Industry-allocated environmental taxes 2017

Environmental tax revenue from the business sector increased in 2017

Statistical news from Statistics Sweden 2019-10-01 9.30

In 2017, environmental tax revenue increased by more than SEK 1.4 billion compared with the previous year. This increase is mainly due to increased revenue from energy tax on electricity in the business sector.

Energy-related taxes account for about 84 percent of total environmental tax revenue. These taxes consist of energy tax on fuels and electricity, and carbon dioxide tax, each contributing about one third. Revenue from carbon dioxide tax decreased by SEK 0.6 billion, while revenue from fuel and electricity tax has increased by approximately SEK 2 billion in total.

In addition to energy taxes, transport taxes account for a large part of the environmental tax revenue, at about 15 percent. However, revenue from transport-related taxes decreased by nearly SEK 0.1 billion in 2017. This was mainly due to lower revenue from vehicle tax.

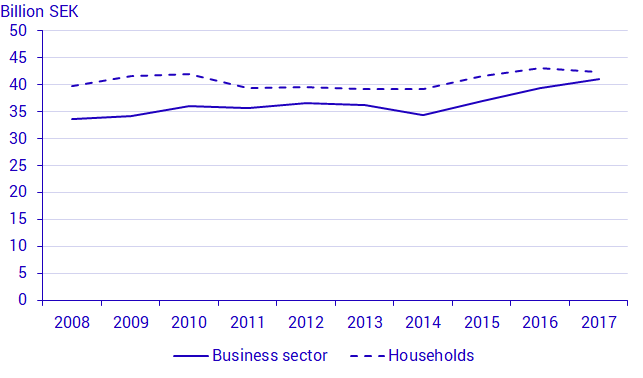

Energy-related taxes separated per industry and households show that households contribute to a greater proportion of energy taxes than the business sector, even though they paid almost as much in 2017. Between 2008 and 2017, energy-related tax revenue increased for both groups, although the business sector increased more; revenue from households increased by 7 percent and from the business sector by 22 percent.

Between 2016 and 2017, households’ contribution decreased by 2 percent and the business sector contribution increased by 4 percent.

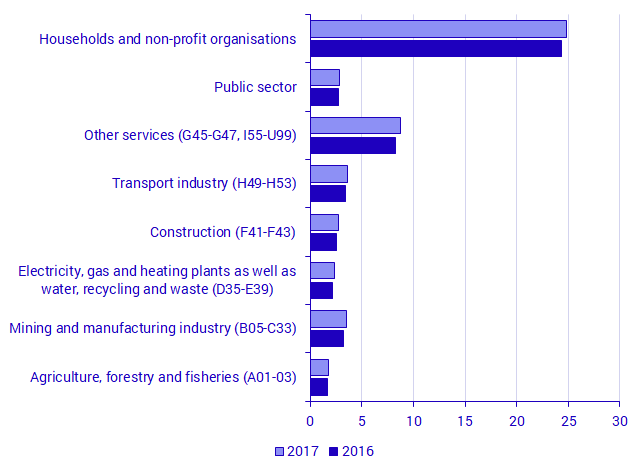

Energy-related environmental tax revenue per industry

In 2017, energy tax rates on electric power and some fuels, such as heating oil and petrol, were increased; this explains why revenue from energy tax on electricity and fuels increased. In the business sector, revenue increased by just over SEK 1.8 billion, primarily from the service industries, transport industries, and the mining and manufacturing industry. However, the increase can be seen in all industry groups. Revenue from energy taxes on electricity and fuels from households increased by more than SEK 0.5 billion.

Revisions

New statistics have been published on energy use by industry and economic statistics from the national accounts. This serves as the basis for distributing environmental taxes to economic operators. Energy tax and carbon tax on certain fuels include adjustments for tax rate reductions, which result in major revisions throughout the time series from 2008 and forward. New statistics on road insurance premiums have been introduced, which affects the calculation of transport taxes.

Total environmental taxes are divided into environmental taxes on energy, transport, pollution and natural resources in accordance with Eurostat’s Regulation on European Environmental Accounts.

For more information on which revisions have been made, see the Environmental Accounts product page under the heading Documentation.

Definitions and explanations

Environmental taxes

The definition of an environmental tax used by Statistics Sweden was developed by Eurostat and the OECD. Today it forms part of the international statistical standard in the SEEA Central Framework and enables comparative studies between different nations. Eurostat’s definition is:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in the European System of Accounts (ESA) as a tax.”

According to the definition, the tax base - not the intention or the name of the tax – determines whether the tax is environmental. The ESA is a framework of guidelines for calculating national accounts used by members of the European Union.

European statistics

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.