deposits, bonds, directly owned shares, funds, private insurance savings and other financial assets. In addition to this, tenant ownership rights and holiday homes abroad are also included. These instruments are usually not considered liquid but are included to be able to deduct liabilities from savings.

In addition to loans from banks and housing institutions, household total loans also include student loans and other loans (which are loans to financial corporations that are not classified as banks or housing institutions). Household net borrowing is calculated as the difference between new loans and amortization.

Household ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. However, single-family homes with ownership rights are not included as it is a real asset. Information on household total assets in dwellings can be found in the publication National wealth.

No major revisions or methodological changes are published in the Savings Barometer. These are instead published in the Financial Accounts where more time for calculations and reconciliations with other sectors is available and revision documentation is published. However, minor revisions may occur because of, for example, revised primary statistics.

In connection with the release of the Savings Barometer for the first quarter of 2025, the time series will be updated with the revisions introduced in the Financial accounts release on 20 March 2025. Thus, there are discrepancies between the financial accounts and the savings barometer with regard to accruals. More detailed descriptions of major revisions are described in the news from the Financial Accounts statistics:

Financial accounts, quarterly and annual

Further information: National wealth

In connection with the publication of Financial Accounts, the National Wealth Report is also published, which contains annual data on both real and financial assets. The financial assets and liabilities are derived from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For more information, see:

National Wealth and National Balance Sheets (pdf) (in Swedish)

Statistical database;

Next publishing will be

2025-08-21 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.