Environmental taxes 2024 and industry allocated environmental taxes 2023

Environmental tax revenues increase in 2024

Statistical news from Statistics Sweden 2025-06-05 8.00

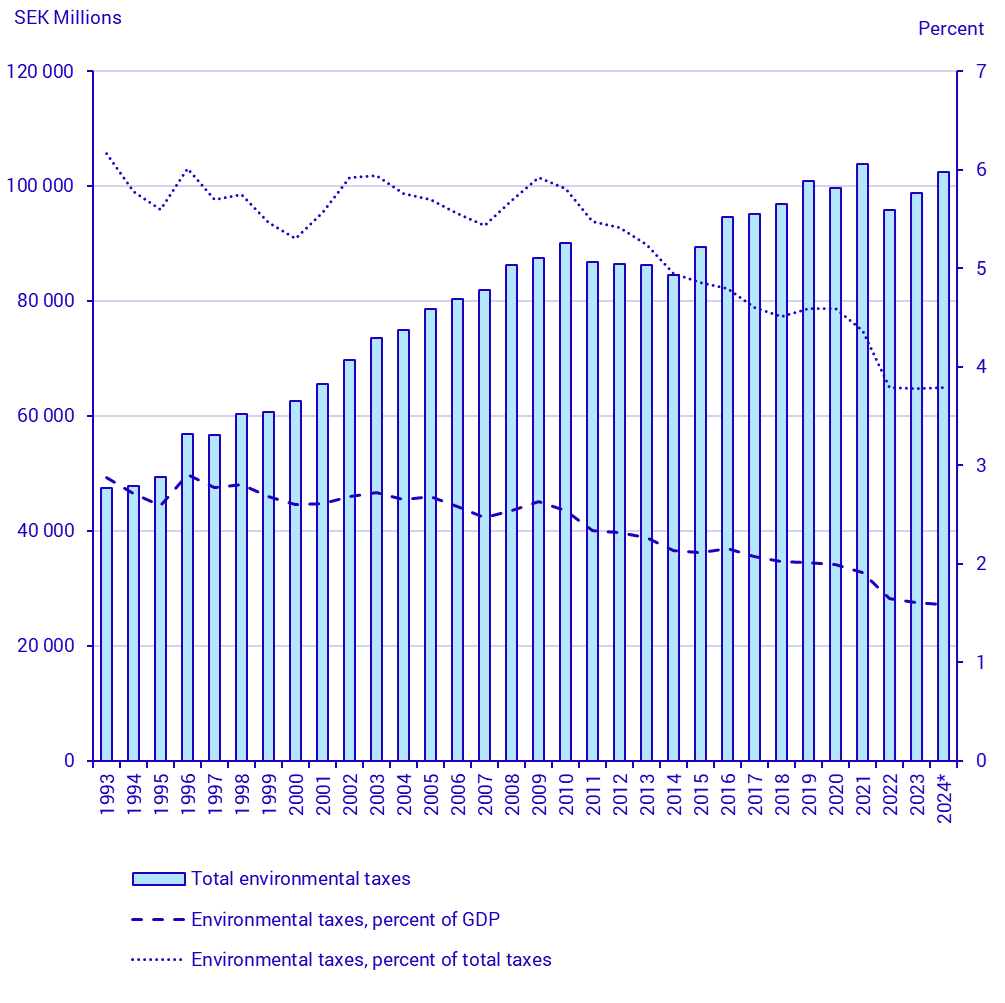

In 2024, environmental tax revenue amounts to SEK 102 billion, representing a 4 percent increase (without adjusting for inflation) compared with the previous year. The largest increase of tax revenues comes from energy taxes which increases by 3.5 SEK billion.

Sweden’s total environmental tax revenue amounts to 102 SEK billion in 2024. That represents 1.6 percent of Swedish GDP and 3.8 percent of Sweden´s total tax revenues 2024 which is almost unchanged from 2023. In 2024 governmental tax revenues from environmental taxes increase by 3.7 SEK billion compared with 2023.

- Total environmental tax revenues increase 2024 while environmental taxes as a share of GDP have decreased since 2016 and amounts to 1.6 percent in 2024. This implies that environmental taxes have increased at a lower rate than the economy and total tax revenue, says Frida Hellman, analyst at Statistics Sweden.

The total environmental tax revenue as a share of GDP has shown a decreasing trend since 2016. In that year environmental tax revenues amounted to 2.2 percent of GDP. A similar trend is shown for environmental taxes as a share of total taxes which has decreased from 4.8 percent in 2016 to 3.8 percent in 2024.

* GDP and total taxes are preliminary.

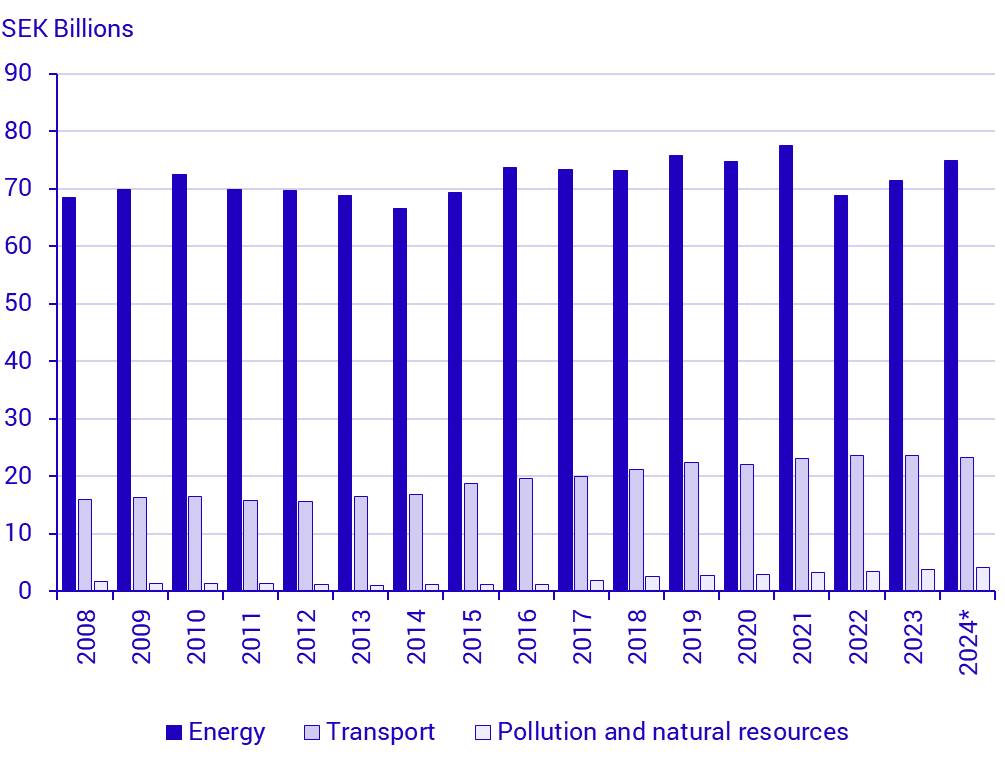

Energy taxes contribute most to environmental tax revenue

Environmental taxes are divided into four categories: energy, transport, pollution, and natural resources. Energy taxes contribute the most to the environmental tax revenue. They account for 73 percent of total environmental taxes in 2024. Energy taxes consist among others of energy tax on fuels, carbon dioxide tax and energy tax on electricity. Transport taxes contribute with the second highest revenue. Transport taxes account for 23 percent of total environmental tax revenue in 2024, and they consist among others of vehicle tax, congestion tax and tax on air travel.

* Total taxes and taxes allocated by industry are preliminary.

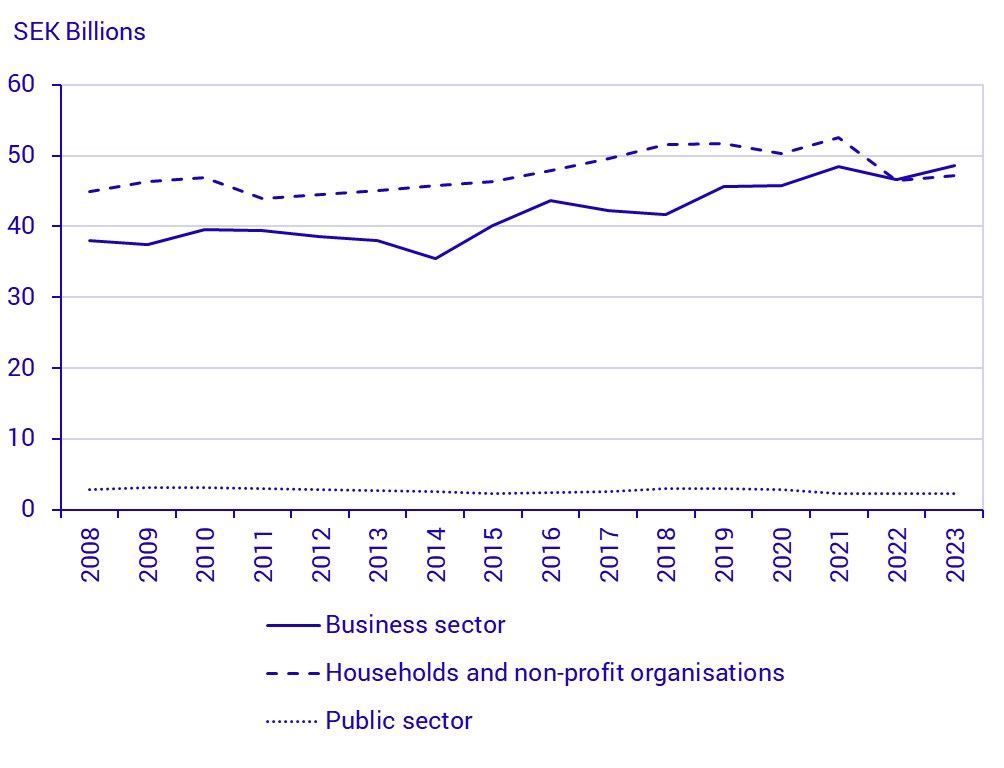

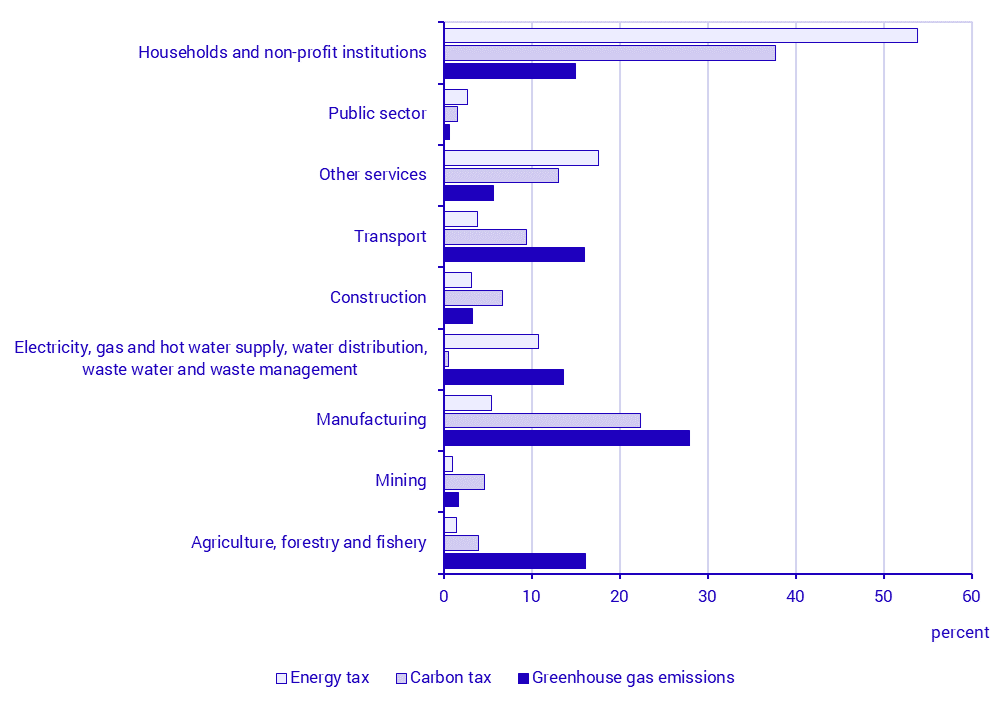

Households and non-profit organizations contribute the most towards energy tax revenues and businesses contribute most towards carbon tax revenues

The last reference year for industry-allocated environmental taxes is 2023, where households and non-profit organizations, and the business sector are paying approximately the same share of the total environmental taxes of 48 and 50 percent respectively. There are however differences regarding which type of taxes they are paying. Businesses pays 61 percent of the carbon tax while households and non-profit organizations pay 38 percent. The shares for the energy tax are 43 percent from businesses and 54 percent from households and non-profit organizations. The remaining parts of carbon and energy taxes are paid by the public sector.

Meanwhile, businesses emit 84 percent of Sweden’s greenhouse gas emissions in 2023 whilst households’ and non-profit organizations’ emissions account for 15 percent.

Revisions

The production of environmental taxes in 2024 led to revisions, primarily for the years 2021 and 2022, due to a comprehensive review of the national accounts. One such amendment was related to the electricity fuel tax, which was adjusted downwards for both 2021 and 2022. Additionally, the values for the NACE Industry C were revised upwards.

In 2023, a new method for calculating emission allowances (ETS) was introduced for production. Instead of sourcing data from the FRIDA database, it is now gathered from the Environmental Protection Agency.

In connection with the 2025 production, exemptions for the carbon dioxide tax and the energy tax for industry H50 were revised for the entire time series. In addition, improvements were made to the scripts for all fuel taxes to enhance the quality of the statistics. For the aviation and chemical taxes, projections are no longer made for the final reference year, as data from the National Accounts is received before the environmental taxes are published.

Definitions and explanations

The definition of an environmental tax used by Statistics Sweden derives from the definitions of Eurostat and the OECD. It is found in the global statistical standard for environmental accounts, SEEA Central Framework, and enables comparative studies between different countries. Eurostat's definition of an environmental tax is:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in ESA as a tax."

According to this definition, it is the tax base and not its motive or name that determines whether the tax is an environmental tax. ESA refers to the European System of Accounts and refers to the guidelines for calculating National Accounts.

Next publishing will be

June 2026.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.